- Short Squeez

- Posts

- 🍋 Goldman Breaks Its Own Record

🍋 Goldman Breaks Its Own Record

Plus: Nike is going pickleball, MrBeast gets a $200M investment, weight-loss drugs are bullish for airlines (per Jefferies), and TSMC sends AI stocks higher.

Together With

“A great many people conclude that something can't be evil if they are profiting from it.” — Charlie Munger

Good Morning! Jefferies says weight-loss drugs could boost airline profits by lowering fuel costs. The two largest publicly traded avocado producers are merging. And Nike is going pickleball, signing No. 1-ranked star Anna Leigh Waters.

Bitmine, the largest corporate holder of Ethereum, is investing $200M in Beast Industries, the company behind MrBeast. Chip stocks jumped after TSMC dismissed bubble fears, and Taiwan pledged $250B toward U.S. chipmaking under a new trade deal.

Plus: Two fitness companies are merging with Jared Kushner’s backing, Amazon says its $475M Saks stake is now worthless post-bankruptcy, and investigators identified the likely cause of the massive Verizon outage.

Worried AI will take your job? Train the models instead and try Endex.

SQUEEZ OF THE DAY

Goldman Breaks Its Own Record

Goldman Sachs posted a record quarter for equities trading, generating $4.31 billion in Q4 revenue, the highest equities-trading result ever reported by any Wall Street bank. The figure surpassed Goldman’s own prior record and came in roughly $700 million above consensus expectations

For Goldman, this wasn’t a one-quarter wonder. Revenue across Goldman’s global banking and markets division hit a full-year record. Goldman’s trading franchise has been aggressively scaling during a period of heavy market volatility, and it looks like it’s paying off.

After failed bets in other areas of finance like consumer, Goldman has doubled down on what it does best: trading, dealmaking, and servicing hedge funds at scale.

Results were broad-based across asset classes. Fixed income, currencies, and commodities trading delivered $3.1 billion in revenue, also beating expectations, with FICC financing hitting a record as hedge funds leaned more heavily on balance sheet access. Goldman even flagged interest in prediction markets, a signal it’s still looking for edge where liquidity and client demand intersect.

Elsewhere, the firm raised its dividend to $4.50 per share and lifted long-term targets for its Asset & Wealth management business, now aiming for 30% pretax margins and high-teens returns. That unit, led by Marc Nachmann, is expanding through acquisitions and pushing toward $750 billion in alternative assets by the end of the decade.

Takeaway: Goldman’s results reflected more than favorable market conditions. It showed that its trading engine is structurally stronger than before, capable of printing record revenues across equities and fixed income at the same time. For a firm that once tried to reinvent itself as a consumer bank, this quarter was a reminder that Goldman’s real superpower is still Wall Street dominance at scale.

PRESENTED BY ENDEX

Investment Bankers Are Training AI Models As Latest Exit Opportunity

Ex-bankers are now training Endex, the Excel agent backed by OpenAI. They’re teaching Endex’s models how Wall Street actually builds DCFs and LBOs.

Firms are leveraging AI tools as a path to streamline tasks that used to take bankers hours.

Frontier AI labs project significant improvements in Excel capabilities after the next year.

Request access to Endex or apply to join.

HEADLINES

Top Reads

Airlines to save big money on fuel as new weight loss pills gain popularity (CNBC)

Avocado producers Mission and Calavo agree to merge (Axios)

Nike signs phenom Anna Leigh Waters in its first pickleball deal (CNBC)

MrBeast platform gets $200 million investment from Tom Lee's Bitmine (CNBC)

Chip stocks jump as Nvidia supplier TSMC dismisses bubble fears (YF)

Taiwan will invest $250 billion in U.S. chipmaking under new trade deal (CNBC)

Two fitness companies are merging with Jared Kushner’s backing (WSJ)

Amazon threatens ‘drastic’ action after Saks bankruptcy, says $475M stake is now worthless (CNBC)

Mortgage rates hit 3-year low after Trump's bond-buying announcement (YF)

Likely culprit in massive Verizon outage revealed (NYP)

New York-style bagel brands battle over customers in Florida (Fox)

Curt Cignetti has won two bowls at Indiana, and eaten 500 bowls at Chipotle (WSJ)

Earnings fall short at Bank of America, Citi, JPMorgan and Wells Fargo (NYT)

BlackRock and Microsoft AI partnership raises $12.5 billion so far (BB)

Stephen Ross sees California billionaire tax as Palm Beach’s gain (BB)

Morgan Stanley tops investment banking forecast on debt haul (BB)

Ares raises $7.1 billion as credit secondaries boom continues (BB)

CAPITAL PULSE

Markets Rundown

Market Update

U.S. equities finished higher as geopolitical tensions eased and earnings surprised to the upside

President Trump signaled no imminent military action against Iran, lifting sentiment

Technology stocks rallied on strong results and raised guidance from Taiwan Semiconductor

Goldman Sachs, Morgan Stanley, and BlackRock all beat earnings expectations, with investment banking a bright spot

Small caps outperformed, with the Russell 2000 +~1%

WTI oil fell nearly 5%, and gold traded lower as geopolitical risk premiums eased

Treasury yields edged higher, with the 10-year rising to 4.17%

Economic Data Highlights

Initial jobless claims fell to 198K, well below expectations (215K) and the 30-year median (320K)

Continuing claims dipped to 1.88M, though still elevated vs. pre-pandemic levels (~1.7M)

Regional Fed activity indices (New York, Philadelphia) both exceeded expectations, signaling steady economic momentum

Sector Trends

Technology led markets on the back of Taiwan Semiconductor’s strong earnings and upbeat AI-driven outlook

Financials rallied after strong results from major banks

Energy lagged as oil prices fell sharply

Industrials and materials remain poised for strong 2026 earnings growth

Looking Ahead

S&P 500 earnings expected to grow ~7% in Q4 and 11.4% in 2025, strengthening to ~15% in 2026

Key sectors—tech, industrials, materials—projected to deliver 15%+ earnings growth next year

With valuations elevated, earnings growth will be crucial for further market gains in 2026

Labor markets remain resilient: despite slow hiring (2025 average 49K/month), unemployment has stabilized at 4.4%

We expect a low-hiring, low-firing dynamic to persist, with 2026 payroll gains in the 50K–100K range and unemployment around ~4.5%

Movers & Shakers

(+) Morgan Stanley ($MS) +6% after the bank beat estimates thanks to strong wealth management, investment banking results.

(+) Taiwan Semiconductor Manufacturing ($TSM) +4% after the semiconductor company posted a 35% increase in Q4 profit.

(–) Eli Lilly ($LLY) -4% after the FDA delayed Eli Lilly’s weight loss pill.

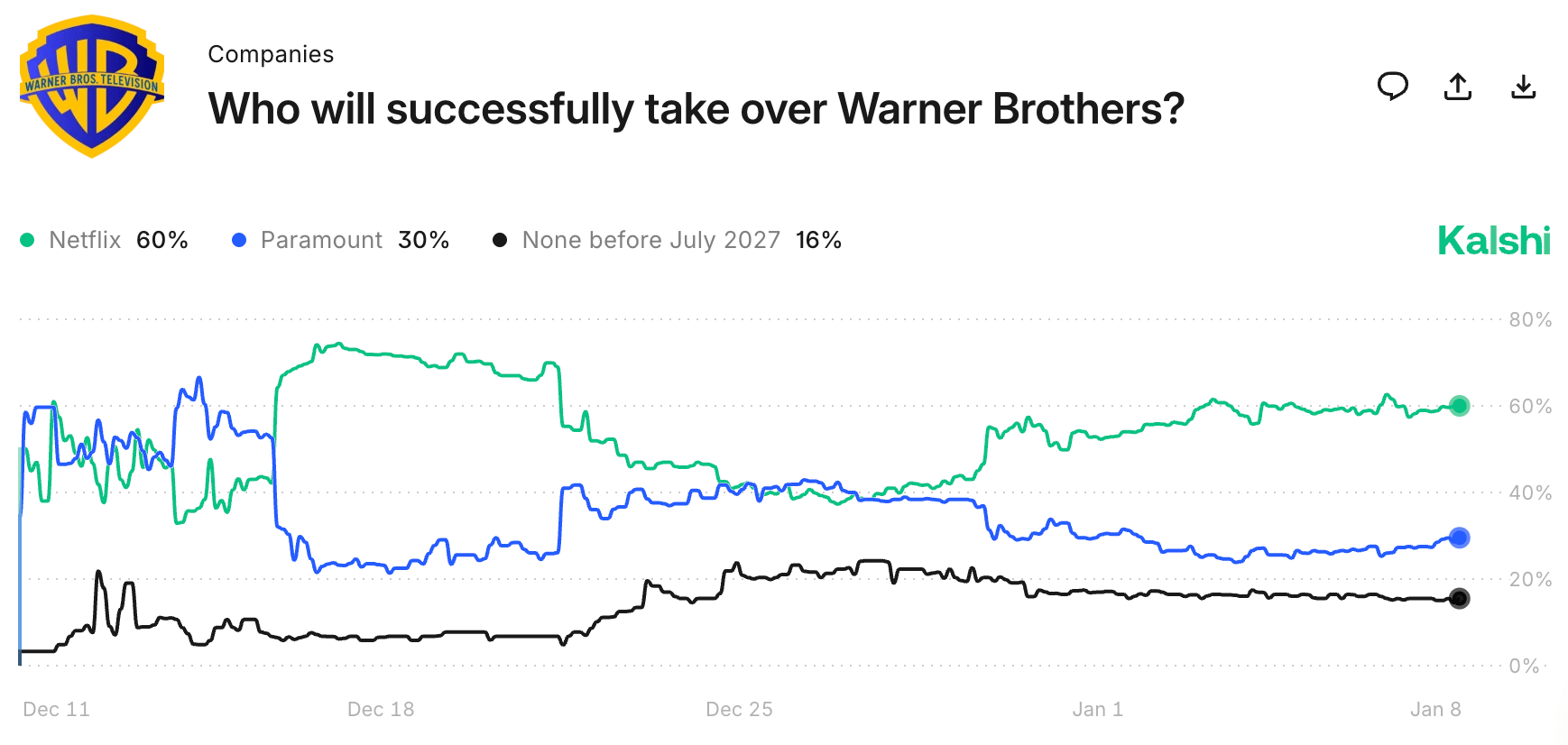

Prediction Markets

If Greenland happens, this will be the second biggest acquisition of the year.

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

Boston Scientific will buy Penumbra, a med tech company, for $14.5 billion

Skild AI, a developer of general-purpose AI “brains” for robots, raised $1.4 billion

Mission Produce agreed to acquire Calavo Growers for around $483 million

Parloa, an automated customer service platform that uses AI voice agents for enterprise call centers, raised $350 million

Alpaca, a stock-trading infrastructure platform that provides APIs for brokerage and investing apps, raised $150 million

Harmonic, an AI research lab focused on training foundation models for reasoning and decision-making, raised $120 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Dead Companies Walking

Description: A contrarian investment memoir and actionable guide from hedge fund manager Scott Fearon, who made his career spotting companies on the brink of collapse and turning their failure into profit. Fearon shares his core framework for identifying the warning signs of doomed businesses, explains common strategic mistakes that lead to collapse, and blends personal stories with market lessons that challenge conventional investing wisdom.

Book Length: 256 pages

Release Date: January 6, 2015

Ideal For: Investors, allocators, market skeptics, and anyone who wants a deeper understanding of risk, failure, and opportunity in capital markets.

“Success in markets isn’t just about spotting winners, it’s about knowing when a company’s future has already walked away.”

DAILY VISUAL

The Industrial Renaissance Is Here

Durable goods data points to a U.S. capex boom, with the One Big Beautiful Bill set to further boost business investment in the coming quarters

Source: Apollo

PRESENTED BY STELRIX

The Card That Treats Your Portfolio Like the Asset It Is

Private banks have offered portfolio-backed lending for decades, but only to clients who clear six-figure minimums and navigate weeks of underwriting. The rest rely on credit cards that ignore their actual financial position.

Stelrix delivers that same institutional infrastructure to high achievers who understand how wealth actually works. The platform connects directly to your brokerage and provides spending power secured by your holdings, not your credit history. Your assets remain invested and continue generating returns while you access capital for opportunities that don't wait for liquidation timelines.

Weighing almost twice a typical Amex, the card's technology is communicated through its physical design. The sleek gold finish signals a different class of financial product. Your capital works on your timeline, deployed when you need it without disrupting long-term strategy.

Join the elite. Reserve your gold card today.

DAILY ACUMEN

Patience

In 1997, Jeff Bezos told shareholders that Amazon wouldn't be profitable for four to five years. Wall Street panicked. Analysts called him reckless. But Bezos understood something they didn't: great things take time, and impatience kills more dreams than incompetence ever will.

Today we want instant results. Plant a seed Monday, expect fruit by Friday. Start a YouTube channel, expect virality by next week. Launch a business, expect millions by year's end.

This instant gratification mentality creates a generation of quitters who abandon ship at the first sign of slow progress. The Chinese bamboo tree is watered and fertilized for five years with no visible growth. Nothing.

Then in the sixth year, it grows 90 feet in six weeks. Was it growing those first five years? Absolutely. It was developing a root system strong enough to support its future height.

Your dreams are the same. The work you're doing today might not show results for years. That doesn't mean it's not working.

Warren Buffett became a billionaire at 56, but he started investing at 11. Most of his wealth came after 60.

What are you abandoning prematurely because results aren't immediate? What if you're in year four of your bamboo moment?

Remember, patience isn't passive waiting. It's active perseverance while trusting the process.

ENLIGHTENMENT

Short Squeez Picks

Why recognition makes you 9x more trusted at work

How to live well in 2026

Add these 2 routines to your workday in 2026

10 ways to develop strong public speaking skills

How to take a perfect lunch break

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply