- Short Squeez

- Posts

- 🍋 Trump Goes Nuclear

🍋 Trump Goes Nuclear

Plus: Blackstone 2025 holiday video, Lululemon surges on activist pressure, inflation cools, ‘Airbnb for boats’ merging, and PE sparks unexpected fly-fishing boycott.

Together With

“When everything works in a spreadsheet, it usually means nothing is working in reality.” — Brent Beshore

Good morning and Happy Friday! Lululemon jumped after Elliott revealed a $1B stake. Core inflation cooled to 2.7%, its lowest since 2021. Coinbase rolled out stock trading plus Kalshi-based prediction markets.

Two “Airbnb for boats” startups are merging, the Florida-based platform is on pace for $100M+ in bookings. Chipotle launched $3.82 high-protein chicken cups. Fly-fishing brand Simms faces backlash after a $1.1B PE buyout.

Plus: Blackstone dropped its 2025 holiday video, Jason Derulo performed at Apollo Credit’s holiday party, an Indian AI stock (with two employees) is up 55,000%, and Tricolor’s Excel guy allegedly couldn’t fix the numbers in a fraud probe.

This Christmas, give yourself the gift of yield.

SQUEEZ OF THE DAY

Trump Goes Nuclear

Trump Media, the social media company behind Truth Social and the Trump family’s crypto holdings, is expanding into nuclear fusion. The company will merge with TAE Technologies, a fusion power developer, in a deal that will value the combined entity at $6 billion.

Trump Media is the money-losing parent company of Truth Social, and has struggled to turn a profit or gain market share in the social media industry.

President Trump is still the company’s largest shareholder with over a $1 billion stake, and the plan is for the combined company to become one of the first publicly traded nuclear fusion companies.

Shares closed 42% higher on the news. After the deal closes, shareholders of Trump Media and TAE are expected to own ~50% each of the combined company, implying significant dilution but also giving Trump Media access to a new capital-intensive growth narrative.

While nuclear fusion could be a clean, safer, and cheaper source of energy, it’s still very expensive and relatively unproven. There are no commercial plants that currently produce electricity using fusion. The combined company wants to start building its first plant next year, a timeline many experts view as ambitious.

Fusion is gaining traction as a possible solution to the massive energy demands of AI data centers. Unlike traditional nuclear power, fusion does not carry meltdown risks, making it more politically and commercially attractive.

The deal is expected to provide TAE with up to $300 million in funding, though analysts caution that total capital needs could be far higher. TAE counts Google, Chevron, and Goldman Sachs among its backers and has already raised more than $1.3 billion.

Takeaway: Trump Media has tried being a social media company, a crypto company, a streaming company, and is now betting on becoming one of the first publicly traded nuclear fusion plays.

While the pivot gives the stock a fresh narrative tied to AI and energy, execution risk remains high, capital needs are substantial, and the path to reversing a difficult year for shareholders is still far from certain.

PRESENTED BY YIELDCLUB

Give Yourself the Gift of Yield

The holidays are expensive. Between flights, gifts, and dinners, cash moves fast this time of year.

The problem? Most money just sits there when it’s not being spent.

Banks pay 0–4% APY. Bonds lock capital for years. Private credit ties up your cash with limited transparency.

YieldClub provides an alternative.

Earn 5–15% APY while keeping your funds fully accessible. The app connects to institutional-grade lending platforms managing $10B+ in deposits, and provides smooth deposit and withdrawal. Move your money anytime with no penalties or lockups.

Holiday spending doesn’t have to mean idle cash. Let your money work, even while you’re spending.

Please Support Our Partners!

HEADLINES

Top Reads

Elliott said to build a $1B+ stake in Lululemon (YF)

November CPI rose at a 2.7% annual rate, lower than expected (CNBC)

The $8 billion black market for Venezuelan oil is suddenly closing down (WSJ)

Two ‘Airbnb for boats’ companies are merging (WSJ)

Fly-fishing brand Simms faces retail boycott after private equity takeover (BB)

Chipotle just introduced "high protein cups" in broader protein push (CNBC)

World-beating 55,000% surge in India AI stock fuels bubble fears (BB)

Tricolor’s Excel guy failed to fix numbers in alleged fraud (BB)

Bill Ackman strikes $2.1B deal for insurer in bid to build ‘modern Berkshire Hathaway (YF)

Berlin launches ‘Germany Fund’ in private equity push (FT)

Friday could be a wild day of trading on Wall Street. Here’s why. (CNBC)

Global PE firms are said to eye TPG-backed school operator XCL (BB)

OpenAI discussed funding at $750 billion value, Information says (BB)

JPMorgan quants warn of extreme crowding in speculative stocks (BB)

Micron earnings beat expectations as AI memory demand surges (CNBC)

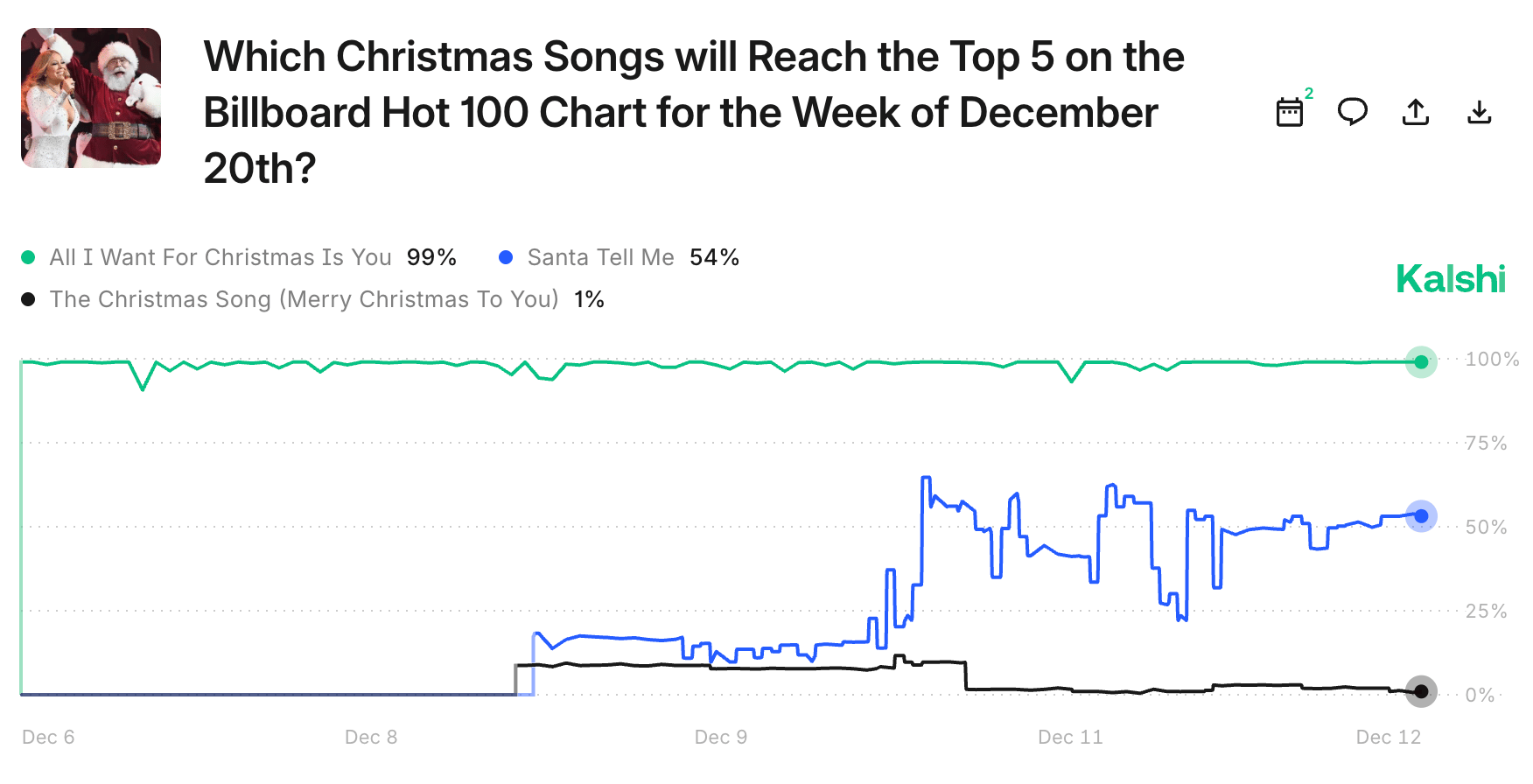

Coinbase announces stock trading and Kalshi-based prediction markets (WSJ)

Blackstone’s Schwarzman says data center business not a bubble (BB)

Apollo expands risk reviews to reflect extreme weather (BB)

CAPITAL PULSE

Markets Rundown

Market Update

Stocks finished higher after inflation came in cooler than expected, led by consumer discretionary and communication services

Energy lagged despite higher oil prices, while defensives underperformed

Bonds rallied, with the 10-year Treasury yield falling to 4.12%

Dollar strengthened against major currencies

Commodities saw WTI move higher amid concerns around potential U.S. action on Venezuelan oil shipments

Economic Data Highlights

CPI inflation eased to 2.7% YoY in November, below expectations to hold at 3.0%

Core CPI slowed to 2.6% YoY, driven by cooling shelter inflation

Shelter inflation decelerated to 3.0%, a key driver of broader disinflation

Jobless Claims fell to 224K, while continuing claims edged higher to 1.9M, signaling a cooling but stable labor market

Rates Outlook remains supportive, with markets pricing two Fed cuts in 2026 after a likely early-year pause

Sector Trends

Consumer Discretionary and Communication Services led gains on easing inflation

Energy lagged despite firmer crude prices

Rate-sensitive areas benefited from lower yields

Market breadth improved modestly as inflation relief supported risk appetite

Earnings Today

CCL – Focus on booking trends and pricing power into 2026

PAYX – Watch for commentary on labor-market demand and SMB hiring trends

Movers & Shakers

(+) Micron Technology ($MU) +10% after the chipmaker issued a strong revenue forecast.

(+) Lululemon ($LULU) +3% because Elliott Management took a $1B stake in the company.

(–) FactSet Research Systems ($FDS) -8% after the financial data platform missed earnings.

Prediction Markets

Mariah Carey is on a generational run. Who else will be a winner?

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

Howard Hughes Holdings bought Vantage Group, a specialty insurer, from Carlyle for $2.1 billion

Lovable, a vibe coding startup, raised $330 million

Radiant, a developer of nuclear microreactors, raised more than $300 million

Syremis Therapeutics, a developer of schizophrenia drugs, raised $165 million

Imprint, a loyalty rewards platform, raised $150 million

Addition Therapeutics, a genomic medicine company, raised $100 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Play Nice

Description: A definitive inside look at one of gaming’s most iconic companies — from its passionate founding culture and era-defining hits to the internal fractures, leadership missteps, and shifting industry forces that brought it to a crossroads. Winther weaves oral history and narrative analysis to show how a culture built on craft and community collided with growth pressures, corporate ownership, and changing player expectations. The result is both a cautionary tale and a blueprint for rebuilding creative organizations in the digital age.

Book Length: 272 pages

Release Date: 2025

Ideal For: Gamers, creators, leaders, and anyone fascinated by how culture, commerce, and community collide in today’s creative industries.

“You can build a universe people love — but if you forget why they loved it in the first place, it won’t matter.”

DAILY VISUAL

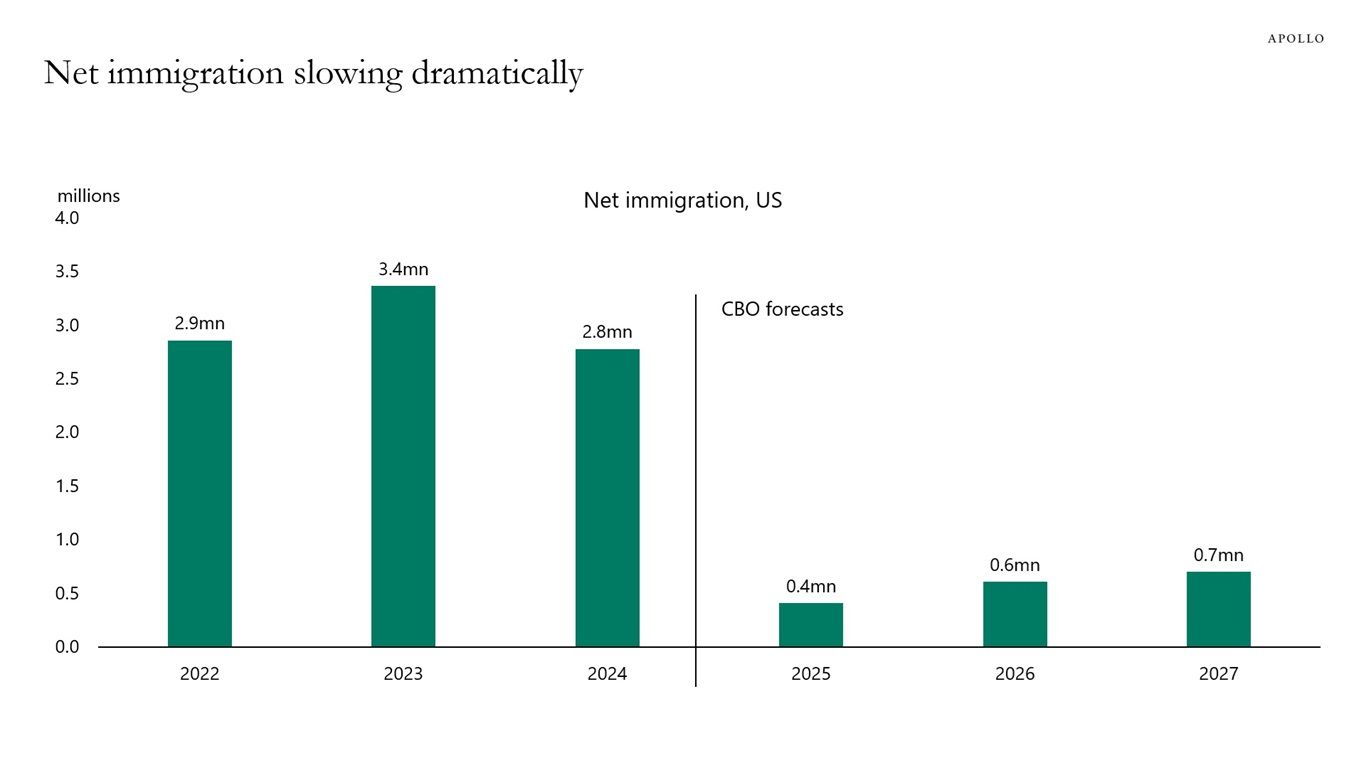

Immigration Stalls

Source: Apollo

PRESENTED BY ORNN AI

Now You Can Trade Compute

The AI bubble has a supply chain.

Right now, that supply chain runs on GPUs, power contracts, and a web of “strategic partnerships” that often look like money doing laps. Call them circular deals, channel stuffing, or pull-forwards, it’s all noise. Very few people are digging past the headlines.

Ornn Compute Exchange does. It tracks the real compute transactions actually powering AI infrastructure.

Not press releases; real GPU trades through indices that show what AI demand looks like at the hardware level - the layer that actually matters. Once you can see the compute market, you can answer the only question that matters: is the spend real?

Ornn aggregates spot compute transactions and publishes transparent GPU indices, revealing pricing, utilization pressure, and where the market is tightening, or cracking.

The AI boom runs on GPU-hours. Ornn lets you see the meter.

Please Support Our Partners!

DAILY ACUMEN

Incremental Progress

In 1975, a janitor at Disneyland named Dick Nunis noticed trash on the ground and picked it up. Walt Disney saw this and eventually promoted him. Nunis continued this practice, and it became a Disneyland tradition, everyone picks up trash, regardless of their role.

This tiny action, multiplied across thousands of employees over decades, became a defining feature of the Disney experience. Small actions, consistently applied, create cultures, build empires, and transform lives.

The ancient Greeks understood this through the concept of "kaizen" - continuous improvement. Toyota used it to revolutionize manufacturing. The British cycling team used it to dominate the Olympics by improving everything by just 1%.

You don't need massive transformations. You need small, sustainable improvements repeated relentlessly. Can you improve your morning routine by 5 minutes? Your work process by 1%? Your relationships by one small gesture daily?

These incremental gains seem insignificant in the moment but become unstoppable over time. What one small improvement could you make today? Remember, Rome wasn't built in a day, but they were laying bricks every hour.

ENLIGHTENMENT

Short Squeez Picks

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

*Denotes a Short Squeez partner post.

Reply