- Short Squeez

- Posts

- 🍋Dimon’s Latest Trade

🍋Dimon’s Latest Trade

Plus: Larry Ellison's Xmas present for David Ellison, Gold and Silver hit record highs, Instacart scraps AI pricing tests, and M&A flurry before the holidays as Google goes AI.

Together With

“Money buys happiness when you spend it on freedom.” — Morgan Housel

Good Morning! Larry Ellison is personally guaranteeing over $40 billion to back his son’s bid for Warner Bros. Gold and Silver hit fresh highs as metals reasserted themselves as the hedge of choice. And Instacart is scrapping AI-driven pricing tests that pushed up costs for some shoppers.

Chinese chipmakers are racing to IPO following two blockbuster trading debuts. A small Indian investment bank’s founders are now worth $35 million each after a buyout by Mizuho. And Clearwater Analytics is being taken private by Permira and Warburg for $8.4 billion.

Plus: Alphabet is buying data-center and energy firm Intersect for $4.75 billion, US luxury retailer Saks is weighing bankruptcy, and how the personal-finance system is stacked against ordinary people.

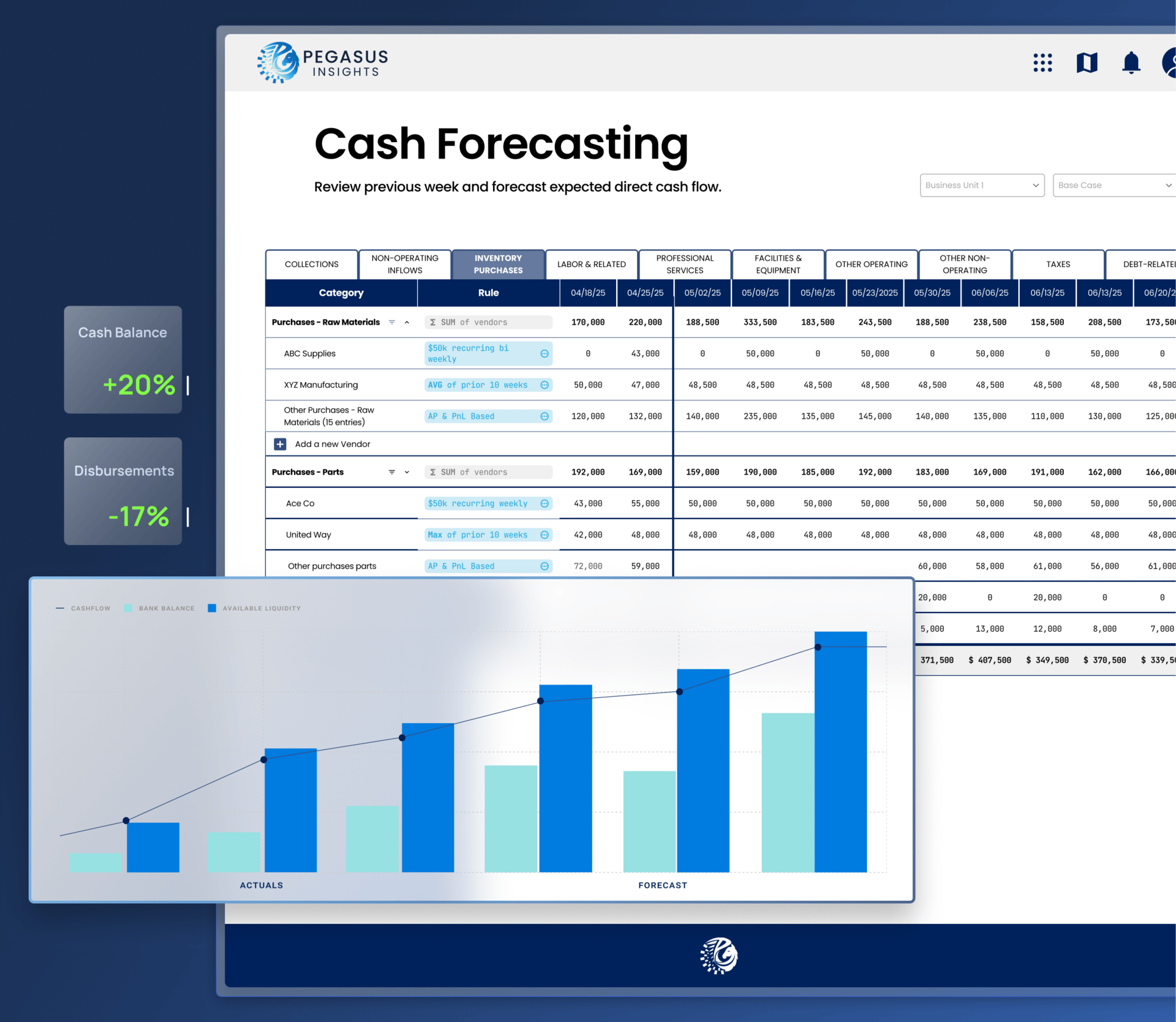

Visibility into cash, liquidity, forecasting, and working capital helps finance leaders move faster and make better decisions. See what Pegasus can do for your team.

SQUEEZ OF THE DAY

Dimon’s Latest Trade

It’s safe to say Jamie Dimon has never been a big fan of crypto. He once called Bitcoin a “fraud,” a “pet rock,” and said he’d fire employees caught trading it. But now, JPMorgan wants to offer crypto trading to its wealthiest and most sophisticated clients.

A new report found that the firm is weighing cryptocurrency trading for both institutional and high-net-worth clients, including spot and derivatives products inside its markets division.

JPMorgan already allows certain institutional clients to use bitcoin and ether as collateral for loans and has said crypto holdings will appear on client statements. This would be the next step: turning crypto from a tolerated nuisance into a monetized product.

The shift is less about ideology and more about incentives. Client demand has become impossible to ignore. Bitcoin ETFs cracked open the floodgates in 2024, giving crypto a regulated wrapper that institutions were willing to touch. And JPMorgan has pressure to catch up to competitors. Goldman Sachs runs a crypto derivatives desk, and BlackRock and Fidelity distribute crypto exposure at scale.

For JPMorgan, staying on the sidelines increasingly means leaving fees on the table and pushing clients elsewhere.

At JPMorgan’s investor day in May, Dimon reiterated his concerns but made it clear the bank would not block client access. “I don’t think you should smoke,” Dimon said. “But I defend your right to smoke. I defend your right to buy bitcoin.”

Takeaway: Dimon may still dislike crypto. But he doesn’t need to like an asset to intermediate it and profit from it. JPMorgan isn’t endorsing Bitcoin, it’s treating crypto like any other controversial but in-demand asset class under the Dimon playbook: ring-fence the risk, offer access, and charge for it.

PRESENTED BY PEGASUS INSIGHTS

Cash Clarity Drives Confidence

In investor-backed companies, cash questions surface fast and, often, under pressure. Without real-time visibility into liquidity and runway, even strong finance teams struggle to respond with confidence.

Pegasus Insights is a real‑time cash and liquidity platform built by finance professionals with deep private equity experience. The platform pulls live data from your systems, consolidates cash positions, and automates forecasting so you can see working capital, liquidity trends, and variances without manual refreshes.

Pegasus Insights provides:

Daily cash visibility dashboards that consolidate balances

Automated 13‑week forecasting and scenario modeling

Working capital insights and spend analytics

Integration with ERPs and bank feeds to plug into existing workflows

For PE and VC operators evaluating portfolio finance teams, Pegasus Insights adds a layer of confidence and responsiveness by replacing manual processes with decision‑ready insight.

Please Support Our Partners!

HEADLINES

Top Reads

Paramount guarantees Larry Ellison backing in amended WBD bid (CNBC)

Gold and Silver prices soar to new highs as the yellow metal reemerges as a hedge (CNBC)

Instacart scraps controversial AI pricing tool (CNBC)

Chinese chipmakers race to IPO after back-to-back listings surge (BB)

Boutique bankers build a fortune on sale of India’s Avendus (BB)

Alphabet to acquire data center and energy infrastructure company Intersect (CNBC)

Clearwater Analytics going private in $8.4 billion deal (Axios)

Saks mulls bankruptcy just a year after raising billions for turnaround (BB)

M&A boom has room to run - here are dealmakers’ predictions for 2026 (BB)

Trump halts wind projects, including Coastal Virginia Offshore Wind (CNBC)

Golden Gate seeks $1.8 billion for deal backed by Ardian, Apollo (BB)

The private-credit party turns ugly for individual investors (WSJ)

Apollo’s Marc Rowan wants to school you in private credit (BB)

KKR’s private-credit deal with utility giant ACWA marks debut in Saudi Arabia (BB)

Goldman, Barclays see US college debt boom persisting in 2026 (BB)

Netflix refinances part of bridge loan tied to Warner Bros Discovery deal (CNBC)

Asset manager Janus Henderson gets bought by Trian, General Catalyst for $7.4 billion (CNBC)

CAPITAL PULSE

Markets Rundown

Market Update

U.S. equities kicked off the holiday-shortened week higher, supported by year-end rally optimism

Small caps and value outperformed, with lighter volumes expected into Christmas

Tech rebounded early, aided by improved AI sentiment, but cyclicals finished strongest

WTI crude jumped ~2.5% to around $58 amid rising geopolitical tensions

Sector Trends

Financials, Energy, Materials led gains late in the session

Technology regained footing after recouping December losses

Precious metals surged, with gold and silver hitting fresh record highs and tracking toward their best annual performance since 1979

Economic & Macro Themes

Markets operate on a shortened schedule this week, with early close on Christmas Eve and closed on Christmas Day

AI sentiment improved following Micron’s recent earnings beat and reports of improving margins in paid AI products

Concerns around AI capex, ROI, and debt issuance are likely to resurface intermittently, keeping dispersion elevated

Looking Ahead

Since early November, leadership has begun rotating away from mega-cap tech, though the sector has stabilized

2026 is expected to bring broader market participation across sectors and regions, driven by earnings rather than multiple expansion

A balanced, diversified portfolio remains favored as leadership continues to rotate

Movers & Shakers

(+) Rocket Lab ($RKLB) +10% after winning a missile-defense government contract.

(+) First Solar ($FSLR) +7% because Alphabet bought Intersect, one of First Solar's largest customers.

(–) Dominion Energy ($D) -4% after Trump halted the largest offshore wind project in Virginia.

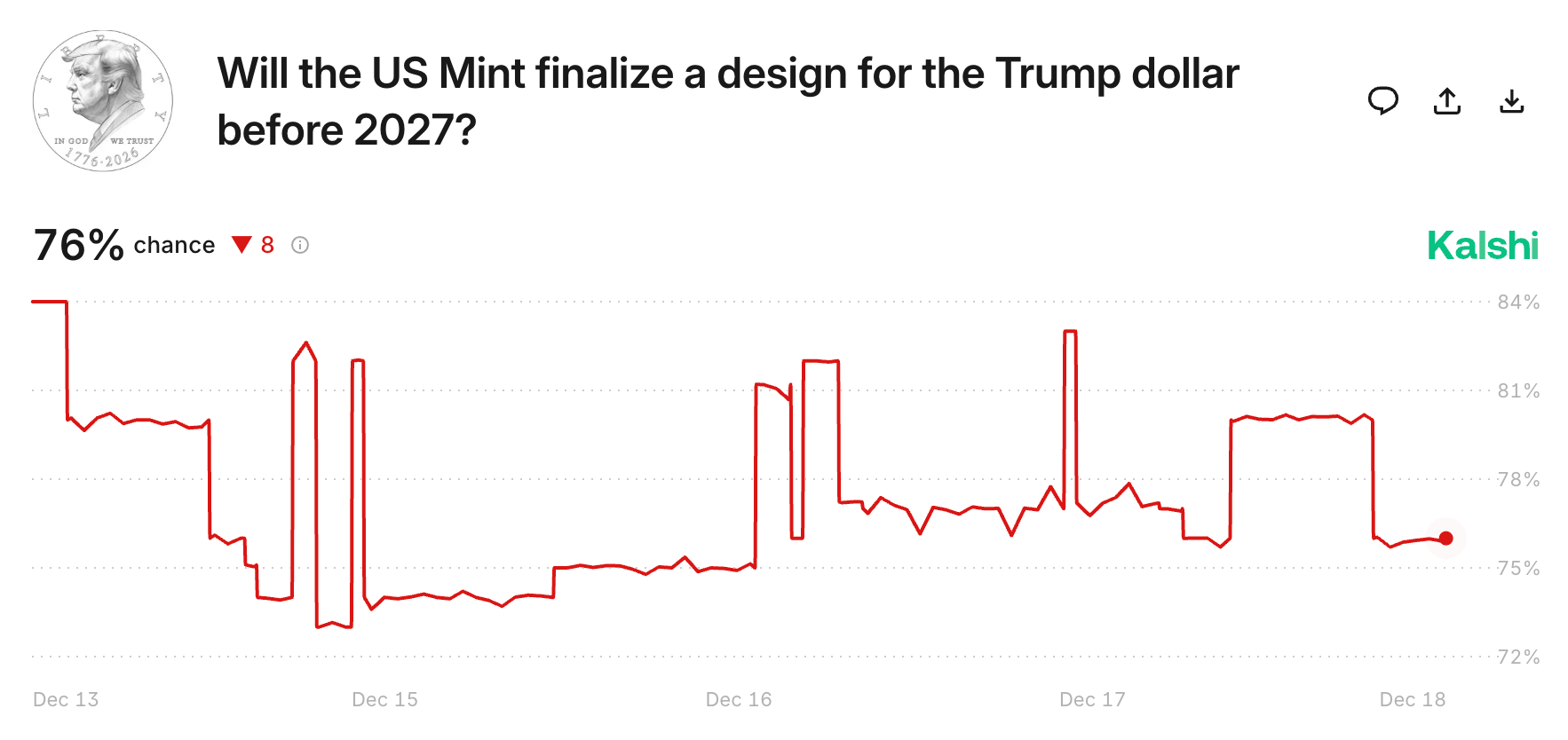

Prediction Markets

Private Dealmaking

Clearwater Analytics, an investment and accounting software provider, agreed to be acquired by Permira and Warburg Pincus for $8.4 billion

Trian and General Catalyst bought Janus Henderson for $7.4 billion

BioMarin, a biotechnology company focused on rare diseases, agreed to acquire Amicus Therapeutics for around $4.8 billion

Alphabet agreed to buy clean energy developer Intersect Power LLC for $4.75 billion

LLOG Exploration, an energy exploration company, agreed to be acquired for $3.2 billion

Steward Partners, a wealth advisory firm, received a $475 million investment from Ares

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

This is for Everyone

Description: A reflective memoir and urgent manifesto from the inventor of the World Wide Web. Berners-Lee recounts how he built the web as a universal, open platform and then wrestles with how it evolved — from boundless creativity and connection to data-driven power plays, surveillance economies, and fractured public life. He blends personal history with big-picture thinking about how we can reclaim a web that serves humanity instead of algorithms and monopolies.

Book Length: 400 pages

Release Date: September 9, 2025

Ideal For: Tech historians, builders, policy thinkers, digital creators, and anyone curious about how the web was made — and how it might still be redeemed.

“The web was meant to be open to everyone — and its future depends on how fiercely we protect that promise.”

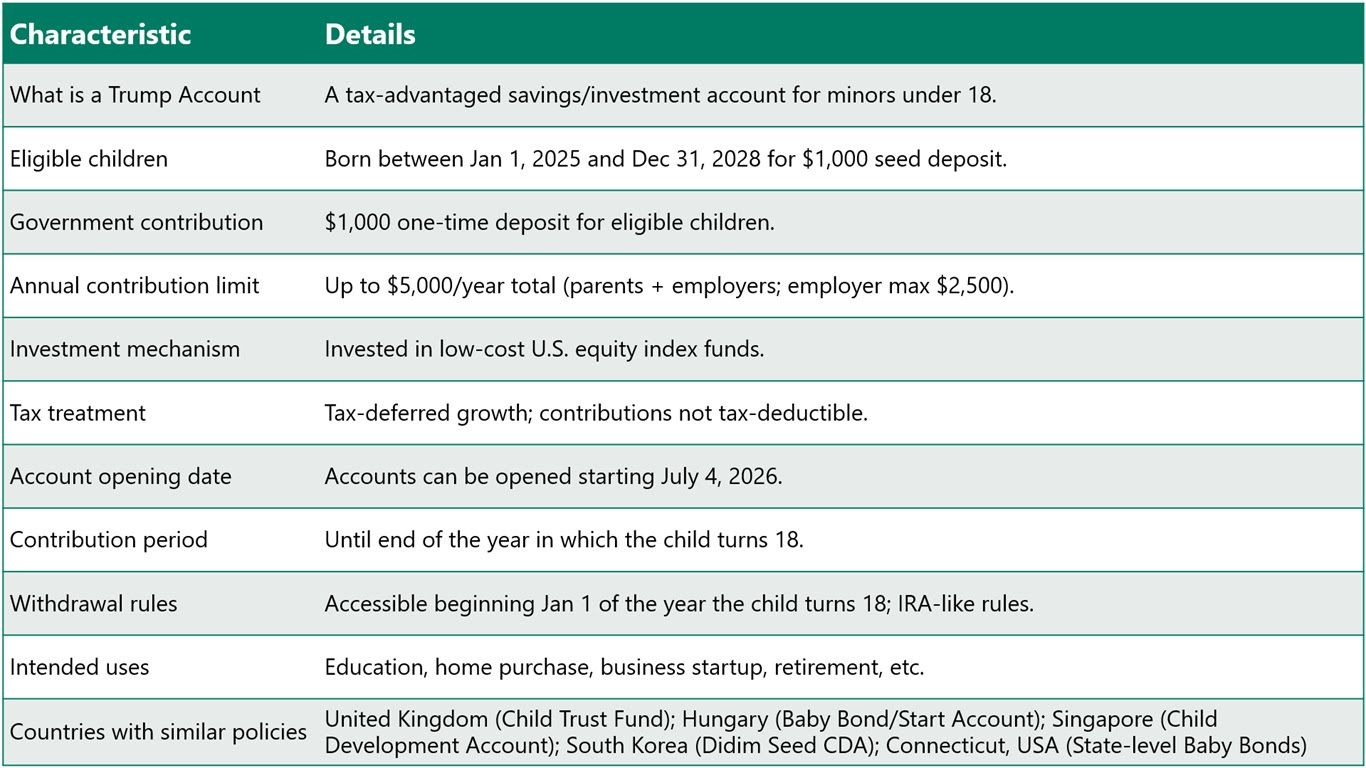

DAILY VISUAL

A Trump Account for Children Under 18

Source: Apollo

PRESENTED BY F2

Data Room to IC in 75% Less Time

Whether you're a private credit analyst spreading financials for covenant analysis, a PE associate building LBO models, or a commercial banker preparing credit committee materials, F2 handles the technical work.

The platform processes Excel models, synthesizes data room documents, integrates market sources like FactSet, and generates investment-grade materials with full transparency. Analysts and Associates reclaim their time. VPs and Principals get better prepared analysis. MDs and Partners see faster deal flow.

Used across private credit, private equity, commercial banking, and investment banking. Teams evaluate deals 75% faster while maintaining the standards investment committees demand.

Please Support Our Partners!

DAILY ACUMEN

Proximity & Association

"You are the average of the five people you spend the most time with." Neuroscience confirms this - mirror neurons cause us to unconsciously adopt the attitudes and behaviors of those around us. Look at your five closest relationships. Are they lifting you higher or holding you back?

When Elon Musk wanted to learn rockets, he surrounded himself with aerospace engineers. Your network doesn't just open doors - it shapes who you become.

Audit your circle. Seek people who embody what you aspire to be. Distance yourself from toxic relationships. Remember, show me your friends and I'll show you your future.

ENLIGHTENMENT

Short Squeez Picks

How institutions capitalize on the AI economy*

Does work-from-home harm young employees?

Stop wasting mental energy

Why Greece is now the world’s best place to retire

How the personal finance system is rigged against ordinary people

Does laziness start in the brain?

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

*Denotes a Short Squeez partner post.

Reply