- Short Squeez

- Posts

- 🍋 Cracking the Personality Code

🍋 Cracking the Personality Code

Remote and hybrid work is here to stay, and managers have a new tool to better understand their employees - personality tests. As the personality testing industry skyrockets to $2 billion, more and more employers are using these tests to gain insight into their employees' personalities and preferences.

Together With

“It is easier to rob by setting up a bank than by holding up a bank clerk.” — Bertolt Brecht

Good Morning! OpenAI released GPT-4, which can reportedly take the bar exam and score in the top 10% of test takers (see Daily Visual below). Moody revised its outlook on the U.S. banking system to negative after the SBV and Signature Bank failures. Meta is laying off another 10,000 employees, Apple is delaying bonuses and hiring, and United Airlines warns of unexpected losses from higher-than-expected fuel costs.

KPMG is feeling the heat after providing clean audits of SVB and Signature Bank - the accounting firm signed off on financial statements less than two weeks before both banks imploded. And a recently listed $150k/month Tribeca penthouse is now the most expensive listing in NYC.

Today's sponsor, Daloopa is giving Short Squeez readers access to ten financial models (any public company) when you sign up for a free account on their website.

1. Story of the Day: Cracking the Personality Code

Remote and hybrid work is here to stay, and managers have a new tool to better understand their employees - personality tests. As the personality testing industry skyrockets to $2 billion, more and more employers are using these tests to gain insight into their employees' personalities and preferences.

Some managers say personality tests can help them identify blind spots and provide extra coaching and feedback where needed. 100 million workers worldwide are taking these tests annually, and even big-name firms like McKinsey are using them to balance introverts and extroverts on their teams.

And in an era where remote hiring has become the norm, many companies are now providing personality tests to job candidates to get a better understanding of who they are and how they would fit into the company culture.

But the increasing popularity of personality tests has sparked a heated debate among experts. While some swear by their accuracy, others dismiss them as mere ‘pseudoscience’ or even ‘nonsense’. In fact, some have gone as far as likening these tests to astrology, suggesting that they are unreliable and should not be taken too seriously.

Takeaway: Managers want to get to know their employees and job candidates, but could employees that test poorly be discriminated against? And is there a ‘universal’ ideal result, or is it all subjective? It’s all up in the air, but experts warn companies to take results with a grain of salt.

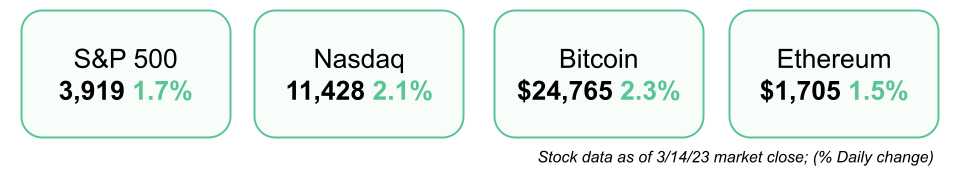

2. Markets Rundown

Stocks surged after bank stock rallied and positive inflation data was published.

Movers & Shakers

(+) Meta ($META) +7% after the Facebook parent will lay off another 10,000 employees.

(–) Gitlab ($GTLB) -24% after the software company issued weak guidance.

(–) Buzzfeed ($BZFD) -26% after the company revealed revenue implosion, most cash tied up at SVB.

Private Dealmaking

Apollo will buy Univar, a chemical company, for $8.1 billion

Blackstone bought CVent, an events and hospitality tech provider, for $4.6 billion

Symphony Technology Group will buy Momentive Global, the parent company of SurveyMonkey, for $1.5 billion

Volta Trucks, a Swedish EV manufacturer, raised $268 million

Chaos Industries, a defense tech startup, raised $70 million

Viridos, a sustainable jet fuel manufacturer, raised $25 million

A Message from Daloopa: Get Access to 10 Financial Models

Part of being a finance professional consists of being one of the world's best-paid data-entry professionals.

It's a pain—and a rite of passage—to build a financial model by painstakingly transcribing information from 10-Qs, 10-Ks, presentations, and transcripts. Or, at least, it was: Daloopa uses machine learning and human validation to automatically parse financial statements and other disclosures, creating a continuously-updated, detailed, and accurate model.

Thomas Li (CEO) puts it best: "Daloopa collects literally everything a company discloses."

Daloopa is giving Short Squeez readers access to ten financial models (any public company) when you sign up for a free account on their website.

3. Top Reads

We’ve entered a complicated new era of bank bailouts (Vox)

Beware a culture of busyness (HBR)

Silicon Valley was unstoppable, now it’s just a house of cards (Atlantic)

Why Bitcoin prices go up when banks go down (Axios)

SVB collapse will hurt startup ecosystem, despite bailout (CNBC)

Meta’s “year of efficiency” still looks costly (WSJ)

Why U.S. banking collapse matters (BBC)

How not to cover a bank run (Atlantic)

Wall Street eyes risk outside banking system after SVB collapse (YF)

Credit Suisse finds material weakness in financial reporting, scraps exec bonuses (CNN)

4. Shortform Book of the Day: Red Notice

Read More Books, Faster - Shortform offers super-detailed guides to 1000+ books in categories like finance, careers, self-improvement, and more. Their comprehensive coverage and deep insights will give you the world's greatest ideas without the fluff.

This is a story about an accidental activist. Bill Browder started out his adult life as the Wall Street maverick whose instincts led him to Russia just after the breakup of the Soviet Union, where he made his fortune.

Along the way he exposed corruption, and when he did, he barely escaped with his life. His Russian lawyer Sergei Magnitsky wasn’t so lucky: he ended up in jail, where he was tortured to death. That changed Browder forever.

He saw the murderous heart of the Putin regime and has spent the last half decade on a campaign to expose it.

Because of that, he became Putin’s number one enemy, especially after Browder succeeded in having a law passed in the United States—The Magnitsky Act—that punishes a list of Russians implicated in the lawyer’s murder.

Putin famously retaliated with a law that bans Americans from adopting Russian orphans.

A financial caper, a crime thriller, and a political crusade, Red Notice is the story of one man taking on overpowering odds to change the world, and also the story of how, without intending to, he found meaning in his life.

“The less people know about how sausages and laws are made, the better they sleep at night.”

5. Short Squeez Picks

6 habits making you miserable

The power of velocity over speed

How you can actually use AI to make your work better

12 powerful visuals about psychology and life

12 tips to start meditating more

6. Daily Visual: GPT-4 Test Taking vs GPT-3.5

Source: OpenAI

7. Daily Acumen

Humans are highly responsive to incentives, which means that we are more likely to take actions that are aligned with our interests and desires. However, the incentives that drive human behavior can be complex and difficult to understand, often leading us to distort our thinking in ways that may not be in our best interests.

For example, a salesperson may genuinely believe that the product they are selling will improve the lives of its users. However, the fact that they are selling the product can create a bias in their thinking, causing them to overestimate the benefits and overlook any potential drawbacks. This bias can be particularly strong if the salesperson's income or job security depends on making sales.

Other examples of incentives that can influence human behavior include social status, peer pressure, and the desire for personal achievement or recognition. These incentives can be powerful motivators, but they can also lead us to engage in behaviors that are not always rational or in our long-term best interests.

8. Memes of the Day

Want more Short Squeez?

Become an Insider. You'll get access to:

Industry deep-dives & compelling investment ideas

Wall Street Insider interviews breaking down their investment portfolio, strategy & investment picks

Knowledge Drop - an exclusive alpha-generating newsletter covering the best weekly research & content (podcasts, articles, blogs)

Vault – a collection of investing & recruiting guides, modeling courses, salary / comp data, institutional research (40+ resources added / month)

See you on the Inside.

*****

What'd you think of today's email? |

Reply