- Short Squeez

- Posts

- 🍋 Goldman’s $2B Boomer Bet

🍋 Goldman’s $2B Boomer Bet

Plus: Nvidia invests $2 billion in Synopsys, Steve Cohen wins approval for casino near Mets stadium, Blackstone exits Vegas resorts, and Strategy in damage control after BTC sell-off.

Together With

"The best type of risks to take are ones where (1) the worst outcome is manageable and (2) the best outcome is life-changing.” — James Clear

Good morning! Bitcoin had its worst day since March, sparking fears of a new crypto winter. Point72 founder Steve Cohen won approval to operate a casino near Mets stadium, and Blackstone cashed out $800 million from its Las Vegas Strip resorts.

Nvidia is investing $2 billion in chip-design software maker Synopsys. Strategy, Michael Saylor’s Bitcoin-buying company, raised $1.5B to weather the crypto downturn. And Cartier has officially become Gen Z’s Rolex, with Taylor Swift–driven hype sending demand for its watches soaring.

Plus: Why bonds won’t shield investors from an AI bubble, top consultancies are freezing starting salaries as AI disrupts the pyramid model, and why jewelry is outperforming the broader luxury market.

Time kills deals. Farsight tailors every deliverable to your firm's historical work and preferred voice, allowing you to move faster. Learn more about Farsight.

SQUEEZ OF THE DAY

Goldman’s $2B Boomer Bet

Goldman is making a $2B bet on boomers, their retirement money, and one of the safest corners of asset management.

The firm is acquiring Innovator Capital Management, the $28B+ in AUM ETF firm behind the defined-outcome products that have quietly become the retirement world’s favorite comfort food.

Innovator helped pioneer defined-outcome ETFs, and the firm’s 159 ETFs cap some upside, cushion downside, and keep investors in the market using options overlays that smooth out volatility. It allows retirees to stay invested without taking every punch from the S&P.

For Goldman, a firm that built its reputation on serving Wall Street, the past five years have been an experiment in reaching Main Street. The consumer push through Marcus, credit cards, and fintech partnerships failed to gain traction. Now Goldman is betting that asset management, not consumer banking, is the path in.

Over the past several months, Goldman has been assembling a new franchise built around long-duration, recurring revenue. The firm agreed to buy Industry Ventures for up to $965M to expand in venture secondaries. It invested $1 billion in T. Rowe Price to bring private markets into 401(k)s. Now it is adding Innovator and its defined-outcome ETF empire, a product lineup built for retirement savers.

Takeaway: Goldman’s acquisition of Innovator is a long-term bet on the deepest, stickiest capital pool in America: retirement assets. By anchoring itself to boomer wealth that will stay invested for decades, Goldman is trading cycle-driven revenue for structural stability.

PRESENTED BY FARSIGHT

Sick of Creating Slides?

Sick of creating slides? Let Farsight handle it.

You already work 100-hour weeks, why spend half of them rebuilding the same decks?

Farsight learns your firm's prior art - from pitch decks, CIMs, templates, and tone - and generates new slides that look and feel like they came straight from your team.

Your formatting, branding, and structure stay perfectly intact, no grunt work required.

Spend less time fixing slides and more time closing deals.

Discover AI that speaks your firm’s language.

Please Support Our Partners!

HEADLINES

Top Reads

Bitcoin's worst day since March (CNBC)

Steve Cohen, Bally’s, and Genting picked to run New York City casino projects (BB)

Blackstone sold $800M stake in Las Vegas strip resorts (BB)

Nvidia takes $2 billion stake in Synopsys as AI deal spree accelerates (YF)

Strategy trims outlook and sets aside $1.44 billion reserve amid Bitcoin selloff (WSJ)

Cartier becomes Gen Z’s Rolex as Taylor Swift drives luxury-watch hype (BB)

Why bonds won’t protect investors from an AI bubble (WSJ)

Top consultancies freeze starting salaries as AI threatens ‘pyramid’ model (FT)

Why jewelry is outperforming the rest of the luxury world (WSJ)

Meta orders Instagram employees back to the office 5x/week (CNBC)

Michael Burry says Tesla is “ridiculously overvalued,” blasts Musk’s pay plan (YF)

“Private-credit hysteria” will get very real next year (BB)

Starbucks to pay $35 million to NYC workers after the city alleges years of labor violations (Gothamist)

Data centers are a gold rush for construction workers (WSJ)

Banks in talks to lend $38 billion to fund sites for OpenAI (YF)

Blackstone, Apollo and KKR sign up to UK stress test of private credit (FT)

JPMorgan plans a $10 billion investment push into defense startups and legacy contractors (BD)

The $260 billion fixed-maturity funds distorting the credit market (BB)

Jim Chanos warns of debt risks tied to Nvidia-backed AI financing structures (YF)

CAPITAL PULSE

Markets Rundown

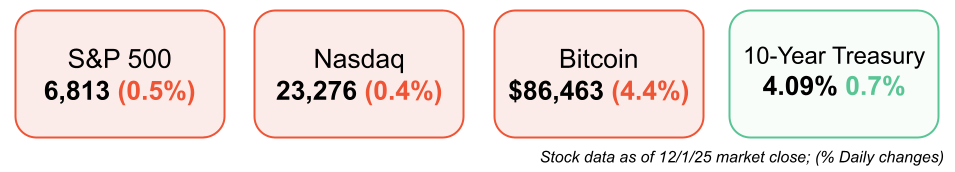

Market Update

Stocks slipped Monday, kicking off December on a cautious note after a choppy November that still delivered a seventh consecutive monthly gain for the S&P 500.

The S&P 500 fell 0.5%, Nasdaq lost 0.4%, and Dow declined 0.9%, while small caps underperformed with the Russell 2000 -1.1%.

Overseas weakness weighed on sentiment, with Japan’s Nikkei down nearly 2% after the Bank of Japan hinted at a potential rate hike, triggering a global bond sell-off.

The 10-year Treasury yield rose 8 bps to 4.09%, while the dollar eased slightly against major peers.

Oil edged higher to $59/barrel, gold climbed to $4,270/oz, and bitcoin dropped more than 6%, reversing much of last week’s rally.

Economic Data Highlights

The ISM manufacturing index fell to 48.2, signaling continued contraction with weakness in new orders and employment components.

Markets are pricing in a nearly 100% chance of a 25 bp Fed rate cut this month, following dovish comments from policymakers and signs of labor market softness.

President Trump signaled he has chosen the next Fed chair, with chief economic adviser Kevin Hassett rumored to be the frontrunner.

Investors will watch this week’s JOLTS job openings and Friday’s nonfarm payrolls for confirmation of moderating labor trends.

Sector Trends

Technology and crypto-linked names lagged as bitcoin’s slide weighed on sentiment.

Energy stocks gained alongside firmer crude, while materials rose with gold prices.

Utilities and consumer staples outperformed amid the risk-off tone, while small caps and cyclicals lagged.

Seasonality Outlook

Despite today’s pullback, the S&P 500 is up roughly 16% YTD, fully recovering from April’s 19% correction.

Historically, December has been one of the strongest months for equities, posting positive returns 71% of the time since 1980 with an average gain of 1.2%.

While not guaranteed, easing policy expectations and stable earnings could support a year-end “Santa Claus rally.”

Earnings Today

CrowdStrike (CRWD) – Reports after the close tomorrow; focus on ARR growth, operating margin expansion, and federal demand trends.

Okta (OKTA) – Reports after the close tomorrow; watch customer retention, enterprise adoption, and FY guidance updates.

GitLab (GTLB) – Reports after the close tomorrow; look for commentary on AI-driven DevSecOps adoption and billings momentum.

Movers & Shakers

(+) Synopsys ($SNPS) +5% after Nvidia will make a $2 billion investment in the engineering design company.

(–) Moderna ($MRNA) -7% because of an FDA memo that found the company’s Covid-19 vaccine was linked to 10 children's deaths.

(–) Joby Aviation ($JOBY) -7% after Goldman initiated coverage on the aircraft company with a sell.

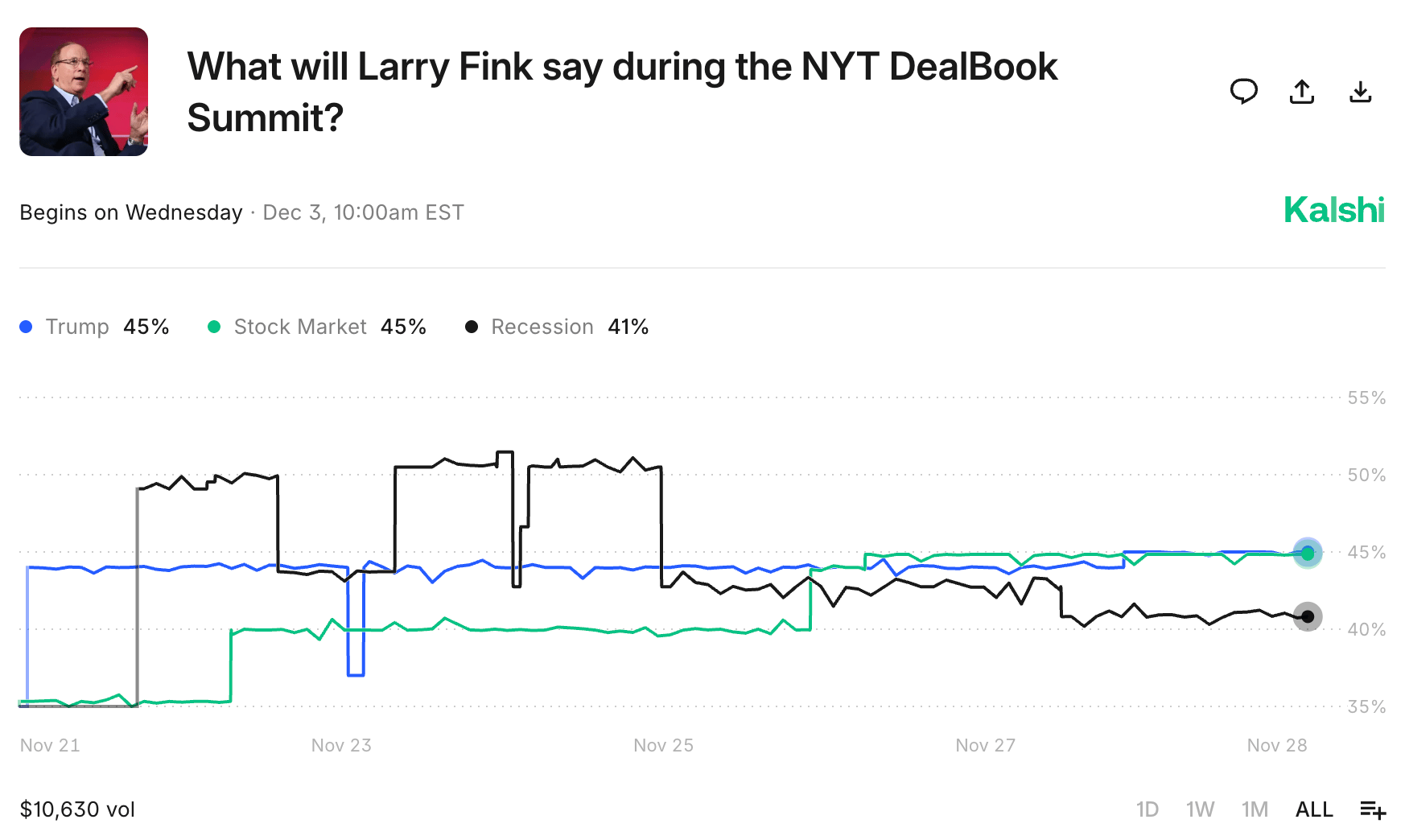

Prediction Markets

The NYT DealBook Summit begins tomorrow, December 3rd.

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

Goldman Sachs agreed to buy Innovator Capital Management, a provider of defined-outcome ETFs, for about $2 billion

Black Forest Labs, an AI image generation startup, raised $300 million

Quantum Systems, a developer of aerial intelligence systems, raised $195 million

Protego Biopharma, a rare disease biotech, raised $130 million

Iambic Therapeutics, an AI drug discovery company, raised $100 million

Neros, a military drone maker, raised $75 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

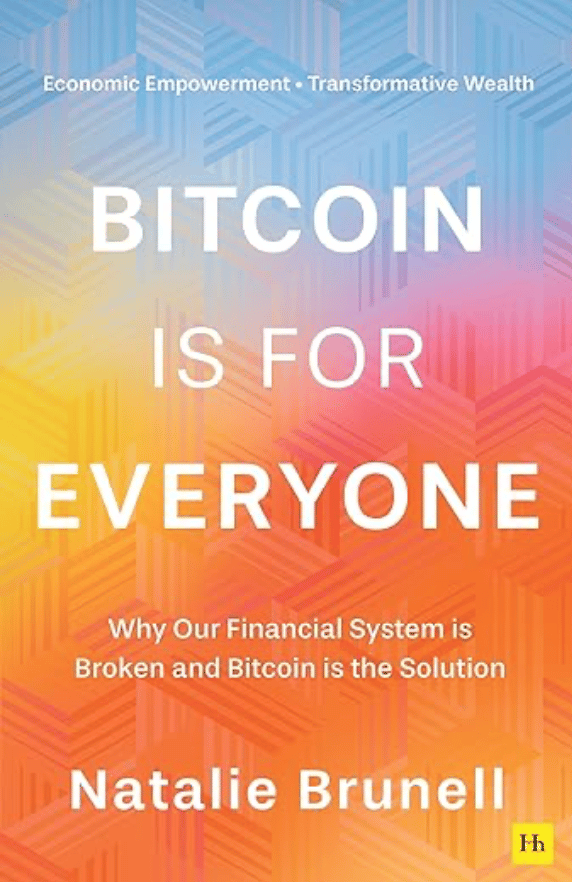

Bitcoin is for Everyone

Description: A fearless, timely case for why our money is broken—and how Bitcoin offers a path to repair it. Brunell dissects inflation, debt-fueled fragility, and eroding trust, arguing that decentralized, verifiable money shifts power from institutions back to individuals. It’s half primer, half rallying cry for readers who feel the system’s math no longer adds up.

Book Length: 256 pages

Release Date: November 18, 2025

Ideal For: Investors, skeptics, builders, and anyone rethinking “sound money.”

“Bitcoin isn’t rebellion—it’s repair. A system built not on promises, but on proof.”

“Bitcoin isn’t rebellion—it’s repair. A system built not on promises, but on proof.”

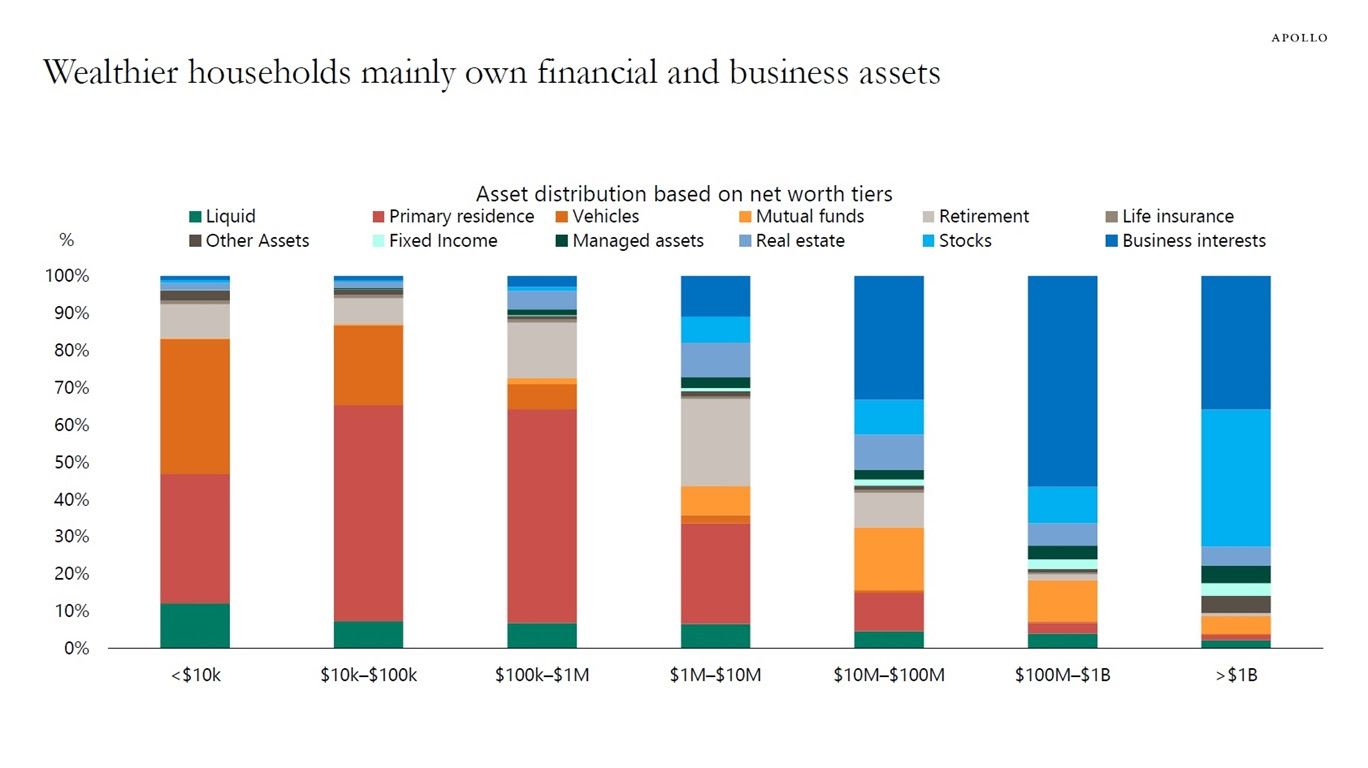

DAILY VISUAL

Asset Holdings Across the Wealth Distribution

Source: Apollo

PRESENTED BY PERCENT

The $2T Market Missing From Your Portfolio

As markets hit record highs and Goldman Sachs projects just 3% annual stock returns over the next decade, sophisticated investors are diversifying beyond traditional assets. Enter private credit - a $2 trillion market that's grown 19x since 2006.

Through Percent's platform, accredited investors can access institutional-quality deals starting at $500. Our marketplace has facilitated over $2B in transactions, with average net returns to investors of 14.9% in 2024.

Join the ranks of institutional investors already leveraging private credit for portfolio enhancement. Plus, new investors receive up to $500 on their first investment.

Please Support Our Partners!

DAILY ACUMEN

10-Year Rule

We overestimate what we can do in one year and underestimate what we can do in ten. Most people quit before compounding kicks in because progress in the early years feels painfully slow. But growth doesn’t move in straight lines. It curves, quietly at first, then suddenly explodes.

Think of careers, fitness, wealth, or relationships. The first five years feel like grinding in the dark. The next five make you look like a genius. What changed wasn’t your intelligence, but your consistency. Every small action was earning invisible interest until the moment it all showed up at once.

Most people chase momentum. The wise build it. They keep showing up while others switch strategies, industries, or identities. In the end, the difference between average and exceptional isn’t speed but staying power.

If you can be patient for ten years, you can do what most people never will.

ENLIGHTENMENT

Short Squeez Picks

How to make your writing more persuasive

12 habits successful people use to project confidence

The 6-6-6 walking trend makes cardio easier than ever

Why people love spicy food even when it hurts

5 ways to sharpen your judgement as a leader

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

*Alternative investments are speculative and possess a high level of risk. No assurance can be given that investors will receive a return of their capital. Those investors who cannot afford to lose their entire investment should not invest. Investments in private placements are highly illiquid and those investors who cannot hold an investment for an indefinite term should not invest. Private credit investments may be complex investments and they are subject to default risk.

Reply