- Short Squeez

- Posts

- 🍋 From Hedge Fund to Head Coach

🍋 From Hedge Fund to Head Coach

Plus: Cannabis stocks jump on Trump news, JPMorgan to hand out $1,000 to low paid employees, OpenAI ends equity vesting, and Wall Street goes old school.

Together With

“Many a man thinks he is buying pleasure, when he is really selling himself a slave to it.” — Benjamin Franklin

Good Morning! Cannabis stocks jumped after reports Trump is expected to sign an executive order reclassifying marijuana as soon as today. JPMorgan is set to give up to $1,000 to employees earning under $80K via a 401(k) bonus. And Blackstone’s private-equity realizations topped $20 billion in 2025.

OpenAI will end its employee equity vesting period. Shopify’s president says some of the company’s best performers work just 40 hours a week. And Wall Street is skipping tech and rotating into old-school growth plays for 2026.

Plus: How Vail’s CEO reinvented skiing and the difference between an authentic leader and an authentic jerk.

Play mini-games to win back up to 100% of your purchases. Download Coverd today.

SQUEEZ OF THE DAY

From Hedge Fund to Head Coach

One of the wildest finance-to-sports pivots in recent memory became official this week when Biff Poggi, a hedge fund founder turned lifelong football lifer, was named interim head coach of the Michigan Wolverines after the firing of Sherrone Moore.

Poggi’s story starts on the gridiron. He played offensive line at Pittsburgh and Duke before launching a very different career in finance. In 1986, with a $25,000 loan, he co-founded Samuel James Limited, growing it into a hedge fund that eventually managed hundreds of millions before he handed it over to former players.

But football never left. While building his finance career, Poggi spent nearly two decades coaching high school football in Baltimore, becoming a local legend and winning multiple championships. He later returned to the college ranks, joined Michigan’s staff, helped build elite high-school programs, and served as associate head coach under Jim Harbaugh.

Earlier this season, Poggi had already stepped in as Michigan’s interim head coach during a suspension stretch, leading the team to wins and earning respect inside the locker room.

When Michigan parted ways with Moore following serious policy violations, Poggi became the obvious interim choice: trusted by players, deeply embedded in the program, and known as a true players’ coach.

Despite owning his own jet and remaining an active investor across energy, logistics, real estate, and biotech, coaching was always the goal. Poggi once joked that he was “obviously” having a better financial year than Harbaugh even when Harbaugh was making $7 million annually, but money was never the point.

Takeaway: His path was accidental only in how it unfolded. Hedge funds and football coaching are both eat-what-you-kill worlds where performance, preparation, and trust compound over time. So if you’re staring at Excel wondering what comes next, remember: you could always go coach high school football and accidentally end up at Michigan.

PRESENTED BY COVERD

Rethinking Personal Finance With Interactive Rewards

Coverd combines spending insights with reward-based mini-games. Users track purchases, play for cashback, and apply winnings toward bills or future expenses. The platform has returned $2 million to early users.

Built by former traders Albert Wang and Eric Xu, Coverd flips the traditional rewards model. Instead of earning fixed percentages that accumulate slowly, users get variable returns through gameplay; up to 100% of purchase amounts back.

The Coverd Card launches early 2026 with the same interactive reward structure built into every transaction.

Please Support Our Partners!

HEADLINES

Top Reads

Cannabis stocks surged after Trump expected to sign executive order to reclassify marijuana as soon as Monday (CNBC)

JPMorgan said to give up to $1k to employees earning under $80k (SA)

Blackstone’s private equity realizations top $20 billion in 2025 (BB)

Shopify President says some of the greatest performers work 40 hours a week (CNBC)

OpenAI to end equity vesting period for employees (BB)

Wall Street skips tech and goes old school for growth in 2026 (BB)

Vail CEO has transformed skiing, whether you like it or not (WSJ)

Hedge fund manager who got stock market rally wrong still nabs 79% gain (BB)

Apollo moves fast-growing lending unit out of buyout division (FT)

Fiber is shaping up to be the latest grocery obsession (CNBC)

UBS climbs to 17-year high on prospect ofc capital compromise (BB)

Boozy hedge-fund scion flips golf cart at $15M Hamptons estate (NYP)

Broadcom stock reverses lower on a misinterpretation of what the CEO said on the earnings call (CNBC)

AQR, Elliott among hedge funds reviving appraisal arbitrage play (BB)

Elite college sports group nears $500mn private capital deal (FT)

CAPITAL PULSE

Markets Rundown

Market Update

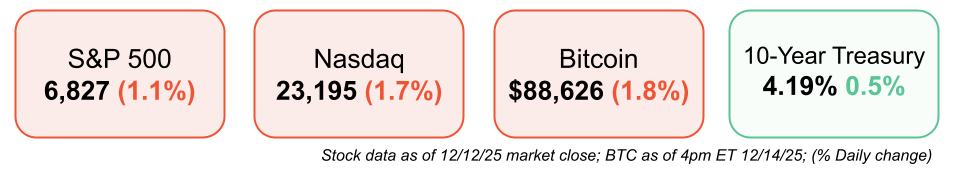

Stocks fell Friday as a sharp pullback in mega-cap tech weighed on the Nasdaq (-1.7%), while the S&P 500 and Dow also retreated from record highs.

Broadcom (AVGO) dropped 11% despite beating earnings expectations, as investors questioned the sustainability of AI-related growth following a 70% rally earlier this year.

Defensive sectors such as consumer staples and health care outperformed amid the day’s risk-off tone, while cyclicals and technology lagged.

Treasury yields rose, with the 10-year yield climbing to 4.19%, while the U.S. dollar was little changed.

Economic Data Highlights

The Fed’s policy meeting earlier this week marked the final major event of 2025, ending with a 0.25% rate cut to 3.5%–3.75%.

Policymakers projected one more cut in 2026 and another in 2027, signaling a gradual easing path ahead.

Chair Powell emphasized optimism around productivity and downplayed inflation risks tied to tariffs, though he noted concerns over data quality given the recent shutdown.

The Fed also announced plans to purchase $40B in short-term Treasuries to maintain balance sheet stability.

Next week’s focus shifts to delayed CPI and jobs data for October and November, which could influence early-2026 policy expectations.

Sector Trends

The Magnificent Seven underperformed, with Oracle and Broadcom extending the week’s losses and contributing to weakness across the AI trade.

Meanwhile, small-caps and cyclicals remained resilient — both the equal-weight S&P 500 and Russell 2000 hit new highs before today’s pullback.

Defensive leadership returned late in the week as investors rotated into value-oriented sectors benefiting from Fed easing and steady economic growth.

Movers & Shakers

(+) Tilray Brands ($TLRY) +44% after Trump is expected to sign an executive order to reclassify marijuana.

(+) Lululemon ($LULU) +10% because the company’s CEO announced he would step down.

(–) Broadcom ($AVGO) -11% despite blockbuster earnings as ‘AI angst’ weighs on Oracle, Nvidia.

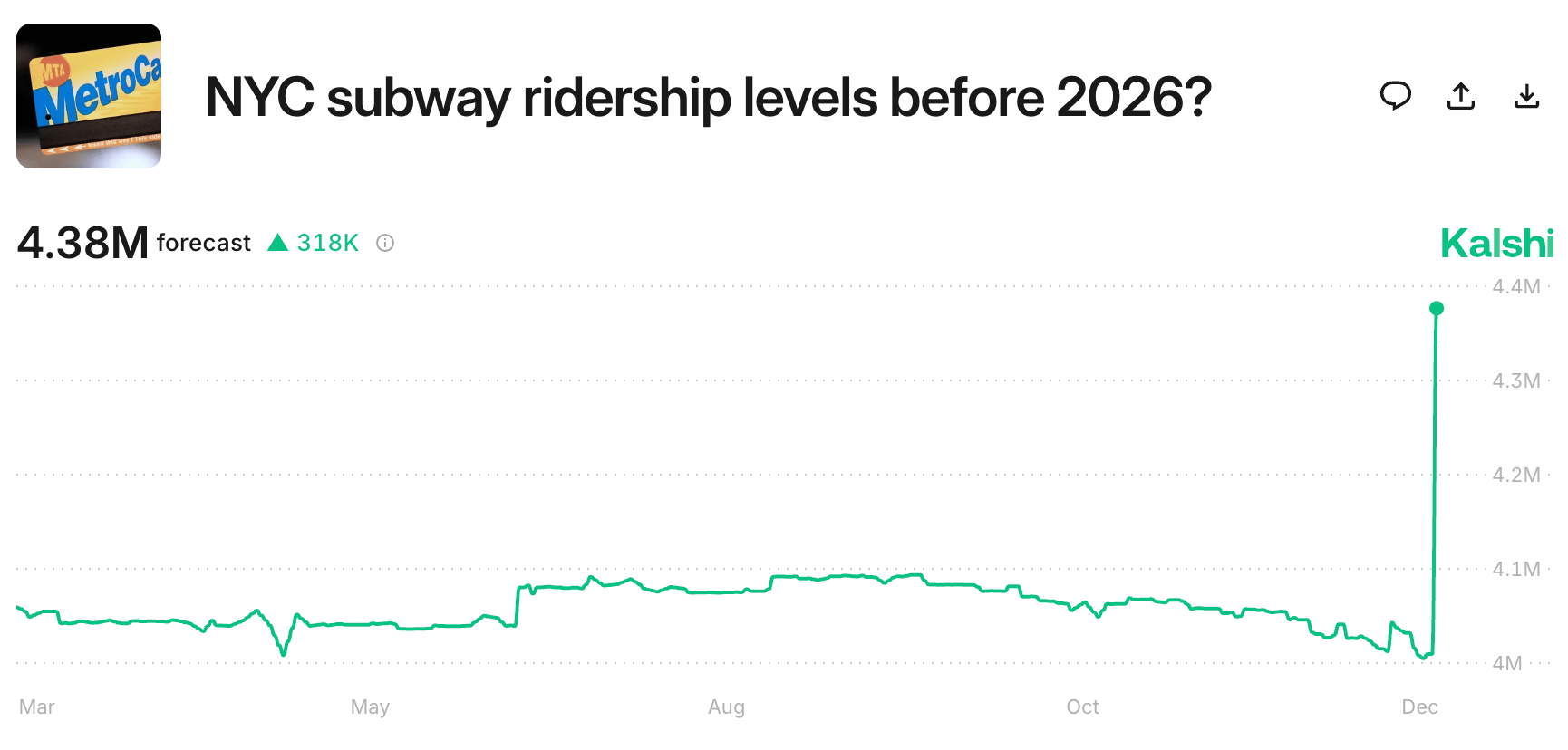

Prediction Markets

It’s Christmas in NYC. How many people will ride the subway through the end of the year?

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

Mollie, a payments firm, will buy GoCardless, an account-to-account payments provider, for $1.14 billion

Stampede Culinary Partners, a maker of prepared protein products, sold to Premium Brands Holdings for $664 million

BlossomHill Therapeutics, a cancer biotech, raised $84 million

Serval, an IT service management platform, raised $75 million

Esusu, a credit-building startup, raised $50 million

Cellular Origins, a cell therapy manufacturer, raised $40 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

The Price of Nice

Description: A smart, candid wake-up call about the hidden cost of being “nice.” Gibbings shows how prioritizing comfort and approval can leave individuals—and organizations—playing small, avoiding conflict, and settling for mediocrity. Instead of platitudes, she offers four concrete actions to break the cycle: get clear on what matters, invite honest feedback, build courage muscle, and act with purpose. It’s part psychology, part leadership manual, all practical.

Book Length: 256 pages

Release Date: 2025

Ideal For: Leaders, creators, managers, and anyone tired of polite stagnation and ready to shake up how they think and act.

“Nice is easy. Change is uncomfortable. Growth demands the latter.”

DAILY VISUAL

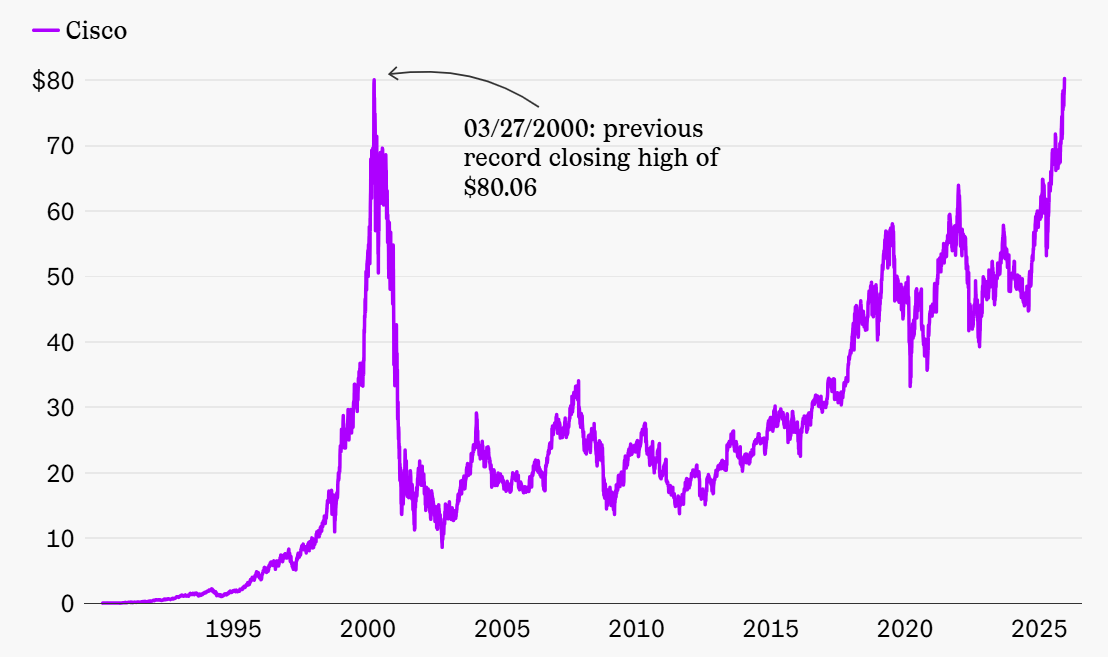

Cisco’s Long Road Back to a Record High

Source: Sherwood

PRESENTED BY ENDEX

New GPT Model Releases - What Does It Mean for Finance?

OpenAI’s Project Mercury appears to be paying off. GPT-5.2 released Wednesday and scored 68% on junior investment banking tasks. These models appear to be powering Endex: OpenAI’s Excel agent.

Major Wall Street firms are rapidly adopting Endex for analyst tasks, as CEOs like Jamie Dimon warn that AI productivity gains will reshape finance teams and eliminate certain roles over the coming years.

They are also hiring additional bankers and analysts to train their agentic capabilities.

DAILY ACUMEN

Strategic Quitting

Seth Godin teaches that "Winners quit all the time. They just quit the right stuff at the right time."

Sara Blakely quit her soul-crushing job selling fax machines door-to-door to pursue her idea for Spanx with just $5,000 in savings. Today, she's a billionaire.

Sometimes quitting isn't failure, it's the wisest decision you can make. We're taught that persistence is always virtuous, but that's only half the story. Persisting on the wrong path just gets you to the wrong destination faster.

The sunk cost fallacy keeps more people trapped than any external barrier. Just because you've invested time, money, or energy into something doesn't mean you should keep investing.

What's draining your energy without giving proportional returns? What opportunity are you missing because your hands are full holding onto something that no longer serves you?

Strategic quitting frees up resources - time, energy, and attention - for pursuits that truly matter.

Remember, every successful person has a graveyard of abandoned projects behind them. The question isn't whether to quit, but what to quit and when.

ENLIGHTENMENT

Short Squeez Picks

Are you an authentic leader or authentic jerk?

The principles of learning any complex skill

How to be yourself as a leader and boost your team’s performance

How to lead when things feel increasingly out of control

8 strategies to keep small talk flowing

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply