- Short Squeez

- Posts

- 🍋 Luxury’s Biggest Rival Is Itself

🍋 Luxury’s Biggest Rival Is Itself

Plus: Google to integrate Kalshi, Tesla shareholders approved Elon Musk’s $1 trillion pay plan, Cathie Wood trimmed her 2030 Bitcoin target, and “vibe coding” was named Collins Dictionary’s word of the year.

Together With

“Good investing is 80% boring, 10% painful, and 10% euphoric.” — Morgan Housel

Good Morning! Charles Schwab will acquire private-shares platform Forge Global in a $660 million deal. Google will integrate Kalshi’s data into its search results. Tesla shareholders approved Elon Musk’s $1 trillion pay plan with more than 75% voting in favor. Apollo told its staff to WFH ahead of a protest at the firm’s Midtown HQ.

Younger consumers are eating less Chipotle and Cava but splurging on luxury goods like Coach bags. Goldman Sachs named its lowest share of female MDs since David Solomon took over. And Cathie Wood trimmed her 2030 Bitcoin target to $1.2 million (from $1.5 million) as other stablecoins gain market share.

Plus: Jamie Dimon warns a blue-state business exodus could backfire, “vibe coding” was named Collins Dictionary’s word of the year, and why Mamdani’s free NYC bus plan could become complicated by a bond-paying pledge.

Want to get smarter on Canadian markets? Subscribe to Bullpen’s Morning Meeting newsletter for insights from equity research professionals.

SQUEEZ OF THE DAY

Luxury’s Biggest Rival Is Itself

After a decade of constant price hikes and logo worship, the hottest thing in luxury right now is not what’s new. It is what has already been sold.

The resale market has become luxury’s fastest-growing engine over the past couple of years. Sales of secondhand goods now outpace boutique sales by a wide margin. The RealReal has grown sales by 10% over the past 18 months, and its stock has tripled over the same period. Fashionphile continues to post double-digit growth. Meanwhile, Europe’s largest luxury companies have reported six straight quarters of flat sales.

Every used sale is one less full-price transaction, and Gen Z and millennials, once the industry’s most coveted customers, are driving the shift. Gen Z spending on new luxury fell 7% last year; millennial spending slipped 2%. The appetite for status is alive, but the willingness to pay full price is not.

The math explains why. After years of 10% annual price increases, a new Chanel bag now costs as much as a small car. And with older models on the Real Real holding nearly 90% of their original value (without the 10% annual compounding increases) and shipping in two days, buying used is a no-brainer for many. Consumers check resale prices before buying new, calculate their post-wear recovery, and treat handbags like short-duration assets.

Luxury brands are watching closely but have little room to maneuver. They cannot enter the resale market without puncturing the illusion of exclusivity. You cannot charge $3,800 for a handbag and then offer $1,200 on trade-in. Instead, brands quietly monitor resale data to see which vintage pieces are trending.

The irony is that the same brands that built their empires on timelessness are now competing with their own archives. For investors, it is no longer a sustainability story or a cultural trend. It is a structural shift eating into future revenue.

Takeaway: Either Gen-Z and Millennials are dropping the latest recession indicator, or luxury brands are getting a little too expensive. But with Gucci and Chanel getting beaten at their own game and the resale market offering the same exclusivity at half the cost, it’s looking like it’s time for a strategy change. And if you bought your latest Hermés drop off The RealReal, you don’t need to worry about Mamdani.

PRESENTED BY BULLPEN

Get Smarter on Canadian Markets

The Morning Meeting, by Bullpen Finance, delivers Canadian market analysis from equity research professionals, not journalists. Published three times per week, the newsletter covers public equities, macro trends, insider transactions, and earnings with the depth finance professionals actually need.

It breaks down topics like Brookfield and Cameco's $80 billion U.S. nuclear partnership or the latest GDP print with charts and management commentary. The format: 5-minute reads that give you the data behind the headlines.

Over 1,000 finance professionals and sophisticated retail investors rely on Bullpen’s newsletter to stay current on Canadian markets.

Get smarter on Canadian markets.

Please Support Our Partners!

HEADLINES

Top Reads

Charles Schwab to acquire private-shares platform Forge Global (CNBC)

Google finance to integrate Kalshi data (BB)

Tesla shareholders approve Musk's $1 trillion pay plan with over 75% voting in favor (CNBC)

Apollo tells staff to WFH ahead of protest at Midtown office (NYP)

October job cuts hit highest level for the month in 22 years (CNBC)

Younger consumers are eating less Chipotle and Cava. They are buying more Coach bags (CNBC)

Goldman taps lowest share of female MDs since Solomon became CEO (BB)

Cathie Wood trims her Bitcoin bull case to $1.2M as stablecoins gain share (CNBC)

Jamie Dimon warns blue-state business exodus could backfire (Fox)

“Vibe coding” named Collins Dictionary’s word of the year (CNN)

Mamdani’s free NYC buses plan complicated by bond paying pledge (BB)

Steve Cohen’s Point72 gears up to raise $1 billion for private credit (BB)

Palantir’s Alex Karp is stealing from Elon Musk’s playbook (BB)

Apple could make $133 billion a year on humanoid robots by 2040, Morgan Stanley says (YF)

US markets tumble amid Wall Street concern over job losses and AI (Guardian)

This fintech unicorn just launched an AI agent to handle CRE lending (CNBC)

JPMorgan CEO says headcount will stay steady as AI tools redeploy staff (BB)

CAPITAL PULSE

Markets Rundown

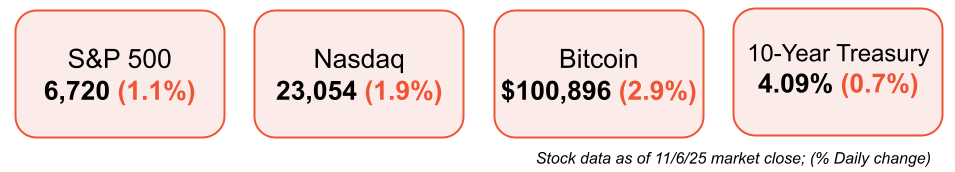

Market Update

Markets closed lower as technology and consumer discretionary stocks pulled back.

Asia finished higher, supported by gains in AI-related stocks.

Europe declined after eurozone retail sales unexpectedly fell.

U.S. dollar weakened, while WTI oil extended its slide on demand concerns.

10-year Treasury yield dipped, reflecting expectations for continued Fed easing.

Economic Data Highlights

Earnings season remains strong, with 86% of S&P 500 companies reported and 82% beating expectations.

Tech, financials, and utilities are leading earnings growth.

Eight of 11 sectors are showing positive year-over-year earnings, signaling broad participation.

Futures markets still lean toward another Fed cut, with potential for further easing into 2026 despite mixed economic signals.

Earnings Today

KKR (KKR) – Focus on fundraising momentum and performance fees.

Enbridge (ENB) – Watch for pipeline throughput trends and updated guidance.

Duke Energy (DUK) – Key focus on regulated utility earnings, capex plans, and rate-case updates.

Movers & Shakers

(+) Datadog ($DDOG) +23% after strong Q3 earnings; a revenue beat.

(+) Snap, Inc. ($SNAP) +10% because of a strong forecast, $400M Perplexity deal.

(–) Duolingo ($DUOL) 25% after issuing light guidance as the company prioritizes user growth.

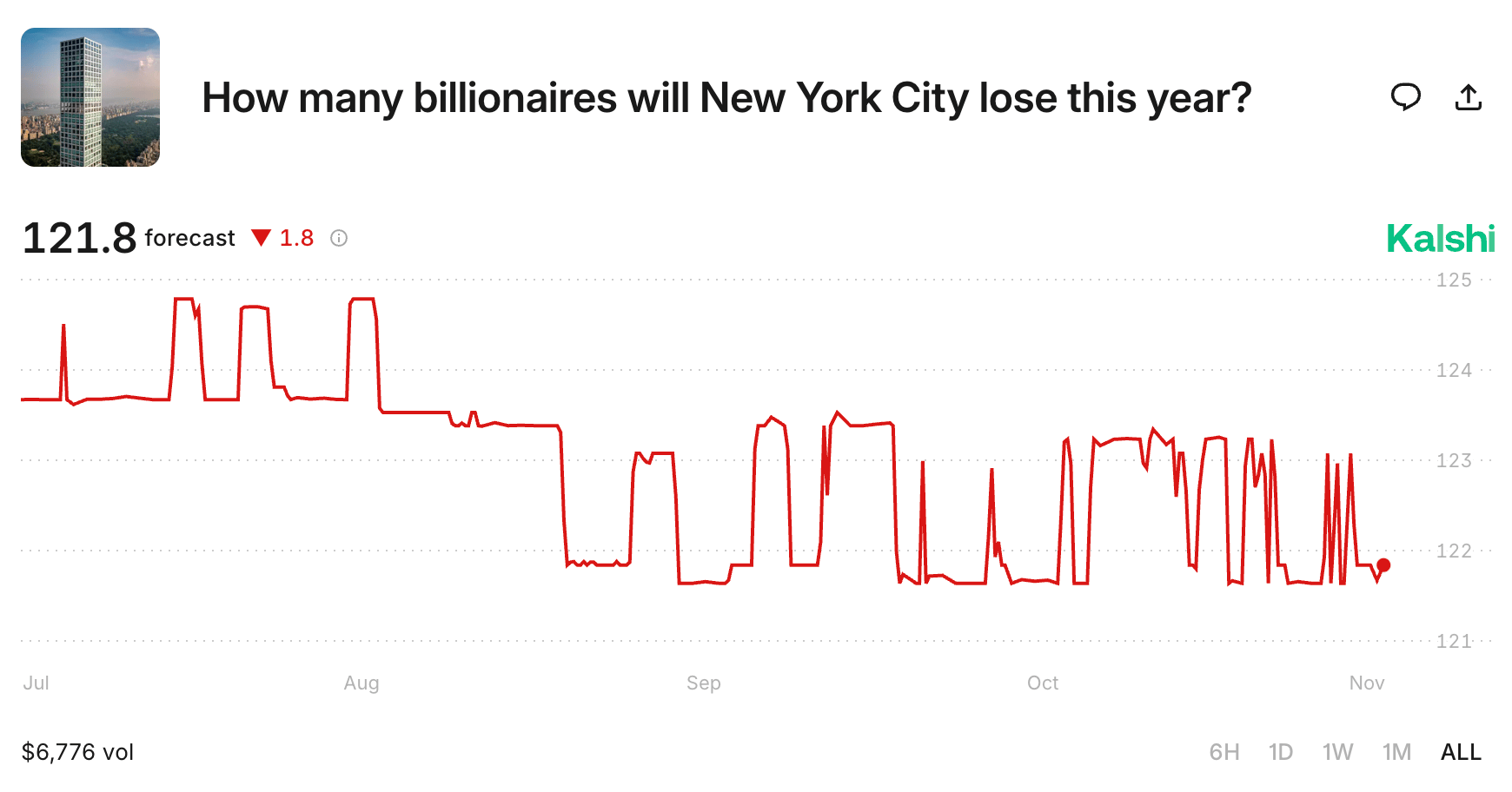

Prediction Markets

Will we see the great billionaire flight from New York City in 2025?

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

Aquarian agreed to acquire Brighthouse Financial for $4.1 billion

Firefly Aerospace completed its acquisition of SciTec for $855 million

Charles Schwab will buy Forge Global, a private shares platform, for $660 million

Synchron, a brain-computer interface startup, raised $200 million

Braveheart Bio, a developer of therapeutics for hypertrophic cardiomyopathy, raised $185 million

Reevo, a go-to-market platform, raised $80 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

The Philosopher in the Valley

Description:

A deeply reported narrative that uncovers the rise of Palantir Technologies and its enigmatic CEO Alex Karp—a trained philosopher turned Silicon Valley kingmaker. The book explores how Palantir’s data-integration software grew from post-9/11 counter-terror tools into a global surveillance engine used by governments and corporations alike. Along the way, Steinberger examines the ethical, political, and cultural consequences of living in a world built on invisible algorithms and secretive intelligence.

Book Length: 304 pages

Release Date: November 4, 2025

Ideal For:

Tech watchers, intelligence-industry observers, business-biography lovers, and anyone curious about how ideas of surveillance, power, and privacy are playing out in real time.

“Palantir stepped into the breach and picked up that contract. The company has not only accepted their grave obligations to national defense; it has fought for the right to serve the country.”

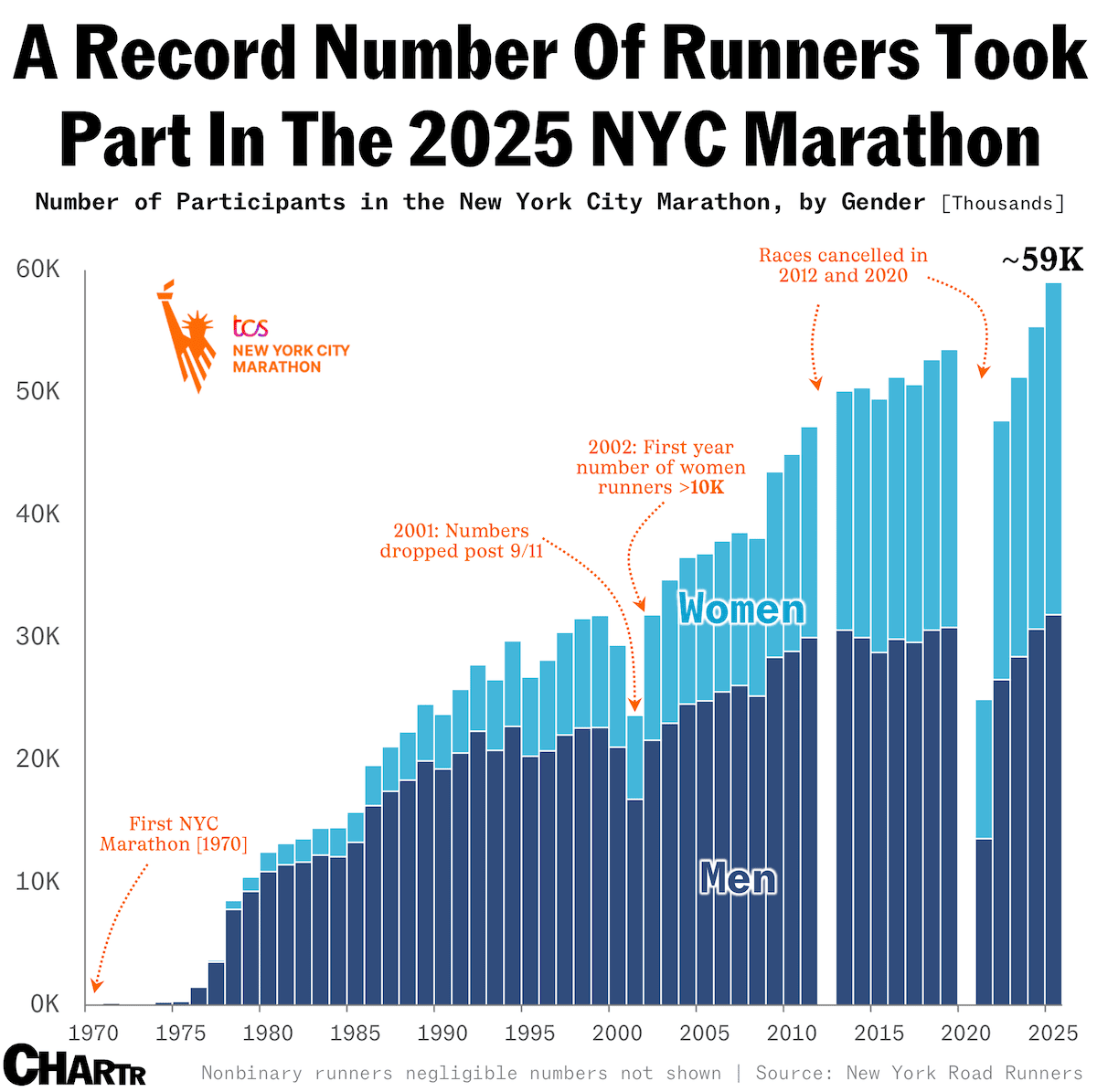

DAILY VISUAL

The Marathon Era

Source: Chartr

PRESENTED BY MOSAIC

The Future of Deal Modeling Starts With an Email to Mo

The world of private equity has changed with the recent launch of Mosaic Autopilot, or Mo for short.

Forward your CIM to Mosaic and receive a fully auditable, bid-ready LBO model in under 5 minutes.

The engine is deterministic, not generative, so you get 100% accurate math and full auditability, unlike the many “AI Excel co-pilots” out there.

Download to Excel with linked formulas or export to PDF in your firm’s format.

No logins or prompt engineering required. Send the file, get back a polished model. See Founder and CEO, Ian Gutwinski, introduce it here.

Please Support Our Partners!

DAILY ACUMEN

Invisible Work

Every high achiever eventually realizes that the most valuable work looks like nothing.

Thinking. Listening. Resting.

These moments don’t photograph well, but they build the foundation for everything visible later.

The best investors spend most of their time waiting.

The best leaders spend most of their time listening.

The best creatives spend most of their time deleting.

The modern world rewards busyness, but mastery rewards restraint.

Do less, but mean more. The invisible hours decide the visible ones.

ENLIGHTENMENT

Short Squeez Picks

Goodbye 9-5, hello 996

Why Jamie Dimon says checking your phone in a meeting is a mistake

How to stay calm when things go wrong

Why success is a game of inches

How to turn Gen-Z into management material

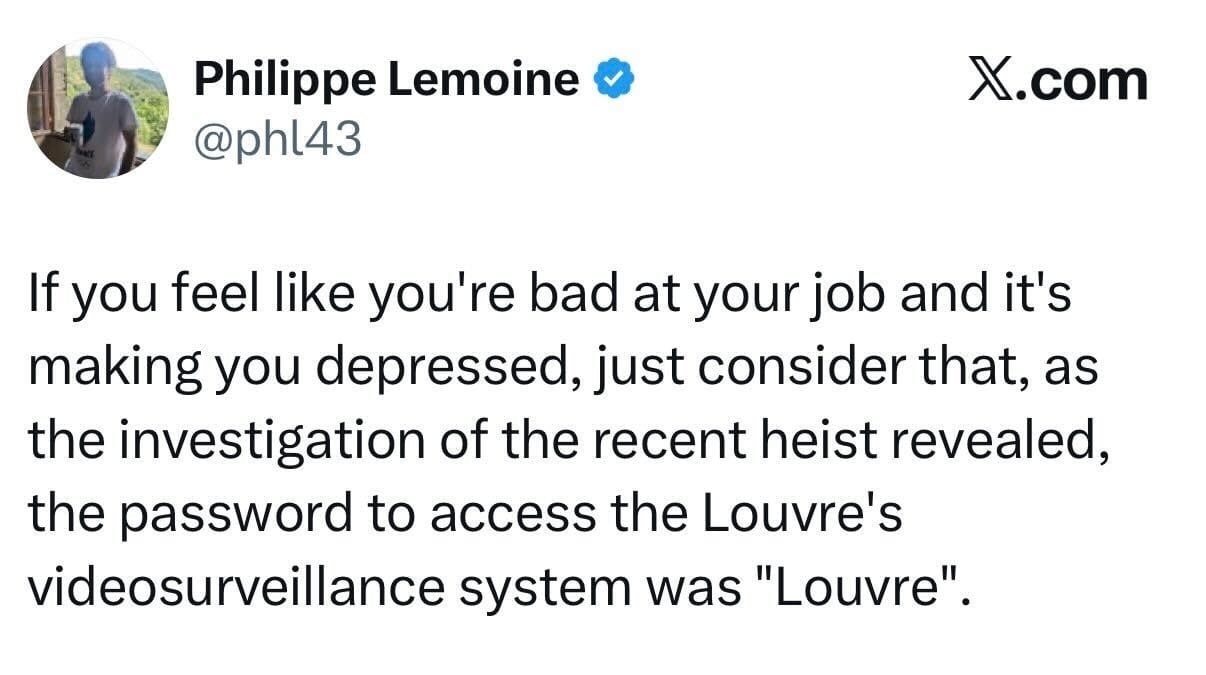

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply