- Short Squeez

- Posts

- 🍋 Burry is Long GameStop

🍋 Burry is Long GameStop

Plus: Zoom makes mega 78x return on Anthropic, Nvidia invests another $2B into CoreWeave, winter storm may freeze Q1 growth, solo 401(k)s are on the rise.

Together With

“The space economy will eventually surpass the total value of Earth’s economy.” — Elon Musk

Good Morning! CoreWeave jumped 6% after Nvidia pledged $2B for data centers. BofA says Winter Storm Fern could cut Q1 growth by up to 1.5 pts. Zoom popped 11% after Baird estimated its Anthropic stake is now worth $2 to $4B, a ~78x return.

CVC is buying Marathon Asset Management for up to $1.2B. Solo 401(k)s are rising as Americans go independent. And the Treasury canceled Booz Allen contracts after an employee allegedly leaked Trump's tax records.

Plus: Blackstone eyes more hiring in Asia, the U.S. takes a $1.6B stake in a rare earths firm, and four signs burnout is changing your personality.

Ornn has built the financial infrastructure for the AI economy. Trade it here.

SQUEEZ OF THE DAY

Burry is Long GameStop

Michael Burry is back in the headlines, and somehow, the stock he’s the most bullish on is GameStop. Even five years after GameStop’s infamous short squeeze, shares jumped yesterday after Burry disclosed in his Substack that he’s been buying the stock.

Burry even calls GameStop “almost as asymmetric as it gets” in U.S. equities. For a manager who has spent the past few years warning about excess and shorting the best-performing names like Nvidia and Palantir, going long a former meme stock is a strange twist after shutting down his hedge fund.

Burry praised Ryan Cohen’s governance, cost discipline, and balance sheet, and argues that the downside is anchored by cash and tangible assets while the upside comes from optionality. GameStop is still down roughly 70% from its pandemic peak, and every post-2021 rally has eventually faded.

Burry is framing this less as a squeeze and more as a deep-value play where potential upside could be realized through acquisitions, further cost rationalization, or a strategic pivot that has yet to materialize.

The market reacted, and shares jumped nearly 9% intraday, options volume spiked, and call premiums surged as traders chased the move. It was the largest volatility pop in months for GameStop.

The irony isn’t lost on the market. Burry famously exited GameStop ahead of the 2021 mania and built his reputation as one of Wall Street’s most vocal skeptics of speculative bubbles. Yet in 2026 he is long a name synonymous with retail mania. The distinction lies in his framing, he is emphasizing valuation asymmetry rather than sentiment.

Takeaway: Whether it works is another story. But when the investor behind The Big Short goes long one of the most notorious stocks and starts talking about downside protection and convexity, Wall Street pays attention. You either die a hero or live long enough to become Roaring Kitty (with a Substack).

PRESENTED BY ORNN AI

The Ornn Index: S&P 500 for Accelerated Compute

GPU compute pricing is messy because compute isn’t interchangeable. An H100 in Dallas is not the same as an H100 in Norway, and the same chip can behave very differently depending on the provider, networking, uptime, and counterparty risk.

But capital providers still have to price it.

Right now, lenders, neoclouds, and data center builders are making multi-year commitments using list prices, surveys, guesswork, and assumptions that don’t map to reality.

Ornn is building the missing reference layer: indices based on actual GPU compute transactions, not quoted rates. Think of it as WTI for high-performance compute, giving the market a common benchmark without pretending everything is identical.

Compute doesn’t need to be fungible. It needs to be observable.

HEADLINES

Top Reads

Nvidia invests $2 billion in CoreWeave to boost data center build-out (YF)

Bank of America warns winter storm could freeze Q1 growth (YF)

Zoom’s ‘hidden gem’ investment in Anthropic could be worth $2-4B (CNBC)

CVC buys U.S. credit manager Marathon for up to initial $1.2 billion (WSJ)

Wall Street pushes solo 401(k)s as more Americans work for themselves (BB)

Treasury cancels Booz Allen Hamilton contracts, sending stock plunging (Axios)

Blackstone eyes more hiring in Asia to tap private market demand (BB)

US government invests $1.6bn for stake in rare earths firm (CNBC)

NYC’s best new offices are adult playgrounds, with racing sims, speakeasies and roof terraces (NYP)

Luxury bets on rich Americans and new designers to revive growth (FT)

AI spending wasn’t the biggest engine of U.S. economic growth in 2025, despite popular assumptions (CNBC)

The man who almost replaced Warren Buffett (WSJ)

Gold, silver soar as 'breathtaking,' 'scary' rally continues (YF)

Nvidia and Alphabet VC arms back AI startup Synthesia at $4B valuation (CNBC)

California easily maintains its startup crown, despite naysayers (Axios)

Goldman’s top precious metals trader Binet-Laisne exits bank (BB)

Goldman Sachs collects $2.8 billion for private-equity co-investing (WSJ)

Blackstone eyes more hiring in Asia to tap private market demand (BB)

Private credit deal gone bad spawns court fight over conflicts (BB)

CAPITAL PULSE

Markets Rundown

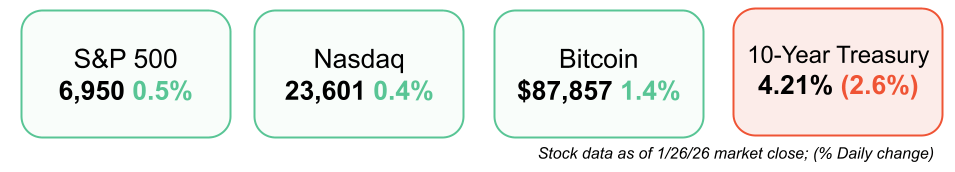

Market Update

U.S. equities opened the week higher as investors looked ahead to a heavy earnings slate

Tariff headlines resurfaced after President Trump threatened a 100% tariff on Canada tied to China trade, though markets reacted calmly

U.S. dollar weakened while precious metals moved higher amid trade and FX uncertainty

Asian markets were mixed; European equities closed mostly higher

Treasury yields edged lower, with the 10-year near 4.22% and 2-year around 3.59%

Earnings Today

Earnings focus intensifies this week, with 90+ S&P 500 companies reporting

Apple, Microsoft, Meta, and Tesla headline results among the Magnificent 7

With ~13% of companies reported, Q4 earnings are tracking ~7% YoY growth, implying ~11%+ full-year 2025 EPS growth

2026 earnings expected to grow ~15%, with all 11 sectors projected to post positive growth

Economic Data Highlights

Durable goods orders (Nov) surged +5.3%, well above the +1% consensus

Core durable goods rose +0.5%, beating expectations for flat growth

Computers and related products +3.8%, signaling continued AI-driven investment

Atlanta Fed GDPNow estimates Q4 GDP ~5.4%, despite shutdown disruptions

Looking Ahead

Investors will focus on AI spending commentary from tech leadership during earnings

The macro backdrop remains supportive, with GDP growth expected near ~2% in 2026

Movers & Shakers

(+) Lands' End ($LE) +34% after the retailer launched a joint venture for brand marketing.

(–) Sweetgreen ($SG) -7% because the winter storm disrupted foot traffic and weighed on sales.

(–) Revolution Medicines ($RVMD) -17% after acquisition talks with Merck broke down.

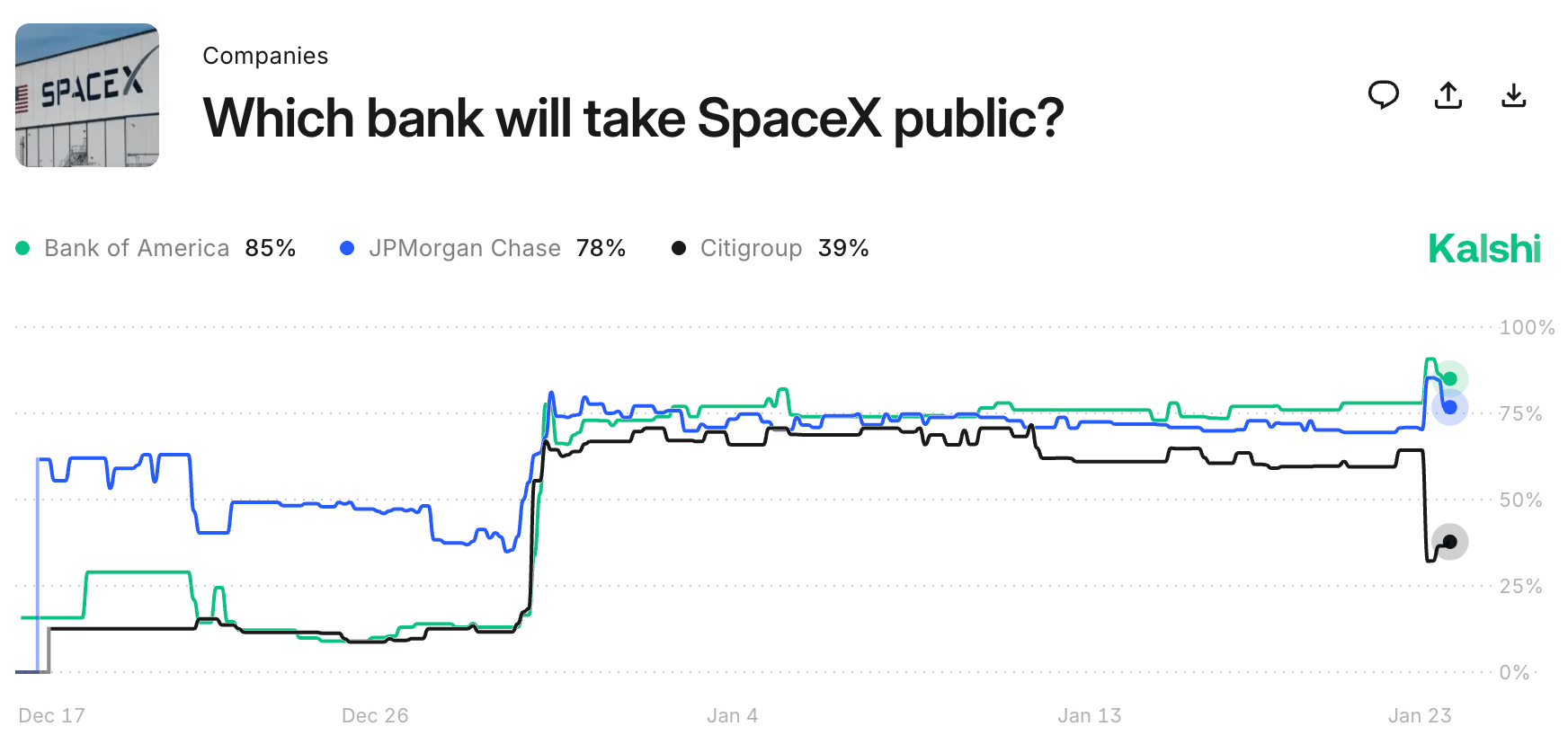

Prediction Markets

At $1.5T, this is expected to be the largest IPO in history.

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

IonQ, a quantum computing company, acquired SkyWater Technology, a semiconductor manufacturer, for $1.8 billion

CVC Capital Partners acquired Marathon Asset Management, an alternative credit investment manager, for up to $1.2 billion

Ricursive Intelligence, a frontier AI research lab focused on advanced reasoning systems, raised $300 million

Upwind Security, a cloud security platform focused on runtime and infrastructure protection, raised $250 million

Synthesia, a B2B AI video generation platform used for enterprise communications and training, raised $200 million

DeepWay Technology, a developer of heavy-duty trucking and autonomous logistics technology, raised $172 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

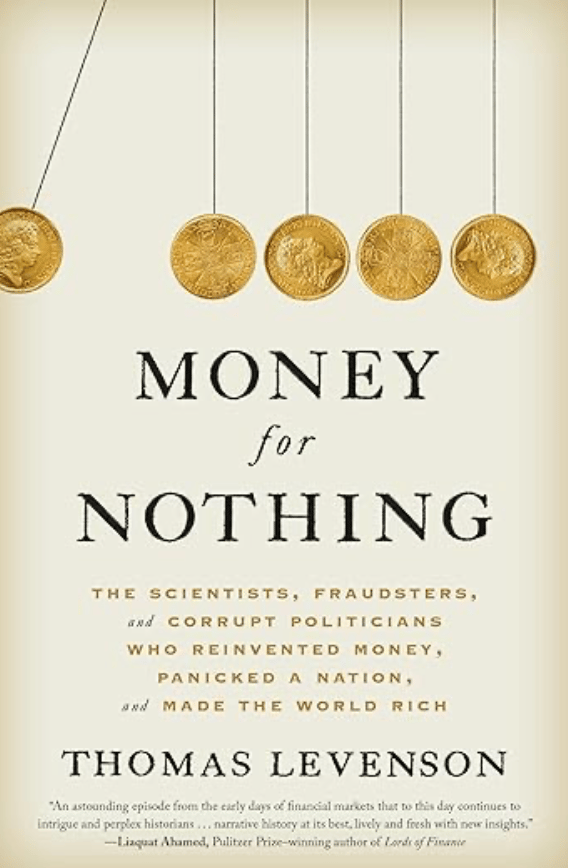

Money For Nothing

Description: A gripping financial history of the South Sea Bubble and the birth of modern money. Levenson tells the story of how scientific thinking, political ambition, and speculative greed collided in early eighteenth century Britain, producing both a revolutionary financial system and one of history’s most infamous market crashes. It is a sharp reminder that innovation and financial engineering can build prosperity or unleash chaos depending on who controls the system.

Book Length: 480 pages

Release Date: August 18, 2020

Ideal For: Investors, market historians, finance professionals, and anyone fascinated by bubbles, financial innovation, and the origins of modern capitalism.

“Every financial revolution promises freedom. Most also plant the seeds of the next crisis.”

DAILY VISUAL

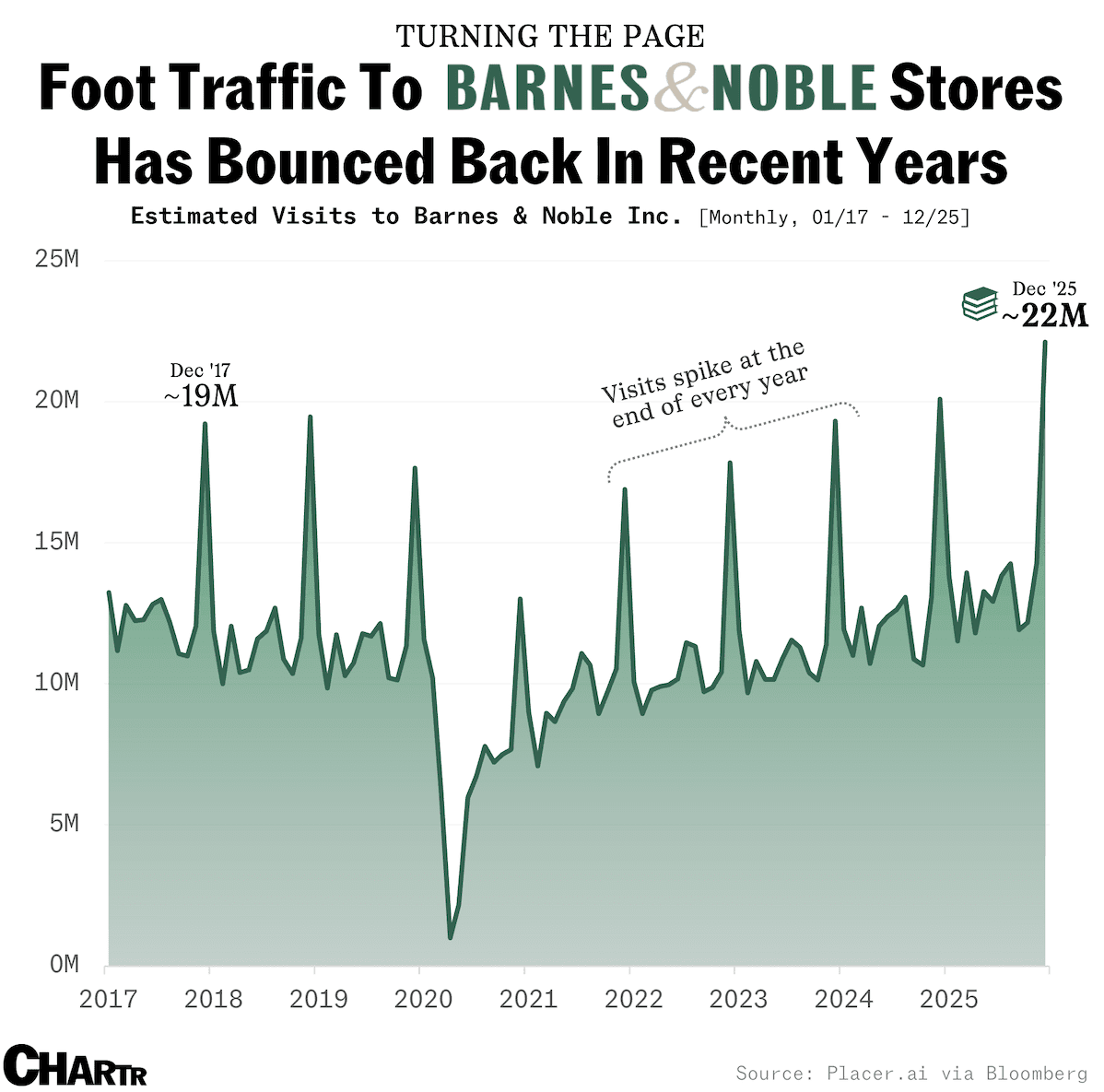

The Barnes & Noble Comeback

Source: Chartr

PRESENTED BY EQUIPMENTSHARE

EquipmentShare Enters the Public Markets

EquipmentShare rang the bell last week, marking a new chapter for the company founded in 2015 in Columbia, Missouri. The company operates a national equipment rental platform that combines a modern fleet with technology-enabled systems, serving customers focused on safety, efficiency, and jobsite productivity.

Company highlights:

Revenue grew from $1.5M in 2015 to more than $4B as of September 30, 2025

Profitable since 2020, with a reported 143% compound annual revenue growth

373+ locations across 45 states and more than 7,700 employees

Plans to expand to approximately 700 rental locations over the next five years

For informational purposes only. Not investment advice.

DAILY ACUMEN

Ergodicity

Russian roulette has a 5/6 survival rate. Play it once, you'll probably survive. Play it repeatedly, you'll certainly die. This is non-ergodicity: what's true on average isn't true over time.

Most advice assumes ergodicity. "The market returns 8% annually." True on average, meaningless for your timeline if you retire during a crash. "Startups have high expected returns." True on average, but you only live once.

Nassim Taleb calls this the difference between ensemble probability and time probability. Ensemble: outcomes across many people at one time. Time: outcomes for one person across time. Confuse them and you'll make terrible decisions.

Taking big risks works in an ensemble. Some win big. Most lose. But you're not the ensemble. You're one iteration in time. One bankruptcy can end your game permanently.

What risks seem acceptable on average but catastrophic personally?

Remember, you can't play life 1,000 times and average the results. You get one path. Choose accordingly.

ENLIGHTENMENT

Short Squeez Picks

4 signs burnout is changing your personality

Life is too short for frequent flyer miles

Why consistent fund performance is overrated

How little exercise can you get away with?

3 magic phrases to be more likable

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply