- Short Squeez

- Posts

- 🍋 Citadel Returns $5 Billion

🍋 Citadel Returns $5 Billion

Plus: Palmer Luckey's digital bank valued at over $4 billion, US economy grew 4.3%, and a rare PE win from pandemic era.

Together With

"There are way easier places to work, but nobody ever changed the world on 40 hours a week." — Elon Musk

Good Morning! Novo Nordisk jumped 7% after winning US approval for a weight-loss pill. The U.S. economy grew 4.3% in Q3, but traders are worried that strong growth could delay rate cuts. And ServiceNow agreed to buy cybersecurity startup Armis for $7.75 billion.

Private equity is struggling to exit roughly 31,000 portfolio companies, but Golden Goose is one of the rare wins, its $2,000 sneakers helped double its valuation over five years under Permira.

Plus: Palmer Luckey's digital bank valued at over $4 billion, 100-month car loans are becoming a thing, Gen Z is killing Jim Beam, and Warren Buffett’s best money and life advice.

OpenAI-backed Endex is deploying AI Excel agents using the newest GPT model release.

We’ll be taking tomorrow off. Hope you all have a wonderful Christmas, we’ll see you back on Dec. 26 🤝

SQUEEZ OF THE DAY

Citadel Returns $5 Billion

Ken Griffin’s Citadel is having a “soft” year by its own standards. The firm’s flagship multistrategy fund, Wellington, is up 9.3% through December 18, putting it on track for its weakest performance since 2018.

Despite that, Citadel plans to return roughly $5 billion of profits to investors in early 2026, reducing assets under management to about $67 billion from roughly $72 billion.

The distribution is a firm-driven capital-management decision, not a response to investor redemptions or liquidity pressure, and does not represent all of the profits generated this year.

Performance in 2025 was broadly positive across equities, fixed income, credit, and quantitative strategies, with natural gas the primary drag.

If current returns hold, this will mark just the sixth year since Citadel’s 1990 founding in which its flagship fund delivered less than a 10% gain.

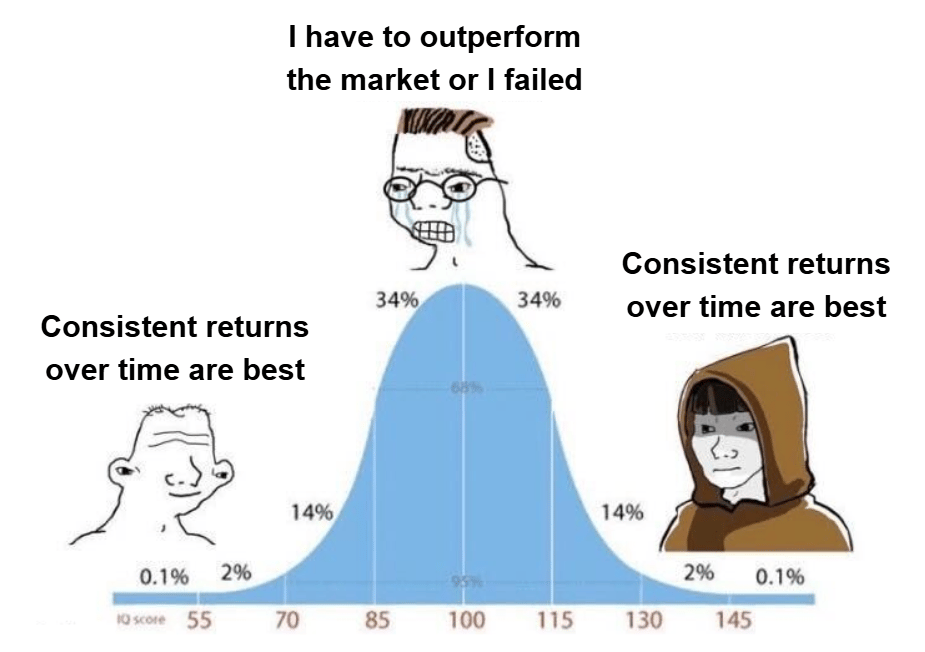

While some commentary has benchmarked Citadel against the equity market, that framing misses the point. Multistrategy hedge funds are not designed to beat stock indices in strong equity years, but to deliver consistent, risk-adjusted returns across cycles while tightly controlling volatility and drawdowns.

Returning capital when opportunity sets narrow is a core feature of the model. Citadel actively sizes capital to preserve flexibility, limit crowding, and protect forward returns.

According to LCH Investments, Citadel is the most profitable hedge fund of all time, generating roughly $83 billion in net gains through 2024 (see chart below), a figure expected to exceed $88 billion when updated rankings are released in January.

Takeaway: Hedge funds are not built to beat equity indices in strong markets. Citadel returning $5 billion after a 9.3% year is not a sign of weakness, it’s the strategy working as intended. That discipline, not beating the S&P in a hot tape, is how Citadel stays Citadel.

PRESENTED BY ENDEX

Sam Altman: "Enterprise Will Be a Major Priority for OpenAI Next Year"

In an interview this week, Altman said 2025 was the year OpenAI's enterprise growth outpaced consumer for the first time. "The models were not robust and skilled enough for most enterprise uses," he said. "Now they're getting there.”

GPT-5.2 now scores 68% on junior IB tasks.

Wall Street is reacting fast. Firms are adopting AI tools for slides and modelling like Endex, OpenAI's Excel agent, to shift analysts from manual spreadsheet work to AI-driven modeling.

HEADLINES

Top Reads

Novo Nordisk wins US approval for weight-loss pill (CNBC)

U.S. economy grows by 4.3% in third quarter, much more than expected (CNBC)

ServiceNow acquiring cybersecurity startup Armis for nearly $8 billion (CNBC)

Private equity, saddled with investments it can't sell, loses its luster (NYT)

Golden Goose's $2,000 sneakers are a rare win for private equity (BB)

Car payments are so unaffordable that some are signing 100-month loans (WSJ)

Gen-Z is killing Jim Beam (WSJ)

How to put some of Warren Buffett’s best money and life advice to work for you (CNN)

The AI boom is making real estate investors rich and exposing them to risk (WSJ)

US airlines see record holiday travel even as airfares climb (YF)

Copper hits $12,000 for first time as tariffs upend market (YF)

Central banks just cut rates at the fastest pace in a decade (YF)

Gas prices fall to four-year lows as millions embark on holiday road trips (CNBC)

Trump unveils warship named after himself in shipbuilding push (YF)

Private credit firms pile into consumer debt as risk-taking mounts (FT)

Ares Management chief eyes private equity as group’s next target (FT)

CAPITAL PULSE

Markets Rundown

Market Update

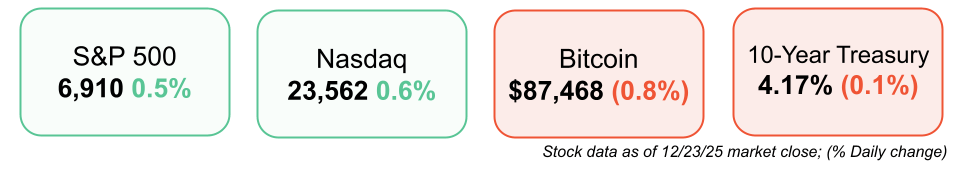

U.S. equities closed higher after a stronger-than-expected Q3 GDP report

Communication services and technology led gains; consumer staples lagged

Treasury yields moved lower, with the 10-year around 4.17%

U.S. dollar weakened against major currencies; Asian markets finished higher after China held rates steady

Economic Data Highlights

GDP (Q3) accelerated to 4.3% annualized, beating 3.0% expectations and marking the strongest growth in two years

Consumer spending rose 3.5%, driving growth across both goods and services

Consumer Confidence fell for a fifth straight month, with the Conference Board index at 89.1 vs 91.5 expected

Sector Trends

Growth stocks outperformed as tech sentiment improved

Consumer staples underperformed amid softer confidence data

WTI crude traded higher on supply concerns tied to Venezuela and renewed attacks on Russian energy infrastructure

Looking Ahead

Q3 data suggest the economy entered the October government shutdown on solid footing

Growth likely cooled in Q4 due to shutdown disruptions and expiring EV tax credits

2026 tailwinds could include Fed rate cuts, larger tax refunds, and easing inflation supporting a cooling labor market

Movers & Shakers

(+) Unusual Machines ($UMAC) +9% after the company secured a major purchase order for its drone program.

(+) Novo Nordisk ($NVO) +7% because the FDA approved the company’s first GLP-1 weight-loss pill.

(–) Asana ($ASAN) -6% after the SaaS company’s COO sold 160,000 shares.

Prediction Markets

Private Dealmaking

ServiceNow is acquiring cybersecurity startup Armis for nearly $8 billion

Severn Group, a manufacturer of industrial valves, agreed to be sold for $480 million

Erebor, a stablecoin banking startup, raised $350 million

Nirvana Insurance, a trucking industry insurtech, raised $100 million

PolyAI, a conversational AI company for customer service, raised $86 million

Adaptive Security, a cybersecurity company focused on deepfake and phishing attacks, raised $81 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Human-ish

Description: A witty, deeply human exploration of why we project life onto the lifeless — from chatting with pets and naming possessions to seeing patterns and intentions everywhere. Philosopher Tim Crane argues that this drive to humanize isn’t silly; it’s a window into how our minds make meaning, connect socially, and stitch coherence into a confusing world. Warm, funny, and surprisingly profound, it turns everyday quirks into insights about what it means to be human.

Book Length: 256 pages

Release Date: 2025

Ideal For: Thinkers, storytellers, psychologists, pet lovers, and anyone curious about the cognitive and emotional bridges we build between ourselves and the world.

“We humanize not because we must — but because we must understand.”

DAILY VISUAL

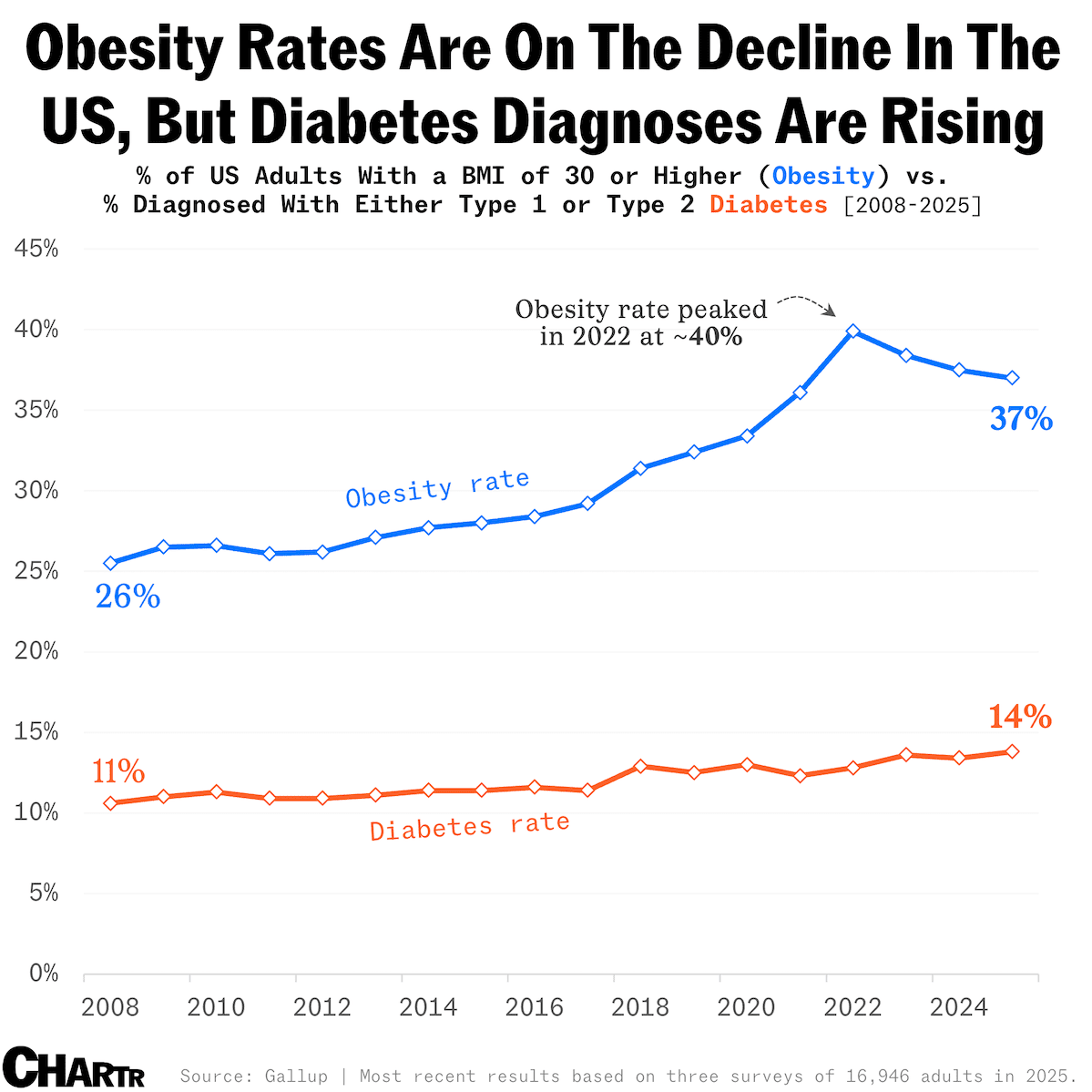

Obesity Rates on the Decline

Source: Chartr

PRESENTED BY STELRIX

The Financial Tool Family Offices Have Used for Decades, Now Available to You

Wealth doesn't liquidate to cover expenses. It borrows against itself.

Family offices and private banking clients have accessed capital this way for generations, using their portfolios as collateral while keeping investments intact and compounding. Traditional securities-backed lines require $100,000 minimums and weeks of underwriting, keeping this approach exclusive to institutional relationships.

Stelrix built that same infrastructure into a sleek gold card that connects directly to your existing brokerage. Your holdings stay exactly where they are, generating returns while you access spending power in real time. Limits adjust automatically based on your portfolio value, and pricing reflects actual risk rather than arbitrary credit scoring.

Manufactured by the team behind the Black Amex Centurion, the card itself signals a different approach to wealth management. Your investments continue working while you maintain flexibility for opportunities that don't wait for liquidation timelines. What you get is simple: capital access without triggering taxable events or disrupting your allocation strategy.

Join the elite. Reserve your gold card today.

Please Support Our Partners!

DAILY ACUMEN

Discomfort

In 1911, Roald Amundsen became the first to reach the South Pole. His rival Robert Scott, with better equipment and more resources, died trying.

The difference? Amundsen deliberately practiced in harsh conditions. He sought discomfort to prepare for it. Scott trained in comfort.

When things got hard, Amundsen had resilience; Scott had only hope.

Comfort doesn't build strength - discomfort does. What are you avoiding because it's uncomfortable?

Lean into it. Take cold showers. Have difficult conversations. Try things that scare you. Remember, everything you want is on the other side of fear.

ENLIGHTENMENT

Short Squeez Picks

The perfect stocking stuffer for the high-performer*

Why understanding personality is the foundation of career success

7 ways to learn faster and improve your memory

The best gifts under $50

How to become truly proactive

3 ways to become a better reader

MEME-A-PALOOZA

Memes of the Day

‘

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

*Denotes a Short Squeez partner post.

Reply