- Short Squeez

- Posts

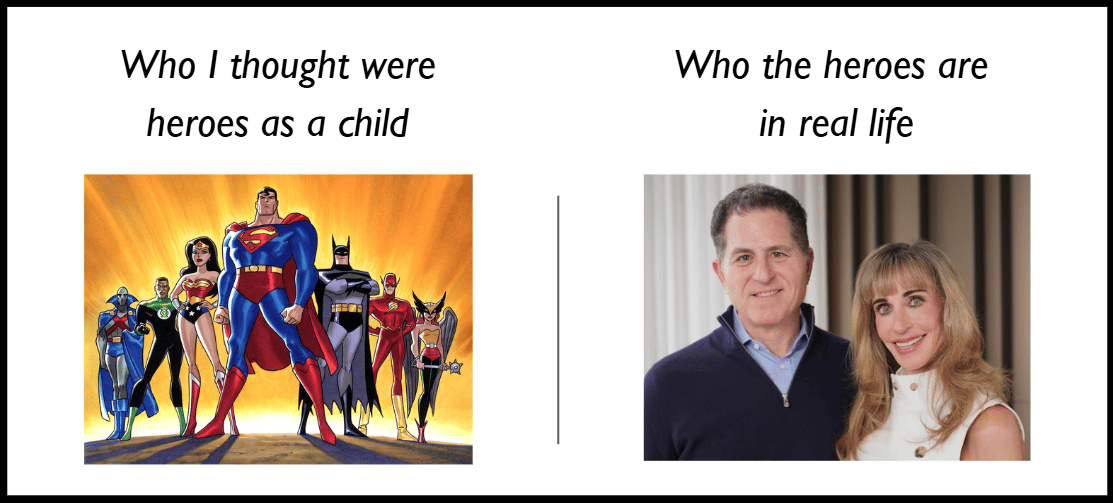

- 🍋 Dell Funds a Generation of Shareholders

🍋 Dell Funds a Generation of Shareholders

Plus: Sam Altman declares “code red”, Trump crypto firm lost half its value in just 30 minutes, and the brothers who are co-heads of Goldman’s Latin America business.

Together With

“When you're impatient with results, every day feels expensive. When you're impatient with effort, every day feels like progress.” — Shane Parrish

Good Morning! OpenAI CEO Sam Altman declared a “code red” to rapidly improve ChatGPT as Google threatens its AI lead. Tariffs are finally hitting corporate budgets, and economists warn they could trigger headcount cuts in 2026. SEC Chair Atkins is also pushing new rules to help smaller companies “make IPOs great again.”

Eric Trump’s crypto firm, American Bitcoin Corp., lost half its value in just 30 minutes. Apollo says global M&A is on pace to top $5 trillion this year. And apartment rents are falling as vacancies hit record highs.

Plus: The brothers running Goldman’s Latin America business, and what to do when professional and personal setbacks hit at the same time.

SQUEEZ OF THE DAY

Dell Funds a Generation of Shareholders

Yesterday, Michael and Susan Dell announced one of the largest philanthropic commitments in U.S. history: a $6.25 billion pledge to seed long-term investment accounts for 25 million American children.

It’s more than double their lifetime giving to date, and it’s built around a simple, powerful idea: if kids start investing early, their entire financial trajectory changes.

The donation will be part of a new national framework of child “Trump” investment accounts launching in 2026. Under the program, Treasury will deposit $1,000 into every newborn’s account for children born from 2025 through 2029.

The Dells are stepping in for the kids who miss that window: all U.S. children ten and under, born before 2025, living in ZIP codes with a median household income of $150,000 or less. Each will receive a $250 seed investment, automatically funded as soon as a parent opens the account.

The concept was engineered by Altimeter Capital founder Brad Gerstner, who built the nonprofit Invest America that pushed for a universal child-investing system. His thesis mirrors what every allocator knows: early exposure to compounding changes outcomes.

Decades of research show that kids with even small investment accounts are statistically more likely to graduate high school, attend college, start businesses, and build wealth as adults. It is financial literacy by way of ownership, and time in the market doing the heavy lifting.

The structure is intentionally simple. All funds must sit in low-cost, diversified U.S. equity index products, locked until age 18, when the assets roll into an IRA. Withdrawals are taxable, but the real power is the time horizon.

Corporations and philanthropies can make additional deposits; Dell Technologies, for example, will match the federal $1,000 for children of its employees.

And the math is the point. A $250 seed invested at historic U.S. equity returns (about 7% annually) grows to roughly:

$845 by age 18

$3,744 by age 40

$22,200 by age 60

Alone, that won’t change a family’s trajectory. But add even $15 a month, basically a Netflix subscription, and the picture changes:

~$14,000 by age 18

~$48,000 by age 40

~$180,000 by age 60

This is the business case behind the Dells’ philanthropy. Compounding is a machine, and the earlier you start it, the more explosive the long-term effect becomes. Their $6.25 billion could be the spark that starts millions of compounding engines at once.

Takeaway: The Dells, worth $148 billion, are trying to create 25 million new investors by giving every child a small ownership stake in the equity markets and if more philanthropies and employers follow, this could become one of the most powerful long-term wealth machines ever built for American families.

PRESENTED BY F2

Sharper Narratives. Faster Turns. No More 3am Fixes.

In banking, deadlines don’t slip, but analysts do. Between redlines, model tweaks, and the perpetual chase for a “quick turn,” even the best teams are stretched thin.

Purpose-built AI for investors, it drafts client-ready summaries, builds first-pass materials that already follow your team's style, and transforms sprawling diligence packets into crisp, defensible insights. No more rebuilding the same pages. No more combing through footnotes at 2am.

Powered by the most advanced AI agent for Excel on the market, F2 gets you faster iterations, tighter narratives, and deliverables that jump straight to VP- and MD-ready. All while keeping your team focused on the high-value judgment calls that win mandates, not the formatting purgatory that burns them out.

The client clock never stops, and with the right AI, neither does your deal team.

Please Support Our Partners!

HEADLINES

Top Reads

Sam Altman declares “code red” at OpenAI as ChatGPT competitors intensify (YF)

Tariffs begin to bite, with companies warning of reduced headcount in 2026 (CNBC)

SEC Chair Atkins pushes new rules to help smaller companies “make IPOs great again” (YF)

Eric Trump’s cryptocurrency firm lost half its value in half an hour (Guardian)

Global M&A volume on track to top $5 trillion in 2025, says Apollo’s Jim Zelter (BB)

Apartment rents drop further, with vacancies at record high (CNBC)

They share a mom, dad, and top Goldman job (WSJ)

Morgan Stanley says China’s new mortgage aid may finally halt the housing slump (BB)

Eventbrite being acquired by Bending Spoons for $500M (TC)

Trump administration to take equity stake in chip startup led by former Intel CEO (WSJ)

Amazon unveils new AI chip as rivals race to challenge Nvidia’s dominance (YF)

Wealthfront aims up to $2.05 billion valuation in U.S. IPO (YF)

Stock market now pricing Google as the frontrunner in the AI race over OpenAI and Nvidia (CNBC)

Black Friday and Cyber Monday turnout jumps, signaling resilient U.S. consumer demand (CNBC)

Amazon launches cloud AI tool to help engineers rapidly recover from outages (CNBC)

Elon Musk lays out his three “most important ingredients” for AI development (CNBC)

General Atlantic secures private loan financing to acquire U.K. chicken chain (BB)

Nvidia-backed Luma AI announces major expansion into London (CNBC)

Why new SEC reforms could revive America’s capital markets (WSJ)

Estée Lauder restructuring costs climb to $1.14 billion (WSJ)

Evercore hires JPMorgan’s health-care banking head Ben Carpenter in major talent move (BB)

Nvidia CFO says chipmaker yet to finalize $100 billion OpenAI deal (YF)

Data center energy demand forecasted to soar nearly 300% through 2035 (YF)

Costco sues the Trump administration, seeking a refund of tariffs (CNBC)

CAPITAL PULSE

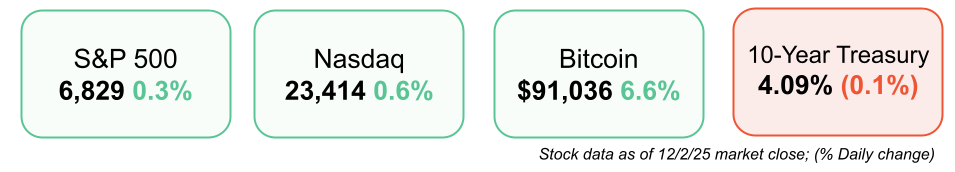

Markets Rundown

Market Update

Stocks finished higher Tuesday, led by gains in technology and industrials.

Tech stocks rose nearly 1%, supported by strong mid-cap earnings from MongoDB and Credo Technologies.

Boeing surged 10%, boosting industrials after management projected stronger aircraft deliveries and free cash flow in 2026.

Overseas, Asian markets were flat, while Europe traded mixed following eurozone CPI at 2.2% YoY, slightly above forecasts.

Bond yields were steady, with the 10-year Treasury around 4.1% and the 2-year at 3.51%.

Economic Data Highlights

It was a quiet day for data, but markets are bracing for a busy stretch.

ADP employment data (expected +40,000) and ISM Services PMI arrive Wednesday, followed by PCE inflation(expected +2.8% YoY) on Friday.

The ISM Manufacturing PMI on Monday showed softness in new orders and employment, hinting at fatigue in the sector.

Despite headwinds from trade-policy uncertainty and the government shutdown, U.S. economic activity remains resilient, supported by labor-market strength and easing monetary policy expectations.

Sector Trends

Technology and industrials led today’s advance, with improving free-cash-flow outlooks and continued AI infrastructure spending boosting sentiment.

Investors continue to rotate into cyclicals like industrials and discretionary, while staying selective in high-valuation tech names.

Earnings Today

Salesforce (CRM) – Focus on guidance for FY26 margins and AI product adoption across the enterprise suite.

Snowflake (SNOW) – Watch for commentary on AI-driven data pipeline growth and enterprise customer retention.

C3.ai (AI) – Key to monitor forward guidance and contract wins, especially within defense and energy verticals.

Movers & Shakers

(+) MongoDB ($MDB) +22% after the company announced strong Q3 results; strong AI platform growth.

(+) Boeing ($BA) +10% because of higher deliveries expected next year.

(–) XPO, Inc. ($XPO) -45% after the logistics company reported a decrease in shipments.

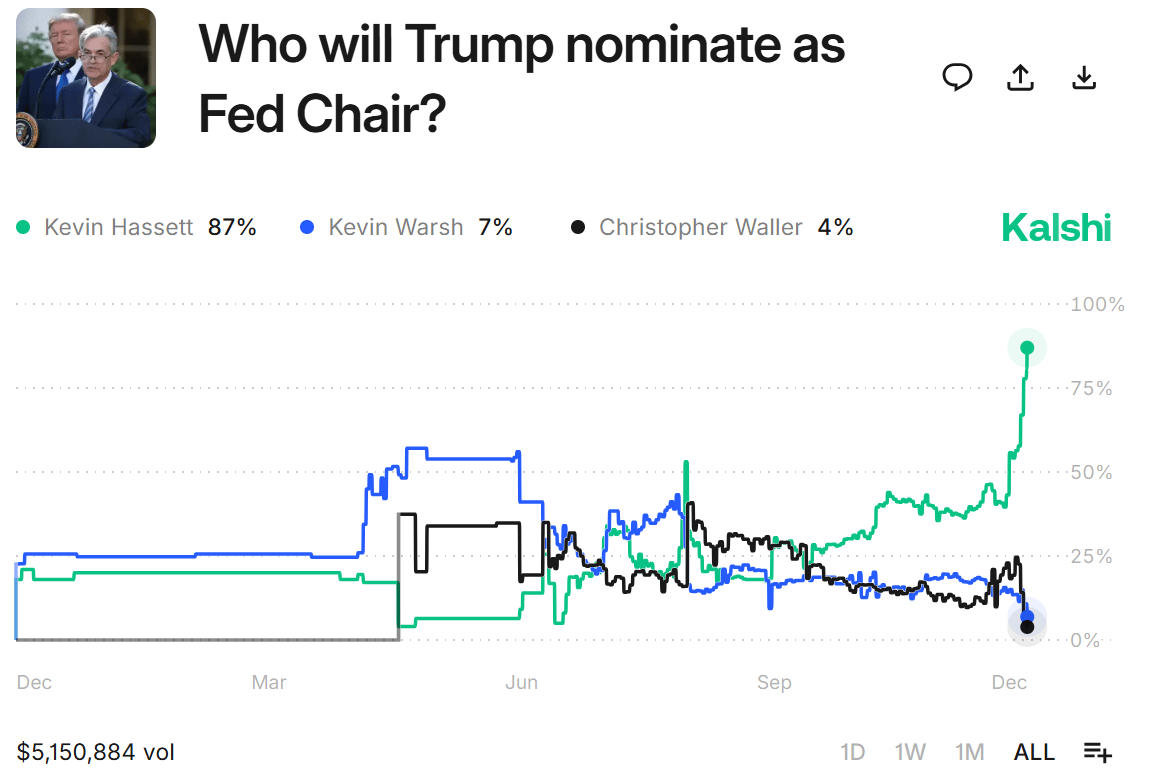

Prediction Markets

Kevin Hassett is 87% likely to be next Fed Chair

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

Kalshi, the largest U.S. predictions marketplace, raised $1 billion

Bending Spoons will buy Eventbrite for $500 million

Heven AeroTech, a developer of hydrogen-powered drones, raised $100 million

Gradium, a voice-AI startup, raised $70 million

Zafran Security, a threat exposure management startup, raised $60 million

Akura Medical, a developer of venous thromboembolism care solutions, raised $53 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

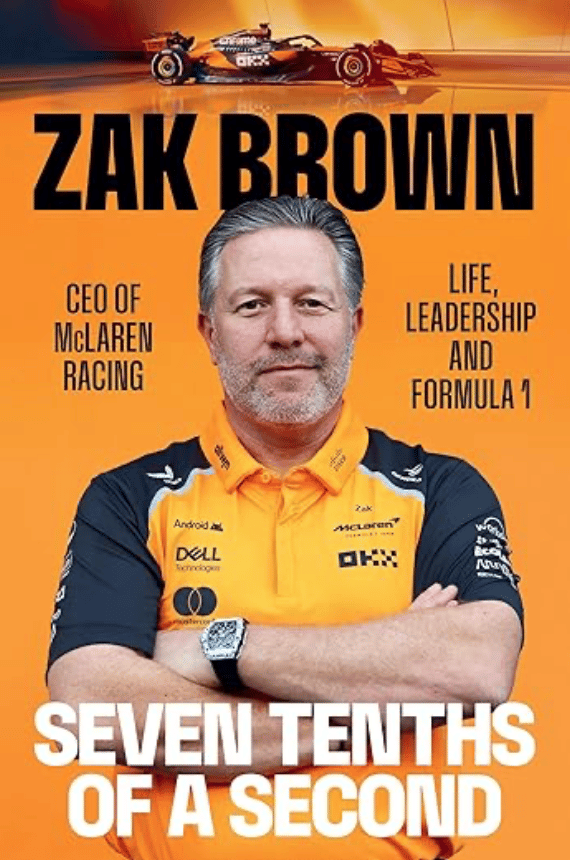

BOOK OF THE DAY

Seven Tenths of a Second

Description: A high-velocity memoir and leadership playbook from the helm of one of the world’s great racing dynasties. Brown chronicles how he guided McLaren Racing from underperformer to champion — weaving stories from the paddock, boardroom, and racetrack into lessons on trust, culture, resilience, and winning under pressure. Whether you're building a startup, managing a team, or just racing toward personal goals, his account shows how to turn split-second decisions into long-term success.

Book Length: 288 pages

Release Date: November 18, 2025

Ideal For: Entrepreneurs, team leaders, sports fans, and anyone who thrives under pressure — or wants to.

“When the margin for error is seven-tenths of a second, discipline isn’t optional — it’s everything.”

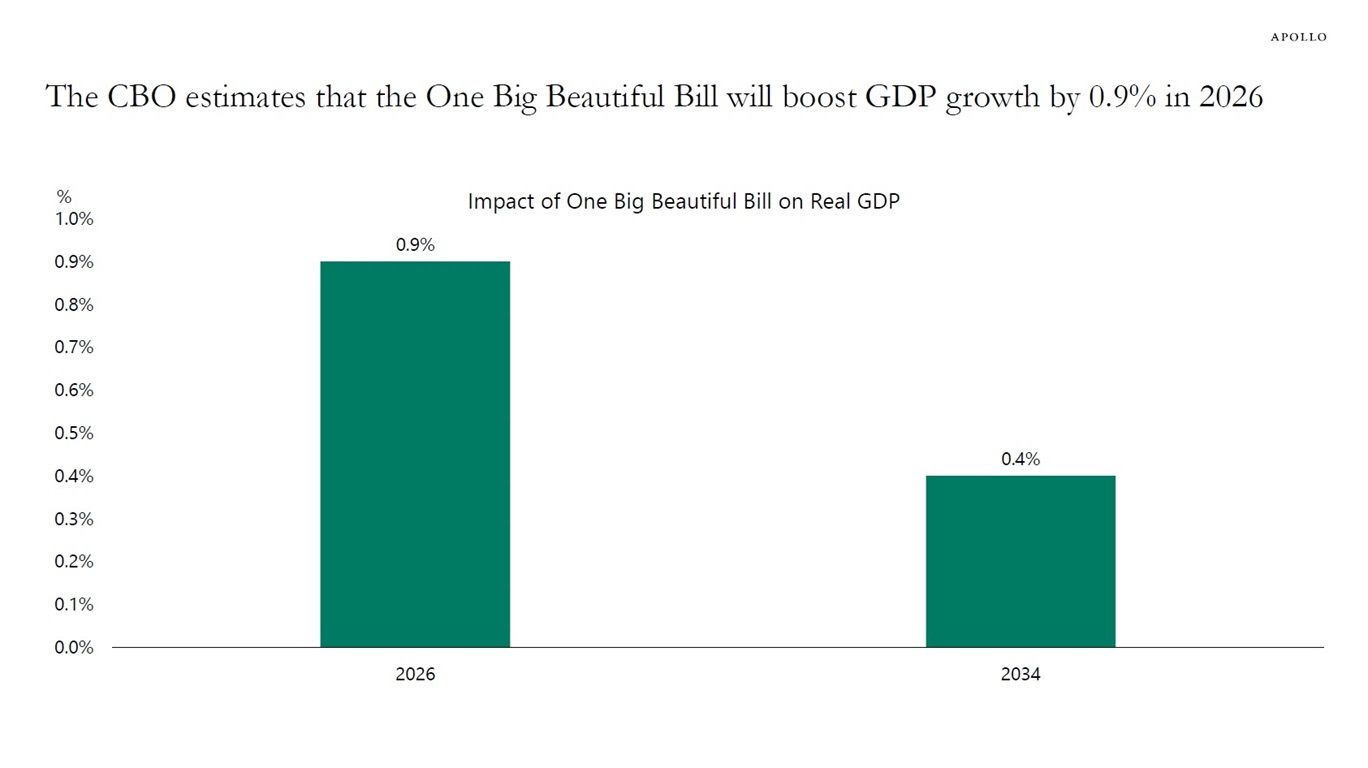

DAILY VISUAL

Significant Fiscal Boost Coming in 2026

Source: Apollo

PRESENTED BY MACABACUS

Pls Fix? Pls, no.

"Pls fix”

Two words that ruin dinner plans, date nights, and any hope of leaving before 9 PM.

Macabacus' Deck Check automatically proofreads your entire deck in seconds. It catches formatting, alignment, and consistency errors before your MD does.

No more late-night revisions. No more weekend “quick fixes”. Just perfect decks, built faster and on-brand.

Trusted by top investment banks and private equity firms, Deck Check keeps you one step ahead of the "Pls Fix" email.

Please Support Our Partners!

DAILY ACUMEN

The Weight of Attention

What you give attention to, expands. If you focus on what’s missing, you live in scarcity. If you focus on what’s working, you start to see opportunity everywhere. Attention is energy, and where it flows, your future follows.

The mind is a magnifier. Feed it with noise, and life feels chaotic. Feed it with signal, and clarity appears. The great performers don’t have more focus than others, they have fewer leaks. They decide, daily, what deserves their awareness and what doesn’t.

The richest people in the world aren’t the ones with the most money. They’re the ones who spend their attention wisely.

ENLIGHTENMENT

Short Squeez Picks

How to focus longer*

The difference between cheap and expensive coats

3 things you should do before noon

10 simple habits of genuinely kind people

When professional and personal setbacks hit at the same time

How to turn the bureaucratic grind of life into a party

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

*Partner sponsored placement.

Reply