- Short Squeez

- Posts

- 🍋 Direct Deals, Indirect Consequences

🍋 Direct Deals, Indirect Consequences

Plus: Anthropic cooks FactSet and S&P Global stocks, KKR dives into pro sports, SpaceX gears up for IPO, HSBC swings the bonus axe, and a $7B hedge fund fortune is on the line.

Together With

“Assume life will be really tough, and then ask if you can handle it. If the answer is yes, you've won." — Charlie Munger

Good Morning! KKR is buying Arctos for $1.4B, giving it a 10% stake in the Buffalo Bills. Anthropic’s new finance AI rattled FactSet and S&P Global stocks. Hims is undercutting Novo’s Wegovy pill at $49 a month but faces legal hurdles.

HSBC is cutting underperformers, with some bankers staring at zero bonuses. SpaceX is pushing for fast-track index inclusion ahead of its IPO. And the co-founder of Two Sigma is locked in a high-stakes divorce that could cost him half of his $7 billion fortune and control over his own $60 billion hedge fund.

Plus: Bitcoin slipped below $63K after Treasury Secretary Bessent says banks won’t be pushed to backstop crypto, the non-tech companies going all-in on AI, and whether insider stock buys are actually bullish.

EquipmentShare rang the bell last month. Read more about what they’ve built.

SQUEEZ OF THE DAY

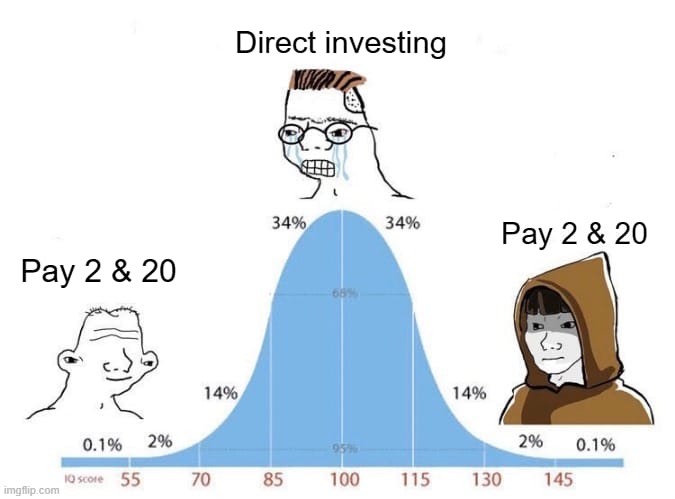

Direct Deals, Indirect Consequences

A Michigan pension fund tried to cut fees and “do it themselves” by investing directly into individual projects.

It spent nine years backing a 1,000-acre coffee farm in Hawaii and lost $86 million. Then it backed a Swiss renewable-energy startup and lost $53 million.

The Municipal Employees’ Retirement System of Michigan manages $16B for firefighters, nurses, and public workers. To save on private equity fees, it skipped traditional pooled funds and invested directly into individual projects, a strategy that has quietly grown across the industry.

Around a third of the roughly $12 trillion in global private-equity capital is now invested outside traditional commingled funds, up from about 10%–15% a decade ago.

On paper, this sounds smart. Fewer fees and more control. “We’ll pick the winners ourselves.” In practice, it meant 99% of the risk on a 1,000-acre Kona coffee farm sat with Michigan retirees.

The farm ran into regulatory issues, illegal housing citations, drainage violations, ran out of money, and is now in foreclosure. A new manager brought in later found a long list of problems that had never been fully surfaced.

The renewable energy bet was even messier. The pension is now suing the Swiss manager, alleging concealed risks and misuse of funds.

To be fair, these two losses equal only ~1% of the fund’s assets, and the pension says its broader private markets portfolio has generated billions in gains. But the episode shows something bigger happening across pensions, endowments, and family offices: Everyone wants private market returns without private equity fees.

And that often means moving from diversified funds to concentrated bets on farms, factories, and startups that can look great in pitch decks but prove far messier in operating reality.

Takeaway: Cutting fees in private markets often means you become the manager. And if you don’t have institutional-grade sourcing, oversight, and operational expertise, you’re not saving 2% in fees, you’re buying 100% of the risk. Turns out the management fee is sometimes the cheapest line item.

PRESENTED BY EQUIPMENTSHARE

EquipmentShare Enters the Public Markets

EquipmentShare rang the bell last month, marking a new chapter for the company founded in 2015 in Columbia, Missouri. The company operates a national equipment rental platform that combines a modern fleet with technology-enabled systems, serving customers focused on safety, efficiency, and jobsite productivity.

Company highlights:

Revenue grew from $1.5M in 2015 to more than $4B as of September 30, 2025

Profitable since 2020, with a reported 143% compound annual revenue growth

373+ locations across 45 states and more than 7,700 employees

Plans to expand to approximately 700 rental locations over the next five years

For informational purposes only. Not investment advice.

HEADLINES

Top Reads

KKR to acquire pro sports investor Arctos in $1.4 billion deal (WSJ)

Anthropic releases new model that’s adept at financial research (CNN)

Novo Nordisk says it will take legal action after Hims & Hers reveals $49 copy of Wegovy pill (CNBC)

HSBC to cull underperformers as some bankers face zero bonuses (BB)

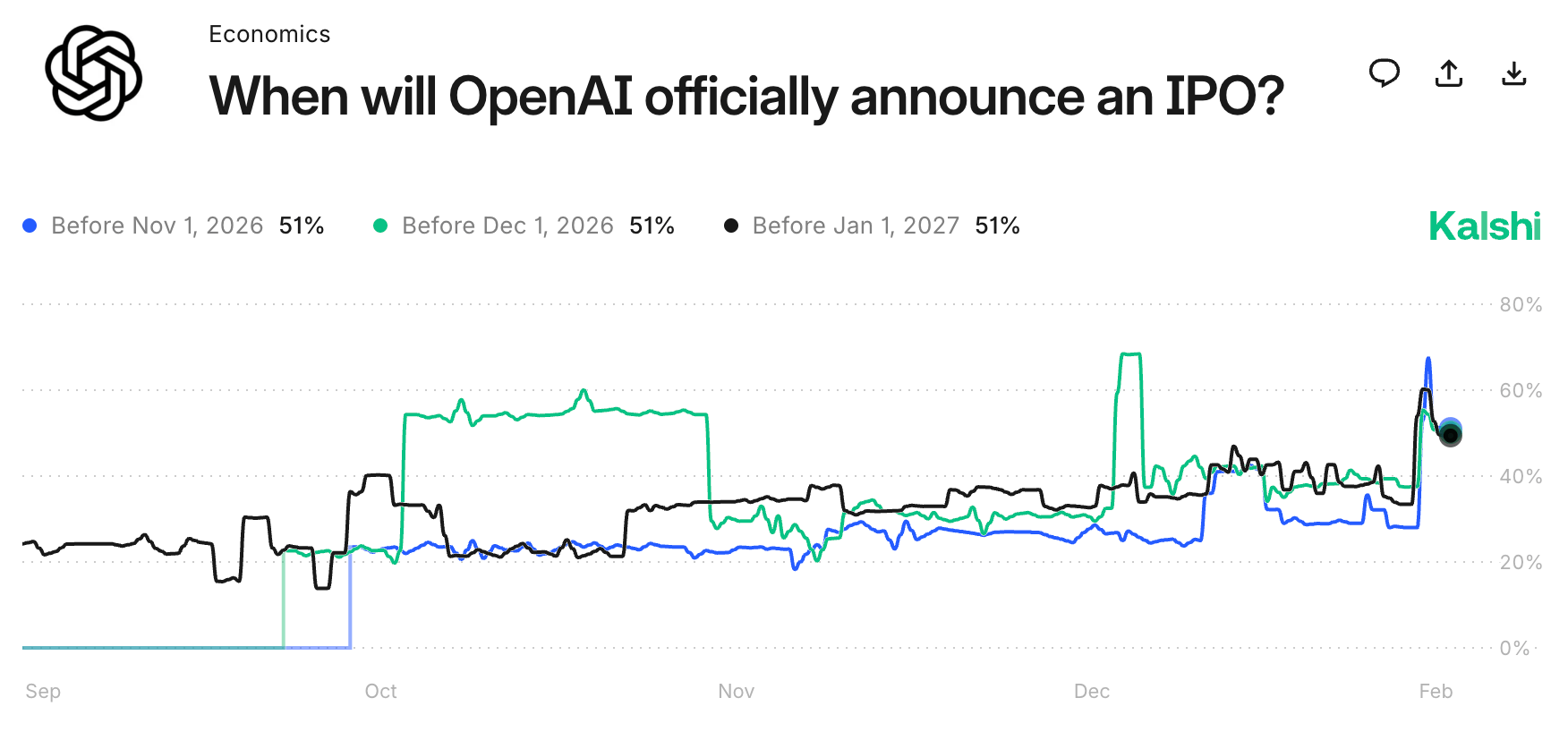

SpaceX seeks early index entry as it prepares massive IPO (WSJ)

How Two Sigma founder’s divorce fight hangs over hedge fund’s future (BB)

Bitcoin sinks below $63,000 after Bessent says the U.S. government can’t tell banks to bail out crypto (YF)

Meet the non-tech firms betting big on the AI boom (WSJ)

Is it really a good sign when executives buy their own stock? We ran the numbers (WSJ)

Last month was the worst January for layoff plans since 2009 (YF)

Leader of Paul Weiss resigns over Epstein ties (WSJ)

Elon Musk’s SpaceX said to open IPO pitching to non-U.S. banks (BB)

Peloton shares plunge 26% on weak holiday quarter, sluggish demand for splashy new products (CNBC)

Where billionaires' investment firms placed their bets in January (CNBC)

Shares of private capital giants sink on worries AI risks hitting growth (FT)

Distressed software loans swell by $18 billion in span of weeks (BB)

CAPITAL PULSE

Markets Rundown

Market Update

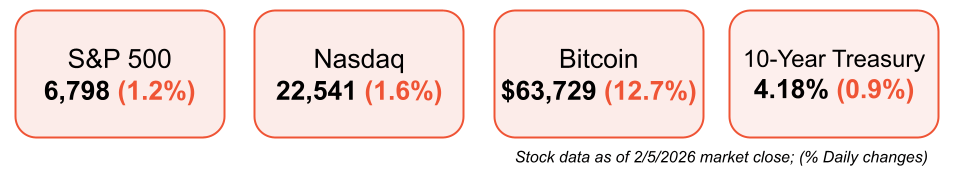

U.S. equities closed lower, reflecting a risk-off tone led by materials and consumer discretionary declines

Technology remained under pressure, with sentiment weighing on growth assets

Cryptocurrencies sold off sharply; bitcoin fell below $64K, nearly 50% off its recent peak

Treasury yields declined, with the 10-year around 4.19%

Asian equities finished lower, led by South Korea’s Kospi; European markets declined after the ECB held rates at 2.0%

The U.S. dollar strengthened; WTI crude pulled back as the U.S. and Iran agreed to hold talks, easing near-term supply concerns

Economic Data Highlights

Initial jobless claims rose to 231K, above expectations, likely reflecting weather-related disruptions

Continuing claims increased to 1.84M, in line with forecasts

Job openings fell to 6.5M in December, below unemployment of 7.5M

Labor data remain consistent with a low-hiring, low-firing environment, supportive of gradual disinflation

Earnings Season

Alphabet (Google) beat earnings estimates but shares fell after raising 2026 capex guidance to $175B–$185B

With just over 50% of S&P 500 companies reported, 79% have beaten estimates with an average 8.2% upside surprise

Q4 earnings growth expectations have risen to ~11.4%, up from ~7.2% at quarter-end

Eight of eleven sectors are projected to post earnings growth

2026 EPS expected to rise ~14%, supporting equities despite elevated valuations

Looking Ahead

Ongoing tech and crypto weakness suggests continued rotation toward value, defensives, and non-U.S. markets

Earnings momentum remains constructive and is broadening beyond mega-cap tech

Movers & Shakers

(+) Pandora ($PNDRY) +17% after the world’s largest jeweler will cut reliance on silver.

(–) Canada Goose ($GOOS) -19% because the luxury coat maker missed profit estimates.

(–) Peloton ($PTON) -26% after the company had a weak holiday quarter, with poor demand for new products.

Prediction Markets

Private Dealmaking

KKR and Singtel acquired STT GDC for $5.2 billion

SiTime acquired the timing business of Renesas Electronics for $2.9 billion

Cerebras, an AI chipmaker, raised $1 billion

ElevenLabs, an AI audio company, raised $500 million

Tomorrow.io, a weather intelligence platform, raised $175 million

Machina Labs, a robotic manufacturing platform for aerospace and defense components, raised $124 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

A Whole New Human

Description: A forward-looking guide for navigating life in an era of rapidly advancing artificial intelligence. Rydall argues that to flourish alongside AI, humans must cultivate capacities that machines cannot replicate, such as creativity, empathy, insight, and self-awareness. By blending ancient wisdom with modern science and human development research, he presents ten evolutionary shifts that help readers preserve their humanity while unlocking deeper potential in work, relationships, and purpose.

Book Length: 256 pages

Release Date: February 24, 2026

Ideal For: Leaders, creators, workers, and anyone curious about thriving in the age of AI and reclaiming human strengths with intention and clarity.

“We are not here to compete with machines. We are here to master what machines cannot replace.”

DAILY VISUAL

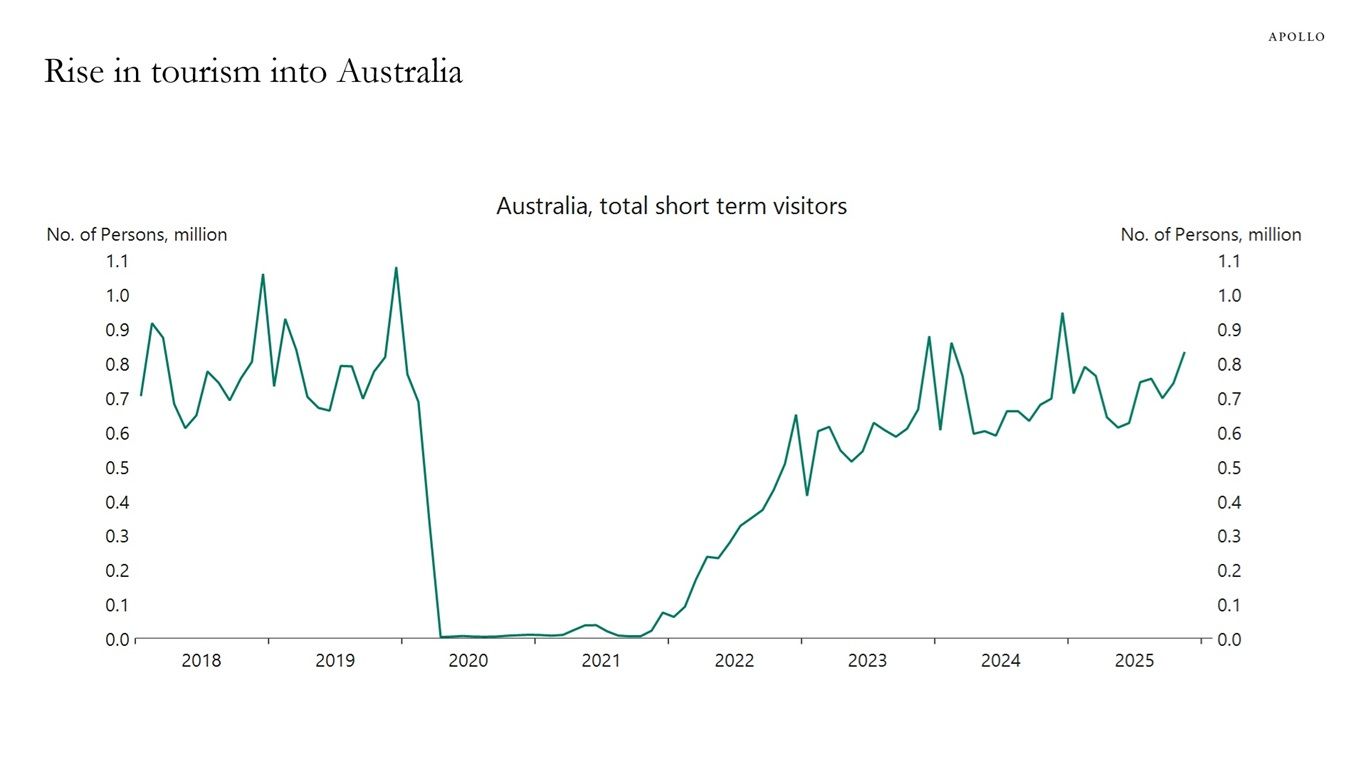

Rise of Tourism into Australia

Source: Apollo

PRESENTED BY MOGUL

Invest like Blackstone Without Outbidding Moms on Single-Family Homes

mogul is a real estate investment platform offering fractional ownership in blue-chip rental properties. This gives you monthly rental income, real-time appreciation and tax benefits without a hefty down payment or 3 a.m. tenant calls.

Founded by former Goldman Sachs real estate investors, they hand-pick the top 1% of single-family rental homes for you. Each property undergoes a vetting process led by the aforementioned GS bankers, and they take care of the property management for you.

Here’s are some of the perks:

Tax Benefits

+7% annual yields

18.8% average annual IRR across 50+ properties*

Long story short: you can invest in institutional-quality real estate for a fraction of the usual cost and avoid the headache of property management. Plus, you don’t need to outbid moms, or Blackstone, to access this powerful investment.

DAILY ACUMEN

Hyperbolic Discounting

Economists discovered humans discount the future hyperbolically. We value $100 today over $110 tomorrow, but we're indifferent between $100 in a year versus $110 in a year plus one day.

This creates time inconsistency. Future you makes excellent plans. Present you abandons them. You commit to waking early, but when the alarm rings, present you doesn't care what past you decided.

Your brain literally values today exponentially more than any future day. Sophisticated people design around this. Automatic investments remove future you from decisions. Pre-commitment devices override hyperbolic discounting.

Remember, you and future you are different people with conflicting interests. Past you needs to constrain present you.

ENLIGHTENMENT

Short Squeez Picks

Why workers are interested in microshifting their schedules

Why your hardest workers may be holding your company back

11 ways to boost your metabolism

What happiness experts do when they feel down

3 yoga poses that will help you sleep

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

*See Important Disclosures. Past performance does not guarantee future results.

Reply