- Short Squeez

- Posts

- 🍋 Forbes 30u30 to Prison Pipeline

🍋 Forbes 30u30 to Prison Pipeline

Plus: SpaceX and xAI's $1.25 trillion merger, tariff deal with India sends stocks close to all-time highs, and the first big oil and gas deal of 2026 just happened.

Together With

“Wall Street makes so much money. And they don’t do very much.” — Jeffrey Epstein

Good Morning! Elon announced that SpaceX has acquired xAI, combining his rocket and AI ventures, ahead of a potential $1.25T IPO. Palantir beat estimates on strong AI and defense demand. Rare-earth stocks jumped after Trump proposed a $12B critical minerals stockpile.

Devon Energy and Coterra Energy are merging in a $58B all-stock shale deal. NYC is on pace for its longest deep freeze in 65 years. Stephen Ross and Ken Griffin say Florida is the future of business.

Plus: pre-revenue AI startups keep raising, U.S. tariffs on India will drop to 18% after India agreed to end Russian oil purchases, and a hedge fund boss sued by his own mother declared bankruptcy while listing two guinea pigs among $239k in assets.

Curious where your net worth stacks up to your peers? See this and other spending habits on Coverd. Download the app to track your spending and access these insights.

SQUEEZ OF THE DAY

Forbes 30u30 to Prison Pipeline

Forbes’ 30 Under 30 list is starting to look a lot less like a crystal ball for future billionaires and more like an early warning system for fraud. After Sam Bankman-Fried, Martin Shkreli, and Charlie Javice made the cut, a 2025 honoree is now facing up to 52 years in prison.

Gokce Guven, the 26-year-old founder and CEO of fintech startup Kalder, was indicted on charges of securities fraud, wire fraud, and visa fraud.

Federal prosecutors allege she defrauded investors from her fintech startup out of roughly $7 million. At the close of its funding round, Kalder was valued at $35 million, and Guven was worth nearly $15 million.

Kalder pitched itself as a fintech marketing platform that helped brands create and monetize custom rewards programs. But according to the indictment, key clients featured in investor materials, including Godiva and the International Air Transport Association, were either exaggerated or nonexistent. Some brands were only running free or heavily discounted pilots. Others had no agreement with Kalder at all.

Prosecutors say Guven maintained two sets of books. One was the company’s actual finances and was prepared by legitimate auditors. And the other was allegedly heavily inflated and shown to investors during the 2024 seed round.

While Guven claimed Kalder had reached $1.5 million in annual recurring revenue by March 2024, internal records reportedly showed total revenue for all of 2023 was closer to $50,000.

Guven is also accused of visa fraud tied to her application for an O-1A visa, often referred to as the “genius visa,” which she was granted last fall.

Takeaway: Forbes’ 30 Under 30 is a spotlight, not a diligence process. That spotlight can amplify founders under intense pressure to grow fast and tell a bigger story than the numbers support. Somewhere between ambition and exaggeration, the line can blur. In any case, the Forbes 30 Under 30 to prison pipeline, once again, stays undefeated.

PRESENTED BY COVERD

Ex-Wall Street Traders Gamify the Credit Experience

The weekend spending cycle can be vicious. Carbone to the Spaniard to the halal truck outside your building leads to a hole you can’t feed… until now. Just play a game of “Flappy Bird” between turning comments to get that kabob covered.

Former Wall Street traders, Albert Wang and Eric Xu, give spenders the technology to win their credit card purchases back with their app, Coverd. In addition to gamifying your spending, Coverd provides spend tracking, subscription monitoring, and even peer net worth insights.

This spring, Coverd is launching the first credit card to offer up to 100% cash back on your purchases. Last weekend, Coverd covered a $16,000 trip for two to the Super Bowl, and all you had to do was get the high score on Flappy Bird and Blackjack.

Download Coverd, and get smarter on your spending.

HEADLINES

Top Reads

Musk confirms SpaceX merger with xAI ahead of IPO (YF)

Palantir beats fourth-quarter estimates on the strength of AI and defense demand (CNBC)

Trump announces $12 billion U.S. stockpile of rare earth minerals (CBS)

NYC on track for longest deep freeze in 65 years, here's when it will finally warm up (NYP)

Stephen Ross and Ken Griffin think Florida is the future for business (NYT)

These billion-dollar AI startups have no products, no revenue and eager investors (WSJ)

Trump says U.S. and India reached trade deal, will lower tariffs immediately (CNBC)

‘Deadbeat’ hedge fund boss declares bankruptcy, lists two guinea pigs among $239K in assets (NYP)

Disney signals its next CEO will take over a company with strong momentum (CNBC)

Nvidia shares are down after a report that its OpenAI investment stalled (CNBC)

Oracle rises after company announces $50 billion fundraising plans. Here's what's happening (CNBC)

Family offices brace for higher inflation with real estate and alternative investments (CNBC)

How HSBC fashioned a $600B debt machine (FT)

Apollo Commercial REIT sells $9 billion book to insurance arm (BB)

China bans hidden car door handles in world-first safety policy (BB)

Carvana’s red-hot growth runs on a cycle of borrowed money (BB)

CAPITAL PULSE

Markets Rundown

Market Update

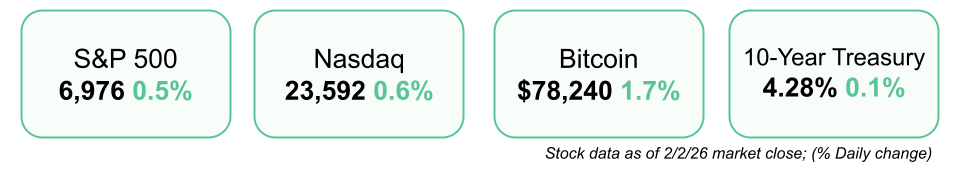

U.S. equities traded higher despite a partial government shutdown taking effect over the weekend

Markets were supported by a stronger-than-expected ISM Manufacturing PMI for January

Treasury yields moved higher, with the 10-year rising to ~4.28%

The U.S. dollar strengthened, with the ICE Dollar Index +~0.7%

Economic Data Highlights

ISM Manufacturing PMI beat expectations, pointing to resilient activity early in 2026

The government shutdown has delayed key data releases, including JOLTS and Friday’s jobs report

GDP impact from shutdowns is typically temporary; past episodes saw activity rebound once funding resumed

Policy & Government Shutdown

A partial shutdown is in effect, impacting six federal agencies

The Senate passed a bipartisan funding bill; a House vote is expected tomorrow

Furloughed workers will receive back pay, Social Security payments continue, and debt servicing is unaffected

Shutdown timing may delay tax refunds, a notable issue given higher expected refunds in 2026

Market Context

Historically, markets have largely looked through shutdowns

During the most recent shutdown, equities rose modestly and bond yields were little changed

Despite a prior estimated ~1.5 ppt drag on GDP during shutdown periods, recent data suggest Q4 growth remained strong, with GDPNow tracking 4%+

Looking Ahead

Early indications suggest the shutdown could be short-lived, limiting economic fallout

Preferred areas remain U.S. large- and mid-caps, supported by AI investment and resilient growth

Internationally, developed small- and mid-caps and emerging markets remain attractive beneficiaries of steady global expansion

Movers & Shakers

(+) Sandisk ($SNDK) +15% after Bernstein raised its price target to $1,000 on strong earnings.

(+) Walmart ($WMT) +4% because Trump reached a tariff deal with India.

(–) Robinhood ($HOOD) -10% after prediction market volume is expected to fall after the Super Bowl.

Prediction Markets

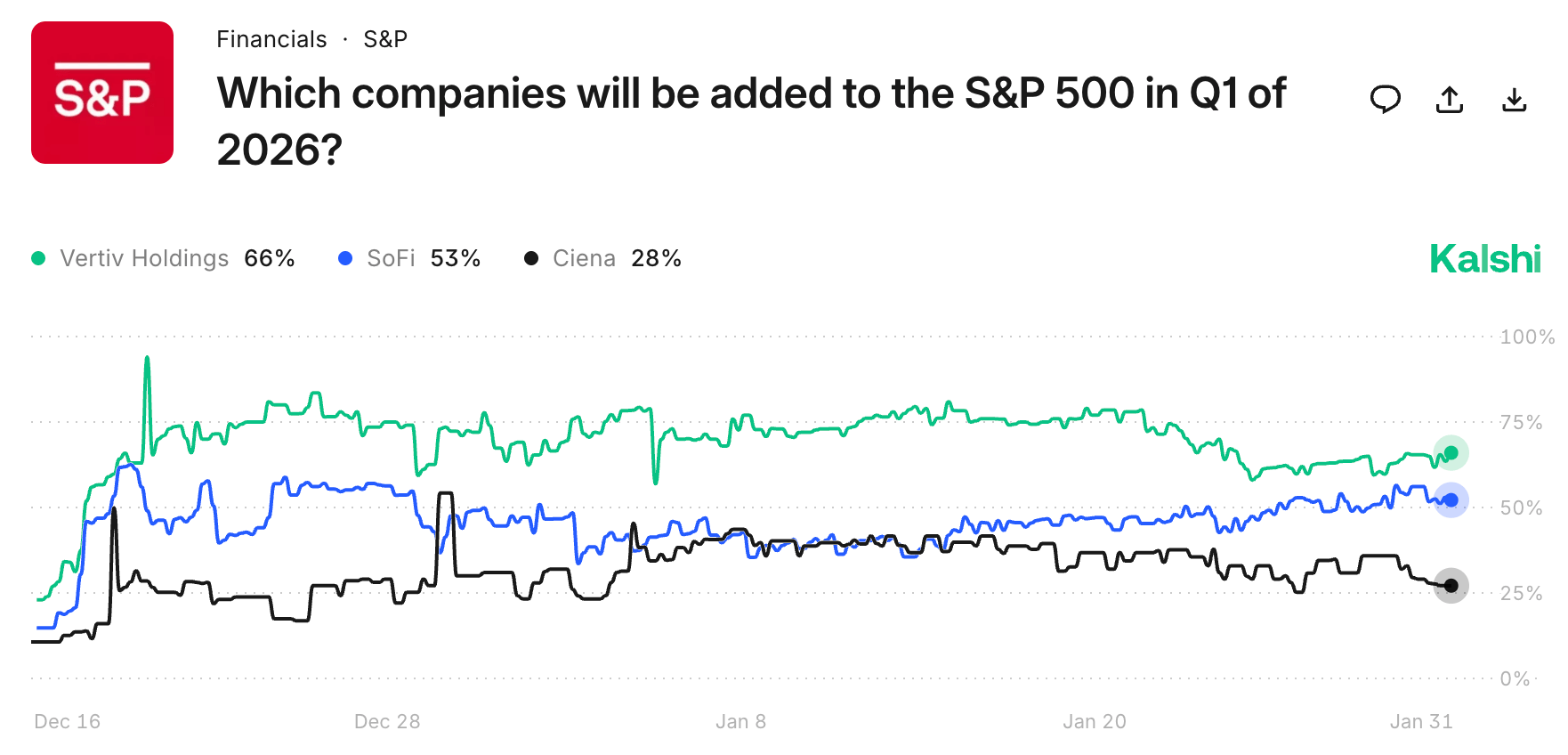

With the growing demand in data center infrastructure, Vertiv Holdings is the current favorite to join the S&P 500.

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

Architect Capital is in exclusive talks to buy a majority stake in OnlyFans at a $5.5 billion valuation

Eldorado Gold agreed to acquire Foran Mining for approximately $2.8 billion

ESAB agreed to acquire Eddyfi Technologies for $1.45 billion

Bain Capital agreed to acquire FineToday, a Japanese personal-care company, for $1.29 billion

CesiumAstro, a space and defense communications company, raised $470 million

VulcanForms, a digital metal manufacturing platform, raised $220 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Regroup

Description: A thoughtful, grounding guide for anyone running on empty in a culture that never slows down. Jenkins explores why burnout is often a signal, not a failure, and offers a framework for stepping back, recalibrating priorities, and reconnecting with your inner compass. Blending personal reflection, psychology, and practical exercises, the book helps readers reclaim energy, clarity, and a sense of self without blowing up their lives.

Book Length: 288 pages

Release Date: January 14, 2025

Ideal For: Burned out professionals, creatives, leaders, and anyone seeking clarity, calm, and sustainable momentum.

“Sometimes progress starts by stopping long enough to remember who you are.”

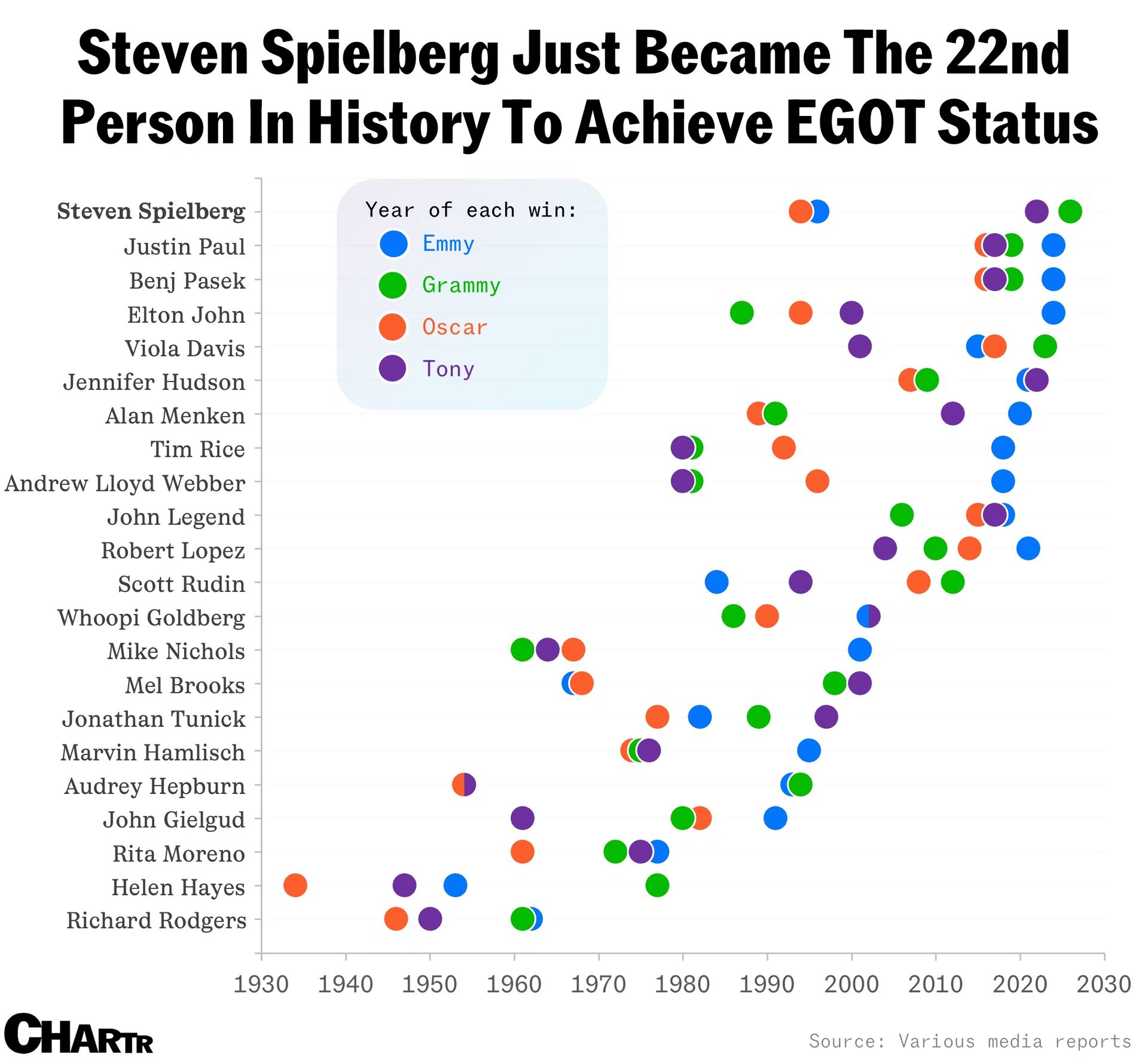

DAILY VISUAL

Emmy, Grammy, Oscar, Tony Status

Source: Chartr

PRESENTED BY BILT

Earn on Your Biggest Monthly Expense

Rent is likely your largest recurring expense, but until now, it's been money that just disappears every month with nothing to show for it (other than a roof over your head). You get rewarded for your coffee, your groceries, your flights. But your rent? Bilt makes sure that earns you something too.

Bilt is the loyalty program for renters that turns every rent payment into points you can use toward travel, Lyft rides, Amazon.com purchases, and more. The loyalty program works with your existing lease, no matter where you live. You're already paying rent, now you can get rewarded for it.

And, starting in February, Bilt is expanding to mortgage payments for the first time. Homeowners will be able to earn points on their monthly payments just like renters do, and unlock exclusive benefits around their neighborhood at over 45,000 restaurants, fitness studios, pharmacies, and more. Whether you rent or own, your housing payment finally works for you.

DAILY ACUMEN

Skin in the Game

Nassim Taleb argues that people who don't bear the consequences of their decisions shouldn't make those decisions. Pilots fly their own planes. Chefs eat their own food. This is skin in the game.

Moral hazard occurs when people make decisions but others bear the risks. Bankers gambled with depositors' money in 2008. They kept the upside, taxpayers absorbed the downside. Incentives diverged from consequences.

You create moral hazard in your own life. You advise others to take risks you won't take. You share opinions on topics you haven't studied deeply. No skin in the game.

The solution isn't silence. It's alignment. Only give advice you follow. Only recommend what you've personally tested. Only speak on topics where you'd bet money on your position.

ENLIGHTENMENT

Short Squeez Picks

How much your partner needs to make to be a stay-at-home parent in NYC

7 ways to increase your resourcefulness

Why a VO2 max test reveals so much about overall health

Why working more doesn’t make you more productive

How AI data centers affect the electrical grid

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply