- Short Squeez

- Posts

- 🍋 Hedge Funds Back on Top

🍋 Hedge Funds Back on Top

Plus: Gold and silver hit records, retail trading hits a new record, and did private credit already peak?

Together With

"The only real test of intelligence is if you get what you want out of life." — Naval Ravikant

Good Morning! Gold had its best week since 2020, and silver crossed $100 for the first time ever. Money managers are employing new strategies and rotating into small caps, commodities, precious metals, and inflation-linked bonds to chase alpha. And KKR is bracing for losses as its pandemic-era bet on Raleigh’s bike business flopped.

Wall Street investors are pulling cash from private credit funds as fears of a credit meltdown grow. Trump threatened a 100% tariff if Canada strikes a deal with China. And Booz Allen Hamilton is investing $400 million to Andreessen Horowitz’s latest funds, its first direct venture bet.

Plus: Air taxis are coming closer to reality, JPMorgan says retail trading just hit a new record, and Elizabeth Holmes is asking Trump for an early release.

EquipmentShare rang the bell on Friday. Read more about what they’ve built.

SQUEEZ OF THE DAY

Hedge Funds Back on Top

It’s been a long alpha winter for hedge funds. More than 90% have failed to beat the S&P 500 over the past decade, and funds have struggled to compete with private equity, private credit, and real estate for institutional dollars. But now, Goldman says hedge funds are back on top for the first time in 10 years.

Goldman’s latest survey of 317 institutional investors shows hedge funds are the most favored asset class for new allocations heading into 2026. About 45% of respondents plan to increase exposure, a record share since Goldman started tracking in 2017.

It’s also well ahead of private equity or private credit, where enthusiasm has cooled. And according to HFR, pensions, endowments, and sovereign wealth funds allocated more capital to hedge funds in 2025 than in any year since 2007.

After years in the shadow of private markets, hedge funds are back at the top of the allocation list. The 2010s were defined by zero rates, low volatility, and high stock correlations that crushed dispersion and suffocated active managers. JPMorgan called it “alpha winter.”

But heading into 2026, the environment has flipped. Rates above 2%, diverging central bank policy, geopolitical shocks, and sharp sector dispersion have rebuilt the conditions hedge funds need to generate differentiated returns. Banks are benefiting too, reporting record trading, financing, and prime brokerage revenue tied to hedge fund activity.

And most importantly, performance has been very strong. A PivotalPath index tracking nearly 1,300 hedge funds rose 11.9% in 2025, its best year since 2013, with the top decile returning close to 30%. Strong performance has been across industries, too; biotech funds capitalized on deal flow and trial results, tech managers rode the AI supply chain, and macro funds thrived on cross-border dislocations.

And the clearest signal of regime change is pricing power. After years of fee compression, managers are once again pushing performance fees higher, in some cases toward 25%.

Takeaway: After a decade where beta crushed everything and passive won by default, volatility and dispersion are restoring the value of active risk. With capital rotating back, fees are creeping higher, and prime brokerage desks are humming again, the, only real question now is whether this is the start of a sustained multi-year alpha cycle, or if this is just a volatility spike. For now, the smart money is betting that hedge funds are here to stay.

PRESENTED BY EQUIPMENTSHARE

EquipmentShare Enters the Public Markets

EquipmentShare rang the bell last week, marking a new chapter for the company founded in 2015 in Columbia, Missouri. The company operates a national equipment rental platform that combines a modern fleet with technology-enabled systems, serving customers focused on safety, efficiency, and jobsite productivity.

Company highlights:

Revenue grew from $1.5M in 2015 to more than $4B as of September 30, 2025

Profitable since 2020, with a reported 143% compound annual revenue growth

373+ locations across 45 states and more than 7,700 employees

Plans to expand to approximately 700 rental locations over the next five years

For informational purposes only. Not investment advice.

HEADLINES

Top Reads

Gold tracks best week since 2020, silver breaches $100 in stunning rally (YF)

There's a new idea of alpha in the market that big money managers are pursuing (CNBC)

KKR braces for losses as pandemic purchase of Raleigh bike owner backfires (FT)

Advisors to the ultra-rich say AI isn't a game-changer for landing new clients (CNBC)

Wall Street braced for a private credit meltdown. The risk of one is rising (CNBC)

Trump threatens to impose 100% tariff if Canada makes deal with China (CNBC)

Booz Allen Hamilton commits $400M into a16z's recent funds (Axios)

Air taxis are going from a Jetsons-like dream to near reality (YF)

Retail investor dip buying hits a record high (Axios)

Elizabeth Holmes asks Trump to let her out of prison early (CNN)

KKR's Varsity Brands nears deal for sports apparel company (Sportico)

Musk’s $1 trillion pay package renews focus on soaring CEO compensation (CNBC)

Flex office firm Industrious is seeing major growth. Here's what's driving it (CNBC)

Amazon planning thousands of job cuts next week after axing 14,000 due to AI (NYP)

He wants New Yorkers to have a stake in the Knicks and the Rangers (NYT)

Former Citigroup banker draws $2 billion for new India firm (BB)

Thriving hedge fund trade gets boost from soaring swap spreads (BB)

It’s time for JPMorgan and BofA to make room up top (BB)

CAPITAL PULSE

Markets Rundown

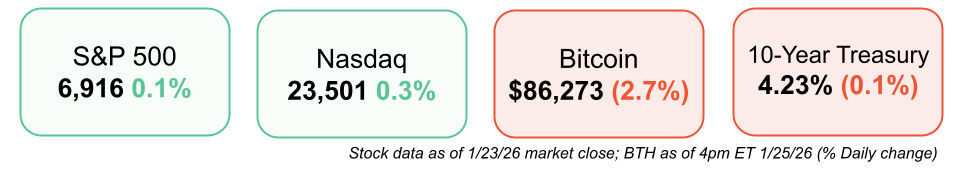

Market Update

U.S. equities were mixed to close a volatile week as Greenland-related concerns faded

Intel –17% after issuing weaker guidance tied to manufacturing challenges

For the week, stocks posted a modest decline, though energy and materials outperformed

Small caps, value, and precious metals continue to attract flows, while mega-cap tech bounced ahead of earnings

WTI crude finished near $61; Treasury yields and the U.S. dollar moved lower

Sector Trends

Energy and materials led weekly gains

Technology stabilized ahead of major earnings

Leadership continues to broaden beyond mega-cap tech, supporting small caps and value

Earnings Outlook

Focus shifts fully to Q4 earnings, with roughly one-third of S&P 500 companies reporting soon

This week includes Meta, Microsoft, Tesla, and Apple, alongside roughly half of the tech sector

S&P 500 Q4 earnings expected to rise ~8% YoY, marking a 10th straight quarter of profit growth

2026 EPS expectations now point to ~15% growth, with all 11 sectors contributing

Profit growth alongside limited hiring suggests rising productivity

Fed & Policy Watch

The Fed meets next week, with markets pricing only a ~3% chance of a rate cut

Economic data continue to show steady growth and a stable labor market, supporting a pause

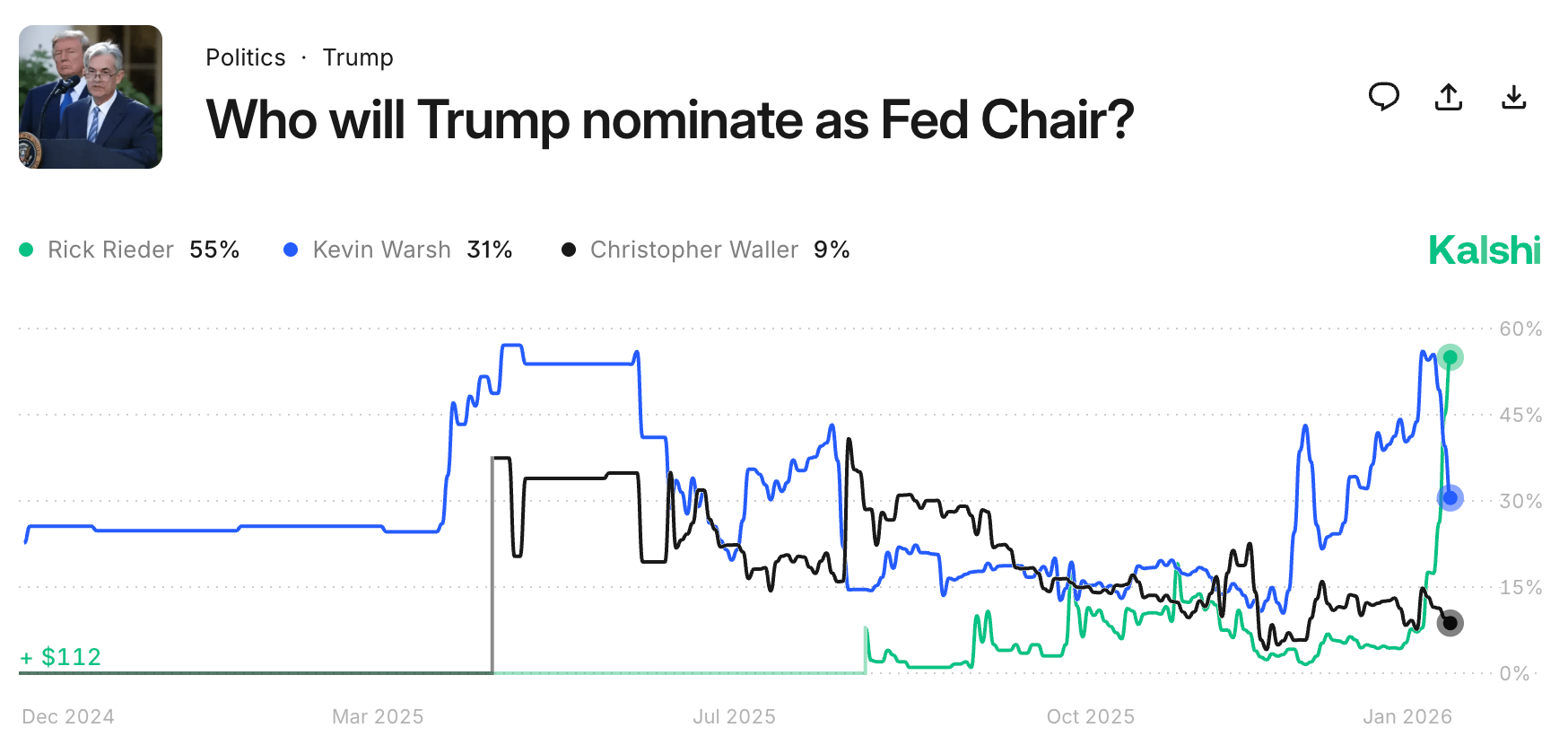

The White House is expected to name a new Fed Chair, with Kevin Warsh or Rick Rieder reportedly leading candidates

The Supreme Court signaled skepticism toward efforts to remove Fed Governor Lisa Cook, reinforcing institutional independence

Markets now expect a slightly higher year-end policy rate (~3.2%) versus prior expectations

Movers & Shakers

(+) Life360 ($LIF) +24% after the information technology company’s monthly user base grew.

(–) Capital One ($COF) -8% after the company bought Brex for $5.15B.

(–) Intel ($INTC) -17% after the multinational technology company issued weak guidance.

Prediction Markets

Could this be Jerome’s farewell tour?

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

Mews, a hospitality operating system used by hotels and lodging operators, raised $300 million

Corxel, a cardiometabolic biotechnology company developing therapies for metabolic and cardiovascular disease, raised $287 million

Claroty, a cybersecurity company focused on protecting cyber-physical and industrial systems, raised $150 million

Neurophos, a photonic AI chip technology company developing optical computing hardware, raised $110 million

LiveKit, a developer platform for building real-time AI agents and voice applications, raised $100 million

Ivo, a legal technology company using AI to automate and analyze contract workflows, raised $55 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

You Deserve To Be Rich

Description: A practical and mindset driven wealth blueprint from the founders of Earn Your Leisure. Bilal and Millings focus on closing the wealth gap by teaching readers how to increase income, control spending, invest strategically, and rewire their relationship with money. Blending financial tactics with psychology, culture, and real life case studies, the book emphasizes building generational wealth through discipline, ownership, and long term thinking.

Book Length: 320 pages

Release Date: January 13, 2026

Ideal For: Aspiring investors, entrepreneurs, wealth builders, and anyone seeking financial confidence, ownership, and long term freedom.

“Wealth is not just about money. It is about mindset, strategy, and believing you deserve more.”

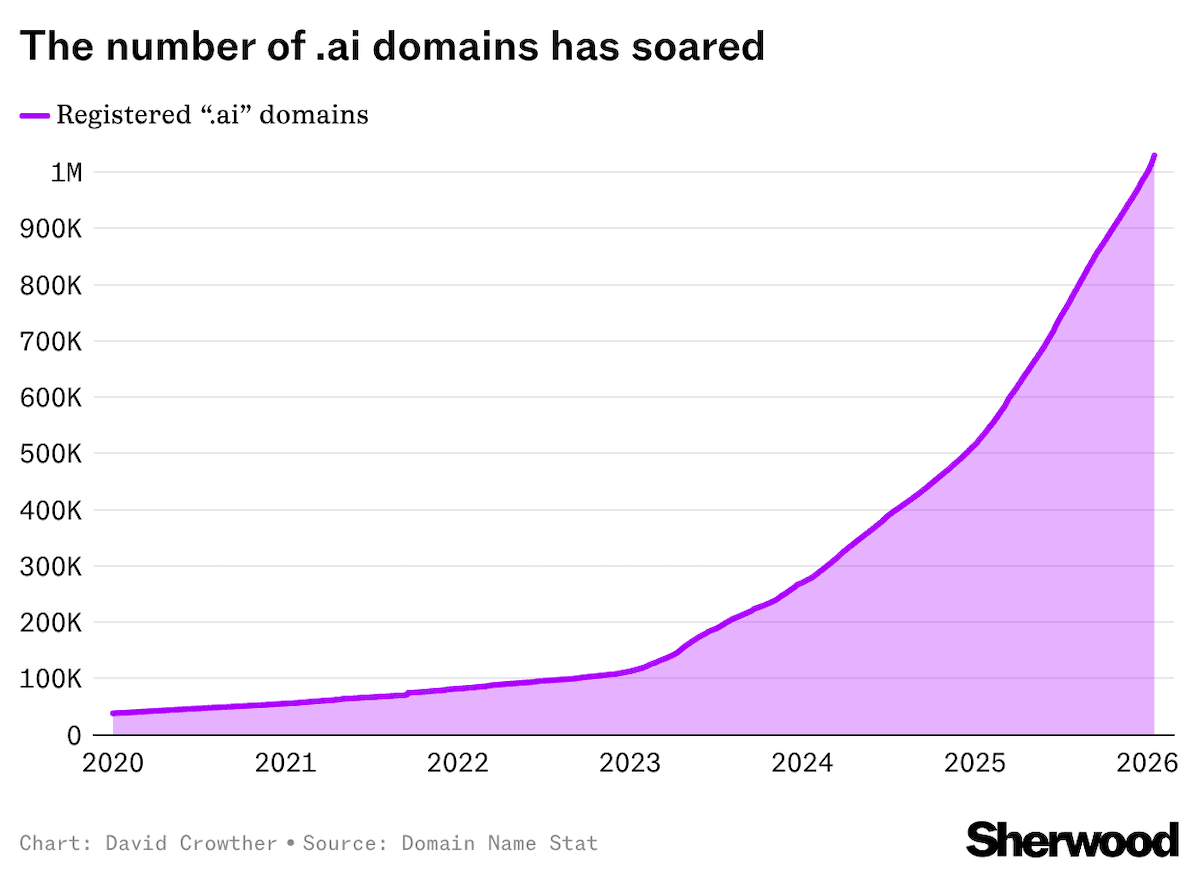

DAILY VISUAL

Now More Than 1 Million “.ai” Domains

Source: Chartr

PRESENTED BY BILT

Earn on Your Biggest Monthly Expense

Rent is likely your largest recurring expense, but until now, it's been money that just disappears every month with nothing to show for it (other than a roof over your head). You get rewarded for your coffee, your groceries, your flights. But your rent? Bilt makes sure that earns you something too.

Bilt is the loyalty program for renters that turns every rent payment into points you can use toward travel, Lyft rides, Amazon.com purchases, and more. The loyalty program works with your existing lease, no matter where you live. You're already paying rent, now you can get rewarded for it.

And, starting in February, Bilt is expanding to mortgage payments for the first time. Homeowners will be able to earn points on their monthly payments just like renters do, and unlock exclusive benefits around their neighborhood at over 45,000 restaurants, fitness studios, pharmacies, and more. Whether you rent or own, your housing payment finally works for you.

DAILY ACUMEN

Short Term Thinking

In 1997, Nike was dominating the athletic shoe market. Reebok decided to compete by slashing prices and flooding the market with cheap products. They won the quarter. They lost the decade.

Nike stayed focused on innovation and brand building. The payoff wasn't immediate, but it was permanent. Today, Nike is worth $200 billion. Reebok was sold for parts.

We're living in the age of instant everything. Want food? It's at your door in 30 minutes. Want entertainment? Stream it now. Want dopamine? Scroll for three seconds. This convenience is rewiring our brains to expect immediate rewards for everything.

But the most valuable things in life don't work on delivery timelines. You can't Amazon Prime a meaningful career. You can't fast-track deep relationships. You can't hack your way to wisdom.

The Chinese bamboo tree gets watered for five years with zero visible growth. Nothing. Then in year six, it shoots up 90 feet in six weeks. Those first five years weren't wasted. They were essential. The tree was building a root system strong enough to support explosive growth.

Your life works the same way. The work you do today might not show results for years. That doesn't mean it's not working. It means you're building roots.

Most people abandon their bamboo in year three. They switch careers because promotion didn't come fast enough. They quit learning guitar after six months. They leave relationships when the spark fades. They're optimizing for quarterly results in a game that rewards decades.

Meanwhile, the world's most successful people think in time horizons that would terrify most people. The founders of Patagonia make decisions based on how they'll impact the company in 100 years. Cathedral builders in medieval Europe worked on structures they'd never see completed. They were planting seeds for trees they'd never sit under.

What are you abandoning prematurely because results aren't immediate?

Remember, in a world sprinting toward instant gratification, patience isn't just a virtue. It's a superpower.

ENLIGHTENMENT

Short Squeez Picks

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply