- Short Squeez

- Posts

- 🍋 Bleak Bonuses

🍋 Bleak Bonuses

Why bankers might get rekt again this year, plus Bitcoin rallying but Tesla down $145B in value.

Together With

Today’s edition is brought to you by Hebbia that makes deal diligence 10x faster and more accurate.

“You don’t want to make money by screwing your investors, and that’s what a lot of venture capitalists do.” — Charlie Munger

Good Morning! If you’re still holding onto Bitcoin, it’s starting to feel like 2021 - hopes of an ETF are spurring $BTC’s largest monthly gains since January. UAW workers won big, locking in a fat pay raise and ending the 6-week strike. That’s bad news for Tesla, in the midst of a rough two-week span that’s seen $145B of its valuation erased on demand woes.

Citadel chief (and proud owner of $43 million US Constitution) Ken Griffin treated 1,200 employees and their families to a Tokyo Disney trip, with entertainment from Maroon 5 and Calvin Harris. And Halloween was a huge test for Party City - the company exited bankruptcy a month ago and is still clinging for survival.

SQUEEZ OF THE DAY

Bleak Bonuses

We all know investment bankers got rekt with their bonuses in 2022. And some are already starting to sound the alarm, saying bonuses could sink 20 to 25% this year.

And it looks like equity capital markets (ECM) bankers might have it worse. During the first half of the year, the S&P 500 rallied almost 20%, and ECM bankers were getting back to work, with marquee IPOs such as Arm and Instacart.

Combined fees from ECM from top eight Wall Street banks rose 13% over the first nine months of the year. But it’s way below expectations - some banks were expecting a >50% rebound.

The brief IPO rebound this summer wasn’t enough to save Morgan Stanley from its worst investment banking quarter since 2009, posting revenue of just over $1B.

ECM junior bankers, usually eligible for bonuses up to 100% of their base salary, face an uncertain bonus season this year, with expectations now adjusted to around 50-70% of their base salary.

Takeaway. The average Wall Street bonus was down 26% in 2022. 2021 was a crazy year, and the average worker took home over $240k in bonus comp. Bankers were hoping 2022 was an anomaly, but early signs from the ECM world are pointing to yet another bleak bonus season. They might have to wait another year to get that rolie.

CAPITAL PULSE

Markets Rundown

Stocks ended a bumpy trading day with gains as Fed decision nears.

Movers & Shakers

(+) Pinterest ($PINS) +19% after better-than-expected Q3 earnings.

(+) SoFi ($SOFI) +9% because the bank says student loan rebound boosted profits.

(–) JetBlue ($JBLU) -10% after the airline forecasted wider-than-expected losses.

Private Dealmaking

Realty Income bought Spirit Realty Capital for $5.3 billion

AMETEK bought Paragon Medical, a medical devices maker, for $1.9 billion

Treasury Wine Estates bought Daou Vineyards for $1 billion

Palo Alto Networks bought Dig, a cloud data security startup, for $400 million

QI Tech, a Brazilian banking-as-a-service startup, raised $200 million

J.C. Flowers sold Romania’s First Bank for $138 million

SPONSORED BY HEBBIA

AI Built for Investment Professionals

Is your firm solidifying their AI strategy? Hebbia’s clients have combined over $4 trillion in AUM.

Hebbia’s AI platform is changing the deal diligence game and saving users hundreds of hours.

Hebbia streamlines market research, due-diligence, drafts DDQ responses and can instantly extract credit agreement / contract terms.

Book a 20 minute demo to see it for yourself.

HEADLINES

Top Reads

Zombie firms are filing for bankruptcy amid Fed interest rate hikes (CNBC)

Colleges facing credit risk due to private equity exposure (BB)

Ares raises $6.6 billion to chase bank loan sales (YF)

Markets on board with Fed’s higher-for-longer policy (CNBC)

Why Exxon and Chevron’s deals could leave investors cold (WSJ)

Andreessen Horowitz prepares next megafunds (Axios)

Toyota doubles down on EV investment as rivals pull back (YF)

Why the U.S. rate surge went worldwide (Axios)

Home prices hit a new record high in August (YF)

Morgan Stanley bonuses raise governance question (BB)

BOOK OF THE DAY

Running With Grace

Nothing about Lori Van Dusen’s childhood indicated she’d become one of the nation’s top independent financial advisors. She was born prematurely on the wrong side of the tracks and with a genetic blood disorder. Her parents divorced when she and her twin brother were less than a year old. But her big, boisterous, loving Italian family, led by her beloved grandfather, a first-generation American with only an eighth-grade education, taught her that the only limitations in life are those we impose on ourselves.

As a young person, Lori wanted to sing on Broadway, not manage money on Wall Street. But in 1986, this quiet, serious young woman walked into the rough-and-tumble, eat-what-you-kill world of Shearson Lehman Brothers and never looked back. She fought her way to the top by thinking outside the box and working her ass off despite the jeers, insults, and sideways glances. Her secret weapon? A need to prove herself so strong she could outwork anyone.

But Lori’s trajectory to the top was not a straight, upward line; it was a rollercoaster. She hit the pinnacle of success only to have it ripped away in a legal battle with one of the biggest banks in the world. She was raped by a PhD candidate at Harvard, swindled by a business partner, and battled two life-altering medical diagnoses. None of that, though, would compare to having the two people she loved most in the world taken way too soon.

Despite the fear and pain, Lori remained hopeful and resilient. In this memorable, poignant, and inspiring memoir, she shares her lowest lows and highest highs as well as hard-earned wisdom from her bumpy personal, professional, and spiritual journey. Life was never meant to be fair, she learned, but we must keep running with grace if we are to find purpose and joy in the face of adversity.

“Running with Grace is a story of triumphs and defeats, told to inspire the reader to never give up.”

ENLIGHTENMENT

Short Squeez Picks

DAILY VISUAL

MCD Still Lovin’ It

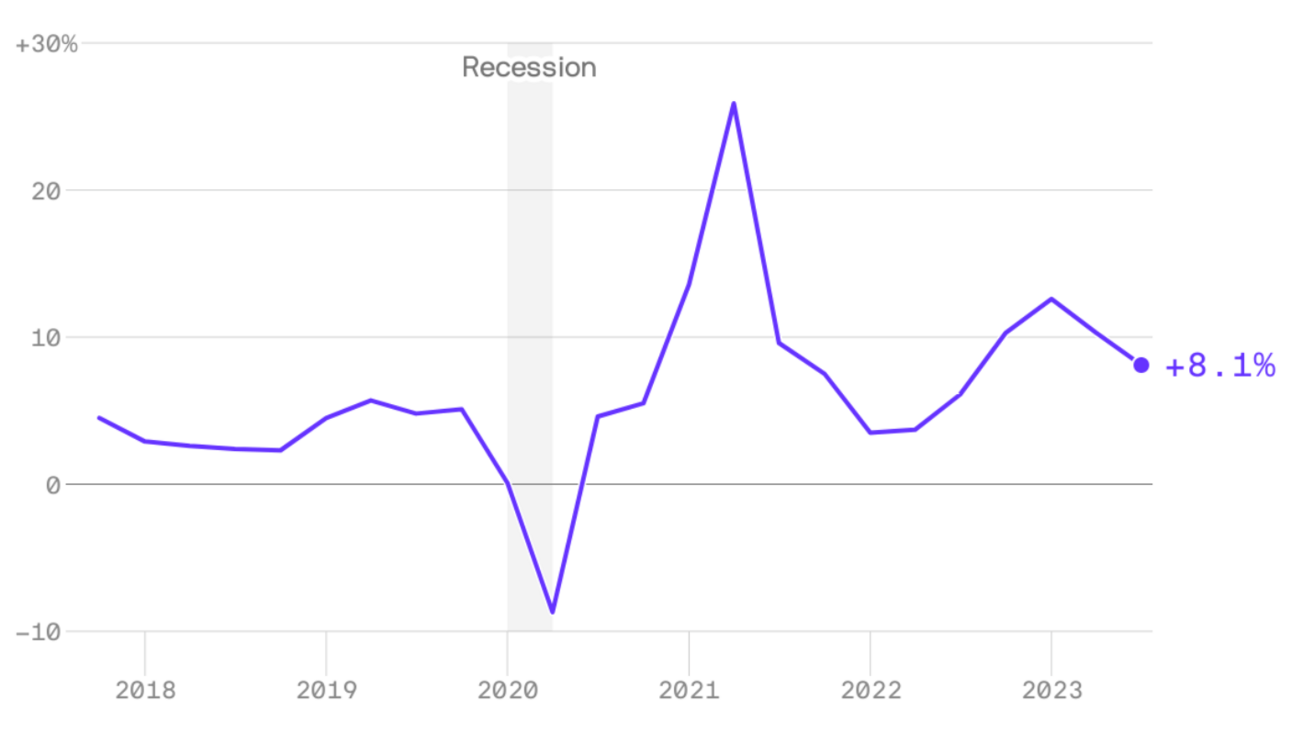

Year-over-year change in McDonald’s same store sales in US

Source: Axios

McDonald's exceeded sales and profit expectations, balancing a dip in lower-income U.S. customer sales with an uptick from wealthier diners.

WHAT ELSE TO READ

No Sensationalism, No Outrage. Just News.

Oh, and humor… there’s humor too! But what would you expect from a newsletter with 110,000+ readers called The DONUT?

DONUT delivers quick, nonpartisan, and trustworthy news that’s enjoyable – keeping you informed and entertained in just four minutes every morning.

DAILY ACUMEN

Tedious Tasks

Ever found yourself drowning in a sea of demanding emails, with some needing intense brainpower while others are just casual invites to the office karaoke night? The question arises: which ones do you tackle first? Well, science has got an answer for you, and they call it the 'easy addendum effect.'

According to a recent study, if you're dealing with a bunch of mind-numbing, repetitive tasks that require attention, finishing your workday with the lighter, more enjoyable ones can make the entire experience feel less exhausting. It's like saving dessert for last; even though it's extra effort, it somehow makes the whole meal more enjoyable.

Edward Lai, one of the researchers behind this idea, stumbled upon it during his PhD days at Virginia Tech. He and his colleagues had their share of never-ending to-do lists and wondered how to make them feel less daunting. Turns out, they naturally separated the difficult from the easy tasks and wondered what would happen if they mixed them up strategically.

Now, this doesn't mean adding easy tasks to complex ones will work wonders in every situation. If you're dealing with super complex, vastly different tasks, or if you thrive on challenges, this trick might not be your cup of tea. But for everyday chores, it's a game-changer. So, next time you're facing a mountain of work, save the best for last—it might just make you feel like a productivity genius.

MEME-A-PALOOZA

Memes of the Day

What'd you think of today's email? |

Reply