- Short Squeez

- Posts

- 🍋 Capital One’s $5B Hedge

🍋 Capital One’s $5B Hedge

Plus: Trump sues JPMorgan for $5B, Goldman raised Gold forecast, retail traders keep buying the “Sell America” dip, and banks line up for the hottest IPO of the year.

Together With

“My only regret was selling Nvidia stock at a valuation of $300M to buy my parents a Mercedes S-Class.” — Jensen Huang

Good Morning! Trump is suing JPMorgan and Jamie Dimon for $5 billion over alleged “debanking.” Goldman raised its gold target to $5,400 an ounce, saying the metal still has more than 10% upside. And Bank of America, Goldman, JPMorgan, and Morgan Stanley are being considered for senior roles to lead the SpaceX IPO.

Spirit Airlines is in talks with Castlelake as the airline tries to avoid bankruptcy. Clorox is buying Purell maker GOJO for $2.25 billion. And retail traders kept their hot streak alive and piled into Tuesday’s “Sell America” dip.

Plus: Why Wall Street is staying quiet about Trump in Davos and Musk says Tesla will start selling humanoid robots by the end of 2027.

It’s like a private bank in your pocket. Join the waitlist for the Stelrix gold card.

SQUEEZ OF THE DAY

Capital One’s $5B Hedge

Yesterday, Capital One announced it will acquire Brex, the fintech startup backed by Peter Thiel, in a $5.15 billion deal. For Capital One, this isn’t just a growth acquisition; it’s a move to regain control over the corporate spend segment and hedge against potential policy and regulatory shifts, like an interest rate cap on credit cards.

Over the past decade, fintechs have cherry-picked the most attractive slices of banking, such as high-margin payments, corporate cards, and software-driven services, without carrying the balance-sheet risk, capital requirements, or regulatory burden traditional banks face.

Brex was built to exploit that gap, and its niche has been fast-growing startups and tech-enabled companies that legacy banks often struggled to underwrite quickly or serve efficiently.

Capital One clearly sees value in Brex’s capabilities and likely figured rebuilding them internally would take years. For much of the past decade, banks partnered with fintechs to fill product gaps. But buying Brex skips the partnership phase entirely and gives Capital One direct control of the technology, client base, and growth engine.

The move comes at a time when a proposed 10% cap on credit card interest rates would pressure traditional lending margins and force banks to defend the parts of the business that still generate attractive returns. Corporate payments are one of those areas with fierce competition. American Express dominates the premium end, and fintechs dominate startups and tech-forward companies.

Capital One now has scale and its own card network after acquiring Discover. But scale alone is no longer a moat. Software, automation, and embedded financial tooling are what win modern corporate clients, and Brex brings exactly that: a payments and expense platform already embedded in the daily workflows of startups and growth-stage companies.

Takeaway: Capital One bought Brex because fintech already won the high-growth corporate segment. Now incumbents with large balance sheets are moving to consolidate what startups built. Capital One chose the fastest route: write the check, acquire the software layer, and bring the clients back in-house.

PRESENTED BY STELRIX

The Card That Treats Your Portfolio Like the Asset It Is

Private banks have offered portfolio-backed lending for decades, but only to clients who clear six-figure minimums and navigate weeks of underwriting. The rest rely on credit cards that ignore their actual financial position.

Stelrix delivers that same institutional infrastructure to high achievers who understand how wealth actually works. The platform connects directly to your brokerage and provides spending power secured by your holdings, not your credit history. Your assets remain invested and continue generating returns while you access capital for opportunities that don't wait for liquidation timelines.

Weighing almost twice a typical Amex, the card's technology is communicated through its physical design. The sleek gold finish signals a different class of financial product. Your capital works on your timeline, deployed when you need it without disrupting long-term strategy.

Join the elite. Reserve your gold card today.

HEADLINES

Top Reads

Trump sues JPMorgan for $5 billion over debanking claims (YF)

Gold prices will soar this year, says Goldman Sachs (YF)

SpaceX lines up four Wall Street banks for potential IPO (YF)

Spirit Airlines reportedly in talks with investment firm Castlelake (Axios)

Clorox buying Purell maker for $2.25 billion (Axios)

Retail traders keep their hot streak going, buying Tuesday’s ‘Sell America’ dip (CNBC)

Wall Street chiefs lay low to avoid Trump’s trolling (BB)

Elon Musk says Tesla will sell humanoid robots by end of 2027 (Axios)

Lucky Strike offers 1 cent bowling for penny retirement (Axios)

Software sell-off sparked by AI sets stage for potential big year of M&A (CNBC)

Blackstone backs startup Applecart at $700 million valuation (BB)

The ultra-rich hiring family for their private investment firms (CNBC)

Florida financial advisor admits to running $380M Ponzi scheme (NYP)

US companies expand protection services for top executives (FT)

Citigroup hires tech executive Govind for investment banking (BB)

Fed's main gauge shows inflation at 2.8% in November, edging away from target (YF)

The bond market keeps the score (Axios)

Bank of America weighs credit card with 10% rate as Trump calls for cap (Axios)

CAPITAL PULSE

Markets Rundown

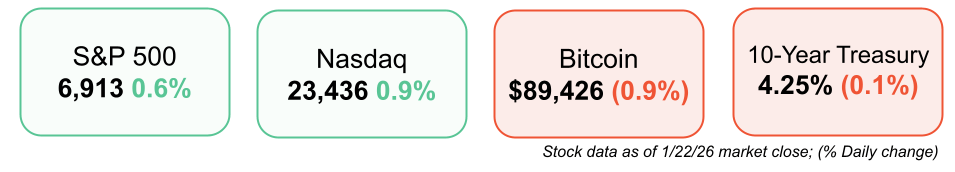

Market Update

U.S. equities closed higher as the rebound extended, supported by steady inflation data

Communication services and consumer discretionary led gains, signaling a risk-on tone

Small caps continued to outperform, with the Russell 2000 +9.5% YTD

Treasury yields edged lower, with the 10-year near 4.25%

European markets advanced after proposed Greenland-related tariffs were canceled

The U.S. dollar weakened; WTI crude pulled back amid easing geopolitical tensions

Economic Data Highlights

Initial jobless claims rose modestly to 200K, below expectations of 207K

Continuing claims declined to 1.85M, better than forecasts for an increase

Unemployment remains at 4.4%, with job openings at 7.1M, consistent with a low-hiring, low-firing labor market

Labor conditions continue to support gradual inflation moderation

Inflation & Fed Watch

Headline PCE inflation held steady at 2.8% YoY in November, in line with estimates

Core PCE also came in at 2.8%, still above the Fed’s 2% target

Goods inflation rose 1.4% YoY, while services inflation cooled to 3.4%

Shelter inflation slowed to 3.3%, aiding broader disinflation trends

Sector Trends

Communication services and consumer discretionary showed renewed leadership

Small-cap equities continued to benefit from improving risk appetite

Energy softened alongside oil as geopolitical risk premiums eased

Looking Ahead

The stabilizing labor market gives the Fed time to assess incoming inflation data

Markets remain focused on inflation progress, earnings momentum, and trade policy developments

Movers & Shakers

(+) Sphere Entertainment ($SPHR) +6% after BTIG initiated coverage on the entertainment company with a buy.

(+) Meta ($META) +6% because Jefferies says the company is a bargain relative to Magnificent 7 peers.

(–) Abbott Laboratories ($ABT) -10% after the healthcare company missed Q4 revenue.

Prediction Markets

10-year treasury yield comes out today at 3:25pm EST.

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

Deutsche Boerse acquired Allfunds, a fund distribution and wealth-tech platform, for about $6.2 billion

EQT acquired Coller Capital, a secondaries investment firm focused on private equity and alternatives, for up to $3.7 billion

Zipline, a drone delivery and logistics company focused on healthcare and retail distribution, raised more than $600 million

Noveon Magnetics, a manufacturer of rare earth magnets used in defense, EVs, and industrial systems, raised $215 million

Upscale AI, a networking and infrastructure platform for AI workloads, raised $200 million

Think Bioscience, a biotech developing treatments for genetic cardiac and lymphatic disorders, raised $55 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

The Elements of Power

Description: A gripping investigative account of the hidden global war over battery metals that power electric vehicles, smartphones, and the clean energy transition. Niarchos traces the brutal human, environmental, and geopolitical cost embedded in the lithium ion supply chain, revealing how cobalt, lithium, copper, and rare metals are reshaping global power while devastating communities in places like the Democratic Republic of the Congo and Indonesia. It is a sobering look at how modern technology depends on one of the dirtiest industrial systems on Earth.

Book Length: 480 pages

Release Date: January 20, 2026

Ideal For: Investors, policymakers, supply chain strategists, climate and technology readers, and anyone curious about the real cost of the energy transition.

“Every clean technology carries a hidden cost. The question is who pays it.”

DAILY VISUAL

Netflix Made $1.5B from Advertising Last Year

Source: Chartr

PRESENTED BY KINGSCROWD

Crowdfunding Analytics Platform Raises Crowdfunding

Startups raised $1.6B from retail investors in 2024. Yet most people still rely on pitch decks and pitch videos to decide where to put their money.

VCs have a team of analysts. Retail investors are left to a founder’s “trust me”.

Kingscrowd is that team of analysts for the retail investor. The platform tracks startups in real time across 100+ crowdfunding portals and has built track record in early-stage investing.

$2.5M+ booked in 2025 sales

7 strategic acquisitions, including Lustro and CrowdCheck, last year

Past investors include Oyster.vc, Global Millennial Capital, and the former CIO of Citibank

Now, they're raising to expand to the broader private market ecosystem.

Learn more about their raise.

DAILY ACUMEN

Illusion of Permanence

In 2007, Nokia was the world's largest phone manufacturer with 40% market share.

By 2013, they sold their phone business to Microsoft for scraps. Six years. That's all it took to go from dominance to irrelevance.

Nothing is permanent. Not your job. Not your relationship. Not your health. Not your success. This sounds depressing, but it's actually liberating.

When you realize nothing lasts forever, you stop taking things for granted. You appreciate your parents while they're here. You cherish friendships instead of assuming they'll always exist. You take the trip instead of waiting for "someday."

The Stoics practiced "memento mori," remembering death to appreciate life. Steve Jobs said his cancer diagnosis was the best thing that happened to him because it clarified what mattered.

What are you postponing that you'd regret never doing? What relationship are you neglecting because you assume it will always be there?

Remember, impermanence isn't the problem. Taking things for granted is. Live like everything could end tomorrow, because it could.

ENLIGHTENMENT

Short Squeez Picks

6 habits for a better 2026

Each state’s favorite fast food restaurants

10 simple habits to have a productive day

Do smaller houses lead to a happier life?

A 5-step plan to upgrade your brain

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply