- Short Squeez

- Posts

- 🍋 Dealmaking Comeback

🍋 Dealmaking Comeback

Why M&A picked up this summer, plus Apple-Messi deal paying off, and RIP NYC Airbnbs.

Together With

Looking for an AI version of Short Squeez? Then check out Synthetic Mind, written by 2 founders doing $10m+ a year.

“Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it.” — Warren Buffett

Good Morning! Apple’s feeling the Messi magic - they say MLS Season Pass signups surged 2,000% ahead of his Inter Miami debut. And NYC’s Airbnb crackdown took effect yesterday - Airbnb says the strict new rules make it virtually impossible to operate.

Oil prices soared to 2023 highs, but a soft landing summer is still pushing recession odds lower. As for summer travel to Europe, it climbed back to pre-pandemic levels - and the average room rate skyrocketed by 80% since 2019. Just don't bank on United Airlines to get you there smoothly – the FAA briefly grounded all of their flights yesterday, citing a vague "tech glitch."

If you are interested in getting in front of a smart, young audience of business leaders, bankers, investment professionals, policy influencers of over 500,000 people, then fill out this form, we’ll be in touch.

SQUEEZ OF THE DAY

Dealmaking Comeback

If you work in investment banking, you’re feeling the seemingly never-ending M&A drought.

But deal activity came to life during the summer - typically one of the quietest periods of the year.

Since July 1st, there’s been a handful of big-ticket deals, like Worldpay ($18.5B), Capri Holdings ($8.5B), and Crestwood ($7.1B). Markets were quiet during the first half of 2023 and M&A value tanked 40%. But through August 31? M&A value has clawed its way back up, now merely down by a modest 26.7%.

Dealmakers are plotting a comeback and are confident thanks to the momentum from the aforementioned mega-deals, surging business confidence, and bank lending easing.

Takeaway: You might be getting more pls fixes as banks get hired to advise on a growing deal pipeline. But there’s still reason to be cautious - the antitrust regime is stricter than ever, and dealmakers are spending a lot more time thinking about regulatory risks before pulling the trigger on a deal.

CAPITAL PULSE

Markets Rundown

Stocks closed lower as oil prices and yields rose.

Movers & Shakers

(+) Airbnb ($ABNB) +7% ahead of the company joining the S&P 500.

(+) Oracle ($ORCL) +3% after Barclays upgraded the company.

(–) Pulte Group ($PHM) -6% because yields climbed, squeezing the homebuilder company.

Private Dealmaking

Orora bought Saverglass, a bottle maker, from Carlyle for $1.4 billion

CVC Capital bought Dutch firm DIF Capital Partners for $1.1 billion

Permira bought Ergomed, a British pharma services firm, for $754 million

Butternut Box, a fresh dog food company, raised $300 million

Star Therapeutics, an antibody drug developer, raised $90 million

ThetaRay, an anti-money laundering startup, raised $57 million

Get access to private deal flow here.

WHAT ELSE TO READ

Use AI to Make $1m+ Year

Our friends at Synthetic Mind interview solo-prenuers making over $1m+ a year who use AI in their business.

It’s awesome, and their 71,000+ new monthly readers would agree.

Get the details on how to use AI as a tool so that it can serve you. Get the inside scoop on how these founders are building & scaling their business.

Written by 2 founders who do $10m+ a year, they offer a great perspective by having been in the trenches themselves.

HEADLINES

Top Reads

Barbenheimer can’t save the movie industry (Axios)

Pros and cons for upgrading to the new iPhone 15 (WSJ)

TikTok has transformed the concert experience (Vox)

UBS mulls options to reopen Apollo deal for Credit Suisse’s SPG (BB)

Apple, Google, Nvidia, others open to buying Arm shares (CNBC)

The U.S. economy’s slow return to 2% norm (Axios)

Disney pushes Charter subscribers to sign up for Hulu amid contract dispute (YF)

Blackstone marks another important milestone with S&P 500 inclusion (MW)

Money-for-nothing lawsuits against private equity founders get boost (WSJ)

Shoppers pull back on big ticket items (YF)

BOOK OF THE DAY

Clear Thinking

You might believe you’re thinking clearly in the moments that matter most. But in all likelihood, when the pressure is on, you won’t be thinking at all. And your subsequent actions will inevitably move you further from the results you ultimately seek—love, belonging, success, wealth, victory.

According to Farnam Street founder Shane Parrish, we must get better at recognizing these opportunities for what they are, and deploying our cognitive ability in order to achieve the life we want.

Clear Thinking gives you the tools to recognize the moments that have the potential to transform your trajectory, and reshape how you navigate the critical space between stimulus and response. As Parrish shows, we may imagine we are the protagonists in the story of our lives. But the sad truth is, most of us run on autopilot.

Our behavioral defaults, groomed by biology, evolution, and culture, are primed to run the show for us if we don’t intervene. At our worst, we react to events without reasoning, not even realizing that we’ve missed an opportunity to think at all. At our best, we recognize these moments for what they are, and apply the full capacity of our reasoning and rationality to them.

“Few things will change your trajectory in life or business as much as learning to think clearly. Yet few of us recognize opportunities to think in the first place.”

ENLIGHTENMENT

Short Squeez Picks

7 mindset shifts for mastering salary negotiations

How to turn every adversity you face into an advantage

4 of the most common work mistakes

Why couples argue more during the summer

How to become a morning person

DAILY VISUAL

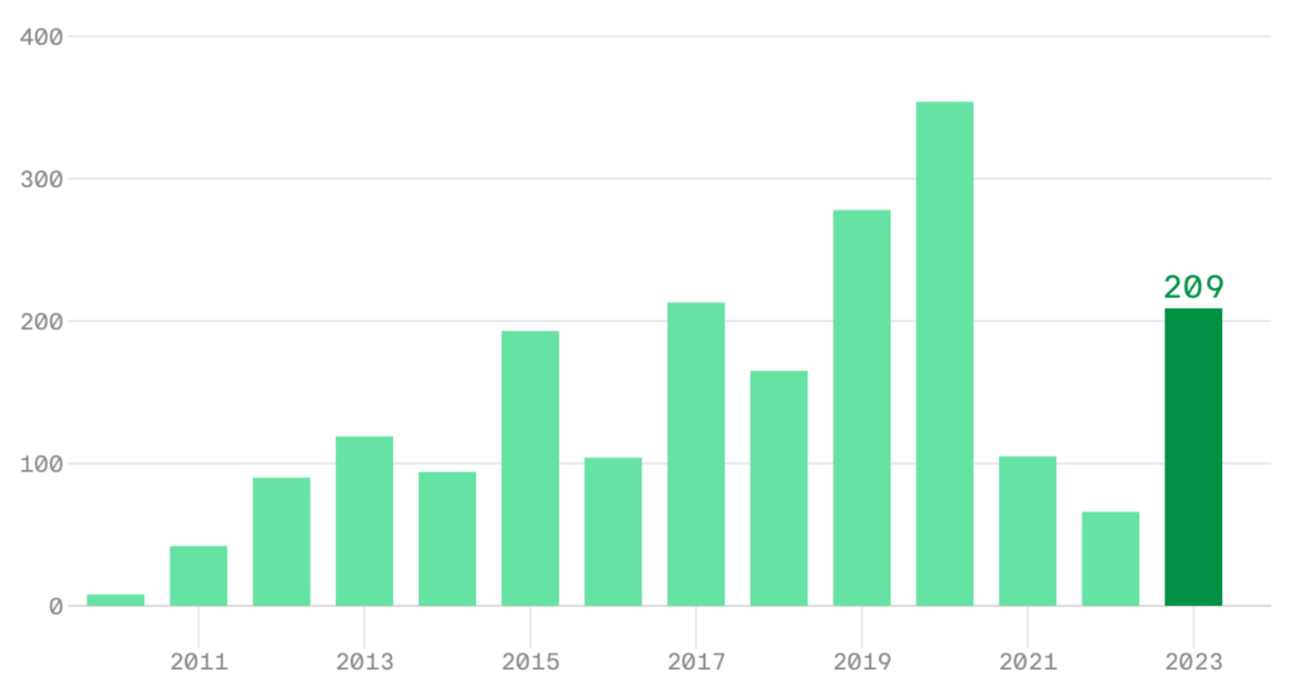

Disney-Charter Fight Could Be the Start of the TV Bundle Breaking

US TV blackouts

Source: Axios

SPONSORED BY JURNY

AI Investment Opportunity

The AI landscape is rapidly evolving, with giants like Google and OpenAI paving the way. Every industry is being transformed, and VCs have taken note, channeling billions into AI startups.

This golden era of AI isn't exclusive to the world of big VCs and IPOs.

Here’s a great startup giving Short Squeez readers a limited-time opportunity to invest in the future:

Jurny: At the forefront of AI-driven innovation, Jurny is revolutionizing the hotel and short-term rental sector by addressing inefficiencies worth over a staggering $1 trillion.

Their impact? Customers are already witnessing efficiency boosts of up to 80%. It’s no wonder Jurny has secured the trust of top-tier investors like Mucker Capital and Okapi Ventures.

DAILY ACUMEN

Your Own Billboard

“Large sections of Los Angeles are studded with billboards for minor TV shows. These billboards exist nowhere else, even though there are televisions globally.

Obviously, there’s ego at work here, but it’s sort of productive.

First, there’s the ego of the producers/networks. They like showing their peers what they’re up to, and it probably makes it easier to recruit the talent that lives nearby. If you’re in the famous business, being more famous, even locally, is a boost.

And then there’s the ego of the stars. After all, if they see the billboard, it’s as if everyone sees it.

Social media is simply a smaller scale digital example of this very tendency.

And getting your billboard right–and doing work that makes it easier to get your billboard right–might be one of the single best side effects of useful social media.

But, like billboards in LA, it’s best to not take them too seriously.”

Source: Seth Godin

MEME-A-PALOOZA

Memes of the Day

What'd you think of today's email? |

Reply