- Short Squeez

- Posts

- 🍋 Deal Season is Back

🍋 Deal Season is Back

Plus: JPMorgan falls after investment banking miss, Elon gives Iran free internet access, Kirkland in hot water and hedge funds post best year since the financial crisis.

Together With

“While I don't agree with everything that the Fed has done, I do have enormous respect for Jay Powell the man.” — Jamie Dimon

Good Morning! JPMorgan stock slid 4% after banking fees dipped in Q4. Meme-stock traders are rallying behind Jerome Powell, and hedge fund investors just logged their best year since the financial crisis.

A $10B startup is paying workers to train AI systems that could one day replace them. Elon Musk is offering free Starlink access in Iran amid an internet blackout. Inflation held steady in December, with CPI at 2.7%, the slowest pace since 2021.

Plus: U.S. Bancorp is acquiring BTIG for up to $1B, Kirkland & Ellis accused of conflict in private equity spat, and the fitness lessons that translate to building a business.

New year, new yield. Earn 5-15% on your cash with YieldClub.

SQUEEZ OF THE DAY

Deal Season is Back

JPMorgan’s investment banking revenues may have come in soft this quarter, but the broader signal is clear. Wall Street is on track for its strongest investment banking year since the pandemic, with momentum building into 2026.

JPMorgan reported earnings yesterday, Bank of America and Citi report today, and Goldman Sachs, and Morgan Stanley report later this week. Together, the five largest U.S. banks are expected to generate nearly $10 billion of investment banking revenue this quarter, up ~13% from a year ago. That puts full year 2025 fees on track for roughly $38 billion, a near 50% rebound from when they bottomed out in 2023, and the best year since 2021.

The recovery is broad-based. Private equity firms are finally able to finance deals again after two years of frozen credit markets. The IPO window remains open. And the massive buildout of AI infrastructure is driving a wave of equity raises, debt issuance, and M&A as companies scramble for data centers, chips, and power.

As the banks most exposed to dealmaking, Goldman Sachs and Morgan Stanley, analysts expect investment banking revenues to rise at least 17% this year, with another 11% increase forecast for 2026. Executives are signaling that pipelines remain full.

Markets are already reflecting this optimism. Goldman and Morgan Stanley trade at their highest forward valuation multiples in more than a decade, signaling expectations of a multi-year deal cycle. More diversified lenders such as Bank of America and Citigroup trade closer to historical norms, given their heavier exposure to consumer and commercial banking, but offer upside if deal activity remains elevated.

Takeaway: After several years where trading desks carried Wall Street’s earnings, investment banking is reclaiming a larger share of the profit mix. Analysts estimate banking fees will account for more than 25% of Wall Street revenues this quarter, the highest level since 2021. With regulatory pressure easing and roughly $182 billion of excess capital across large U.S. banks, the question is no longer whether dealmaking is back, but how long and how large this cycle becomes.

PRESENTED BY YIELDCLUB

The Easiest Way For Your Money to Make Money in the New Year

Looking to earn more than 4% on your cash?

YieldClub is a simple platform that helps you earn 5–15% APY on your money while keeping full control of your funds (self-custody).

Your returns compound every 16 seconds, and the platform is built on audited protocols that already manage $10B+ in deposits.

You can earn institutional-grade yield on idle cash (without lockups, hidden fees, or confusing structures) while keeping your money ready for the next investment opportunity.

HEADLINES

Top Reads

JPMorgan profit falls on investment-banking miss, Apple Card charge (WSJ)

He’s their daddy: meme stock traders rush to Powell’s defense (WSJ)

Hedge funds turn chaos into cash for best gains in 16 years (BB)

Job seekers train AI to do their own roles (WSJ)

Musk offers free Starlink in Iran as internet blackout persists (BB)

Inflation eases in December; core consumer prices rise at slowest pace since March 2021 (YF)

This is who companies call when they want to become a bank (BB)

China may crack down on “Singapore-washed” tech companies (Axios)

U.S. Bancorp to buy BTIG for up to $1 billion (WSJ)

Ackman pitches prepayment penalties as way to cut mortgage rates (BB)

Behind the unraveling of Apple's credit card partnership with Goldman Sachs (WSJ)

JPMorgan, Citi in talks to finance $1 billion Argentina pipeline (BB)

Kirkland & Ellis accused of conflict in private equity spat (BB)

Meta begins job cuts after shifting focus from metaverse to phones (BB)

Blackrock to slash hundreds of jobs (NYP)

Rio Tinto taps Evercore’s Robey, JPMorgan on Glencore pursuit (BB)

Data-center REIT CEO Andy Power says market not oversupplied (CNBC)

CAPITAL PULSE

Markets Rundown

Market Update

U.S. equities moved lower, with large caps lagging and the S&P 500 –0.2%

Financials –2% led declines following disappointing JP Morgan earnings

Short-term Treasuries rallied on softer inflation, with the 2-year at 3.52% and 10-year at 4.17%

The dollar initially fell post-CPI but rebounded to finish higher

Gold edged off record highs, while oil hit a two-month high on rising U.S.–Iran tensions

Economic Data Highlights

December CPI offered the first clean look at inflation after shutdown-distorted October and November data

Headline CPI firmed on higher food prices

Core CPI rose 0.2% MoM, bringing the YoY rate to 2.6%, softer than expected

Core goods inflation was flat in December and is up just 0.2% annualized over the past three months

Some volatility reflects used car prices, but evidence suggests tariff-driven pressures may be easing

Services inflation was firmer, with shelter rebounding after prior collection issues, though the broader trend remains moderating

Sector Trends

Financials dragged the market lower after bank earnings disappointments

Energy benefited from higher oil prices amid geopolitical tensions

Safe-haven dynamics were mixed: gold eased, while the dollar recovered and short-duration Treasuries strengthened

Looking Ahead

CPI data are unlikely to alter the Fed’s expected pause in January

Cooling core inflation supports the case for measured easing through 2026, especially with hiring still subdued

Markets now price ~20 percent odds of a 25 bp cut in March or April, rising to ~45 percent for June

The Powell investigation adds political noise, but bipartisan pushback has helped calm fears over Fed independence

Overall, the report reinforces a backdrop of gradually easing inflation and a patient, cautious Fed stance for early 2026

Movers & Shakers

(+) Moderna ($MRNA) +17% after the CEO announced the company expects revenue to beat guidance.

(+) Intel ($INTC) +7% because of an upgrade by KeyBanc that factors in 30% upside.

(–) JPMorgan Chase ($JPM) -4% after banking fees missed expectations.

Prediction Markets

Private Dealmaking

JetZero, a developer of blended-wing aircraft, raised $175 million

Defense Unicorns, a provider of air-gap software delivery for national security mission systems, raised $136 million

Deepgram, a speech-to-text platform, raised $130 million

Lyte, a robotics software company developing “visual brains” for autonomous machines, raised $107 million

Swap, an e-commerce logistics and fulfillment platform, raised $100 million

Proxima, an AI drug discovery company focused on proximity therapeutics, raised $80 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

The New Science of Momentum

Description: A research-driven leadership playbook that decodes how momentum really work, and how the world’s most successful coaches and leaders spark it, sustain it, and turn a single moment into lasting advantage. Drawing on extensive interviews and case studies across sports, business, politics, and the military, this book shows that momentum isn’t mystical luck, it’s a system you can understand, influence, and replicate.

Book Length: 288 pages

Release Date: May 20, 2025

Ideal For: Leaders, coaches, founders, managers, and anyone who wants to build and maintain momentum in teams, organizations, and personal goals.

“Momentum doesn’t happen by accident, it’s engineered through insight, action, and relentless follow-through.”

DAILY VISUAL

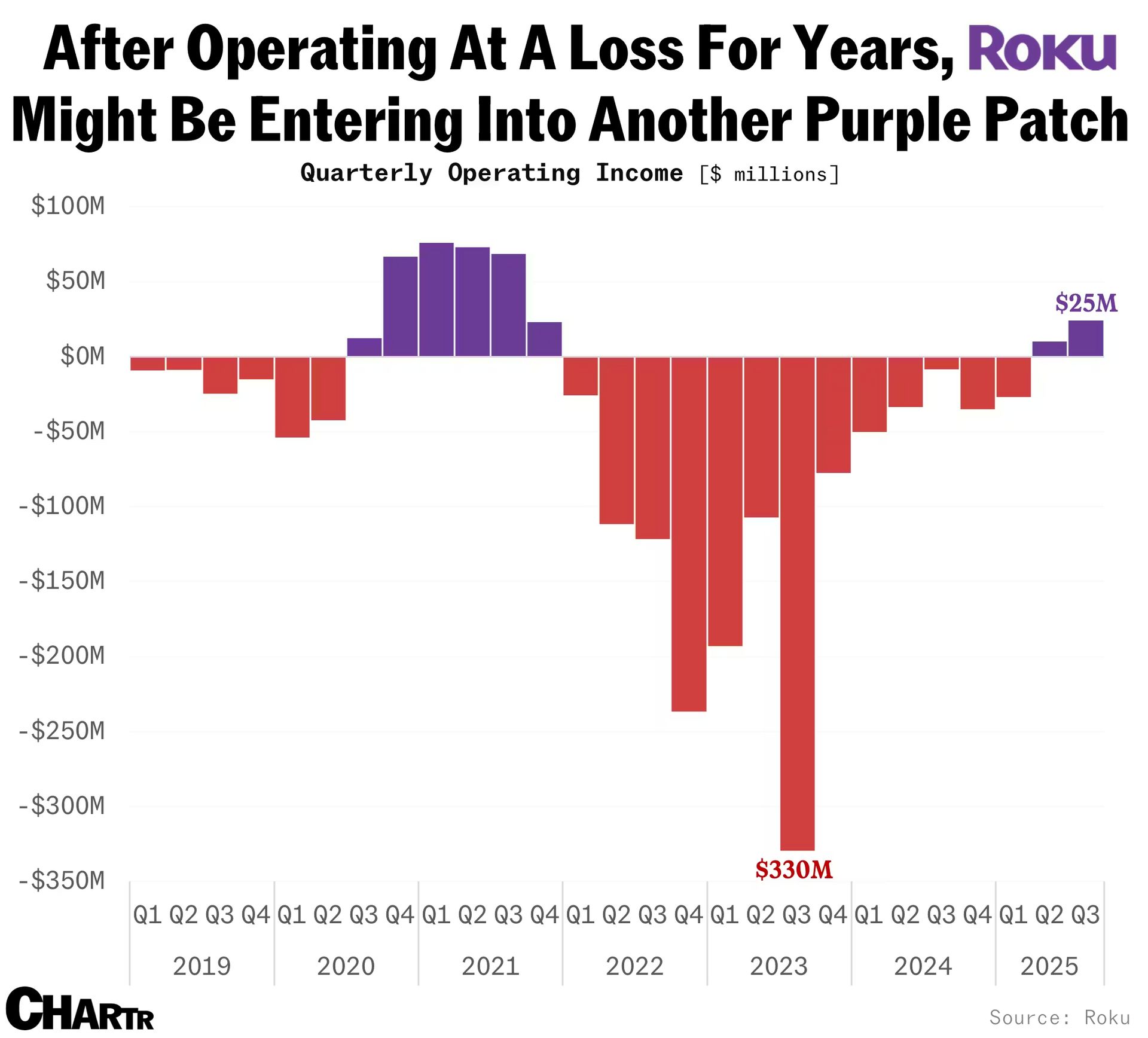

ROKU’s Purple Patch

Source: Chartr

PRESENTED BY MACABACUS

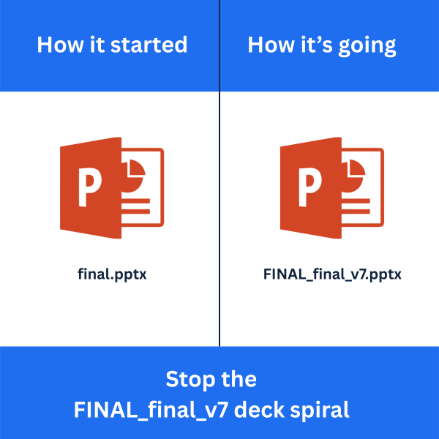

Retire the FINAL_final_v7 Deck

There are two kinds of “final” decks: the ones you send, and the ones you keep fixing.

If yours is living somewhere around FINAL_final_v7, you are not alone. Every edit introduces drift: a slightly different font, a chart that nudges off-grid, and bullets that break. Multiply that across 60 plus slides and it turns into late-night cleanup right before the deck goes upstairs.

Deck Check by Macabacus runs a fast quality pass across your pitchbooks, CIMs, and client decks to flag formatting, alignment, branding, and consistency issues, so “final” can actually mean final.

DAILY ACUMEN

Asymmetry of Risk

Nassim Taleb introduced the concept of "antifragility,” things that gain from disorder. Your career has this property if you understand asymmetric risk.

When you start a business, you risk time and money but gain potentially unlimited upside.When you stay in a safe job, you risk little but cap your upside entirely.

Jeff Bezos left a VP position at a hedge fund to sell books from a garage. The downside? He'd have to get another job. The upside? He built a trillion-dollar company.

Most people reverse this logic. They take symmetric risks (gambling, expensive cars, lifestyle inflation) with capped upside and unlimited downside.

But they avoid asymmetric opportunities (starting a side business, learning new skills, making bold asks) with limited downside and unlimited upside.

What would you attempt if failure meant you'd be exactly where you are now? That's asymmetric risk, you can't lose what you don't have.

Ask for the promotion. Pitch your idea. Start the project. Launch the product. The worst they can say is no, leaving you where you started. But yes changes everything.

Remember, you don't need to take big risks. You need to take smart risks where the upside dwarfs the downside.

ENLIGHTENMENT

Short Squeez Picks

What is the best way to train for a marathon?

How to improve your sleep with evening rituals

Three lessons from fitness about building a business

Why do major corporations hire a management consultancy?

Why communication is the number one skill for the future

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply