- Short Squeez

- Posts

- 🍋 Blank Checks are Back

🍋 Blank Checks are Back

Plus: Bessent is a soybean farmer, Blackstone becomes largest shareholder in India's Federal Bank, stocks hit fresh highs, and record $38B debt sale for data centers.

Together With

"Martha, in case you don't know it, I'm actually a soybean farmer, so I have felt this pain too." — Scott Bessent

Good Morning! Trump slapped a 10% tariff on Canada over a Reagan-era trade ad. Novartis will buy U.S. biotech firm Avidity Biosciences for $12 billion. Stocks hit fresh all-time highs after September inflation came in lower than expected.

Scott Bessent said he ‘felt this pain’ from China refusing to buy American crops because he’s ‘actually a soybean farmer.’ Blackstone invested $706 million for a 10% stake in India’s Federal Bank. And banks are preparing a $38 billion debt deal to fund data centers tied to Oracle Corp.

Plus: Qatar’s former ruler is quietly assembling a multi-strat team, hiring Goldman’s former Monaco chief to lead the charge, one in three Manhattan condo owners sold at a loss this year, and what your heart rate should be when you work out.

Optimizing your business tax strategy is an easy way to put money in your pocket. See Gelt’s track record and what they can do for your business.

SQUEEZ OF THE DAY

Blank Checks are Back

The blank-check boom that defined 2020 is finally making a comeback. After four years of dormancy under tougher SEC scrutiny and higher rates, SPAC sponsors have raised more than $24 billion since last November, already surpassing the past two years combined.

This new wave is supposed to be more disciplined than 2021’s meme-era mania. The sponsors aren’t influencers or athletes anymore. They’re former bankers, hedge-fund managers, and private capital veterans raising money for sectors tied to the administration’s priorities: defense tech, quantum computing, crypto, and AI infrastructure. That political tailwind gives bankers the perfect story to sell, and plenty of fees to collect.

For Wall Street, SPACs remain one of the most lucrative products. The underwriting stack pays twice: banks earn ~2% upfront when the SPAC IPOs, and another ~3% deferred when a deal closes. Add M&A advisory and fairness-opinion fees, and every transaction becomes a two-for-one payday. And once a sponsor team succeeds, they often rinse and repeat with the same banks attached.

For issuers, it’s an expensive shortcut to public markets. Between underwriting, sponsor promotes, PIPE costs, and legal work, total transaction expenses can top 15%-20% of capital raised (a traditional IPO costs closer to 6-7%).

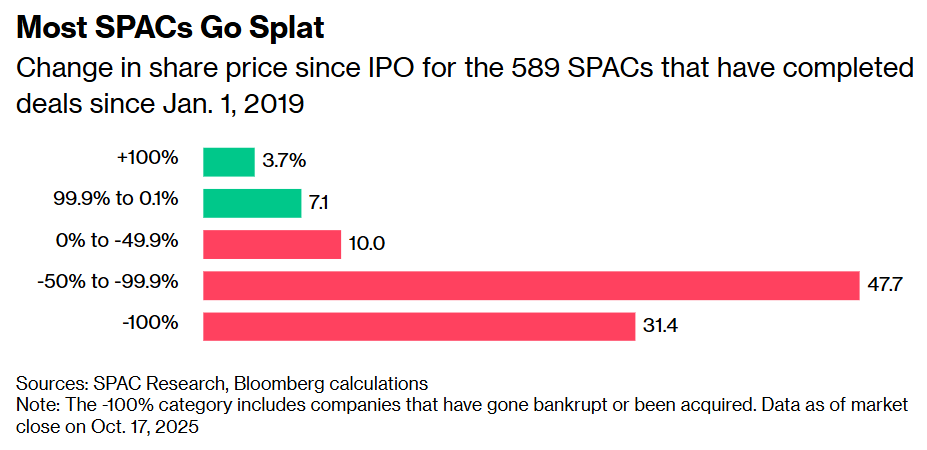

Investors, meanwhile, keep learning the same lesson. Only ~11% of companies that merged with SPACs since 2019 trade above their issue price.

Source: Bloomberg

“The rate of success of SPACs does not justify the risk,” says Greg Martin, managing director at Rainmaker Securities. “These are probably companies that couldn’t go out the regular way.”

For banks, that risk is irrelevant. They get paid when the deal lists, not when it performs. SPACs are less about innovation and more about monetizing liquidity. Every filing means more fees and bigger bonuses.

Takeaway: SPACs remain the purest expression of modern finance: monetize urgency, transfer risk, and arbitrage optimism. The public gets a fast path to growth stories that weren’t ready for prime time, while Wall Street locks in economics regardless of performance. And once again, it’s a great time to be Chamath Palihapitiya… just don’t ask how the stock trades after the bell.

PRESENTED BY GELT

Smart Tax Moves for Founders & Business Owners

Running a business means juggling growth, funding, and compliance, all while building the financial discipline investors expect.

Gelt’s dedicated CPA team leads your tax strategy, supported by proprietary AI tools so you can move faster with fewer surprises:

Dedicated CPA lead: consistent point of contact, quarterly planning, fast answers

Built for complexity: equity planning, R&D credits, multi-state compliance, liquidity events, handled end to end

Clarity meets automation: one platform to track deadlines, projections, filings, and opportunities

Cost-conscious design: uncover savings early, extend runway, avoid surprise audits

These strategies have helped one founder save an estimated $30,000 annually.

From fundraising to acquisition, Gelt helps founders stay ahead on tax strategy.

Please Support Our Partners!

HEADLINES

Top Reads

Trump says he’s increasing tariffs on Canada by 10% after Ontario’s Reagan ad (CNN)

Inflation rate hit 3.0% in September, lower than expected (CNBC)

Novartis to acquire Avidity Biosciences for $12 billion (CNBC)

Trump’s ballroom fundraising taps cash from crypto, tech allies (BB)

Scott Bessent says he’s 'actually a soybean farmer’ (CNBC)

Blackstone invests $706 million for 10% stake in India’s Federal Bank (BB)

Oracle-tied data centers eye record $38 billion debt sale (BB)

One in three Manhattan condo owners sold at a loss in the past year (CNBC)

Cooler-than-expected inflation keeps Fed on track for rate cut this week (YF)

Global fund managers flag inflation, geopolitics as top year-end risks (CNBC)

Blackstone’s distributable earnings rise as firm hauls in $54 billion in cash flows (WSJ)

Fast-money quants stumble as momentum bust roils strategies (BB)

Qatar royal hires top Wall Street bankers to manage his multibillion-dollar fortune (BB)

Optimism rises for Thursday summit between Trump and Xi (YF)

Jane Street and rivals capture 30% of global trading market share, BCG says (BB)

Bitcoin miners use computing power to service a thirsty AI boom (YF)

NFL’s Roger Goodell praises private-equity expansion, backs Bad Bunny (BB)

How to tackle private credit’s “cockroaches” as contagion fears grow (CNBC)

Private-equity and credit stocks tumble amid contagion worries (Barron’s)

CAPITAL PULSE

Markets Rundown

Market Update

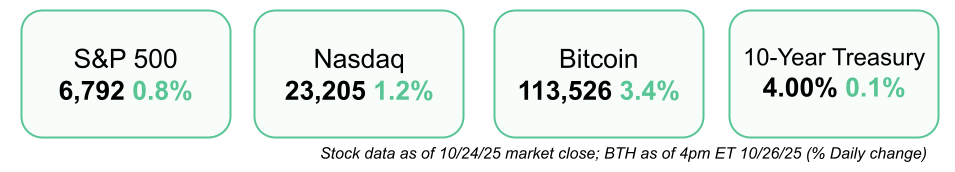

Stocks closed higher as CPI inflation came in cooler than expected, easing rate concerns.

S&P 500 and Nasdaq hit record highs, led by strong gains in technology and communication services.

Trade tensions resurfaced after President Trump ended negotiations with Canada following a tariff dispute, though Ontario’s government pledged to pause the offending ads.

Bond yields fell, with the 10-year Treasury at 4.00%.

Oil prices rose after new U.S. sanctions on Russian energy firms, while Europe’s PMI data signaled the fastest growth since May 2023.

Economic Data Highlights

CPI inflation rose 3.0% year-over-year in September, below estimates for 3.1%.

Core CPI also eased to 3.0%, while rent of shelter fell to 3.5%, its lowest level in four years.

Gasoline prices increased 4.1% month-over-month, driving most of the headline gain.

Reported Earnings

Procter & Gamble (PG) – Delivered steady organic sales growth, with pricing strength offsetting softer volumes.

General Dynamics (GD) – Posted strong results, driven by aerospace demand and defense order growth.

Earnings Today

NXP Semiconductors (NXPI) – Focus on automotive chip demand and margin guidance amid AI-driven tailwinds.

Waste Management (WM) – Watch for volume growth trends and margin resilience as costs stabilize.

Movers & Shakers

(+) Ford Motor ($F) +12% after the automaker beat earnings.

(+) IBM ($IBM) +8% after Bank of America increased its price target; the company will use AMD chips for quantum.

(–) Beyond Meat ($BYND) -23% after a price cut by Mizuho.

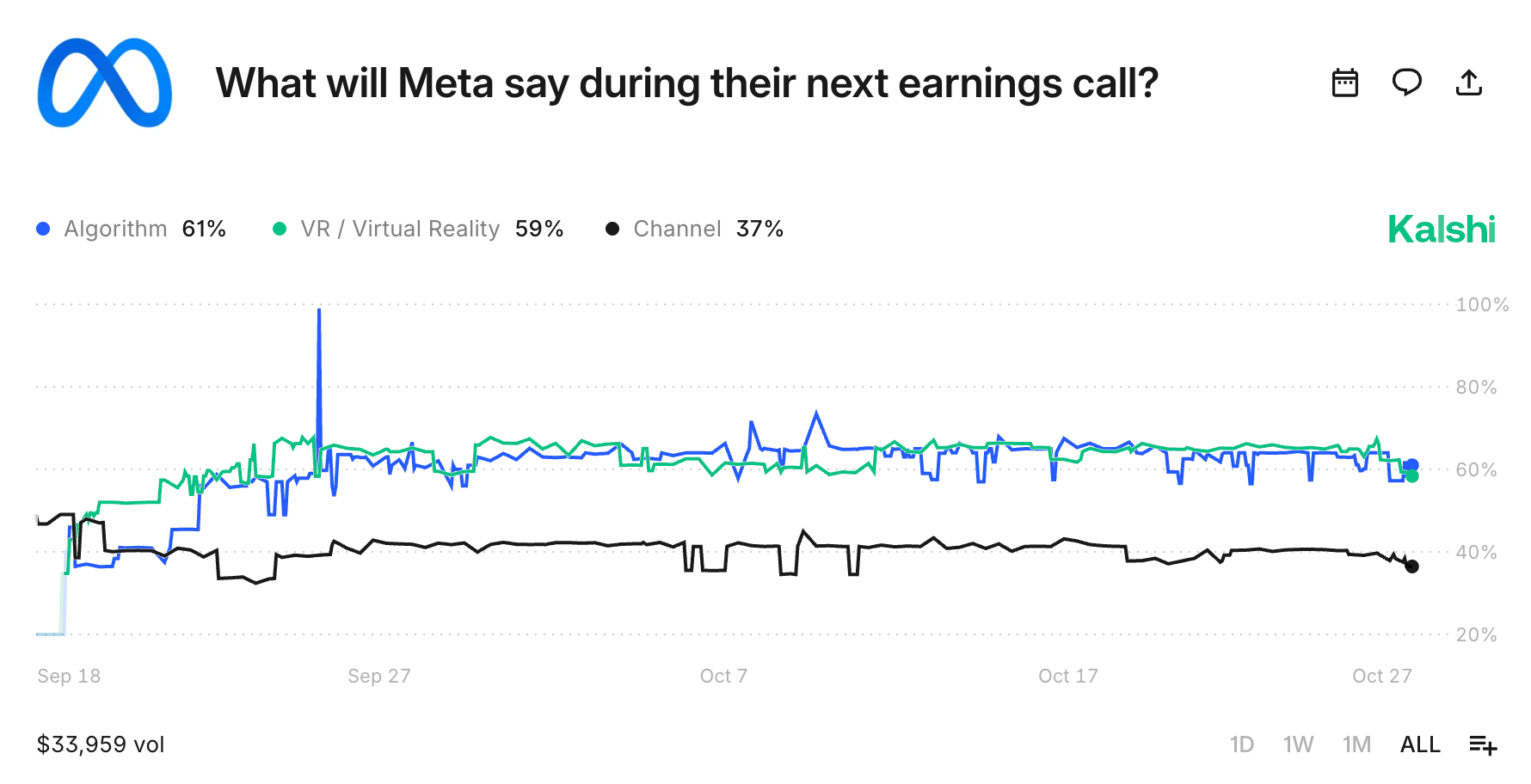

Prediction Markets

Private Dealmaking

Blackstone invested $706 million for a 10% stake in Federal Bank

Chainguard, an open-source security startup, raised $280 million

MD Integrations, a telehealth platform, raised $77 million

CoMind, a brain monitoring startup, raised $60 million

Dreamdata, a B2B marketing platform, raised $55 million

Simple Life, an AI health coach, raised $35 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

NEIGHBORHOOD WATCH

Real Estate Digest

Need help with real estate? Our official partner, Nest Seekers International, can help you buy, sell, rent, or invest, anywhere in the world. Get in touch here.

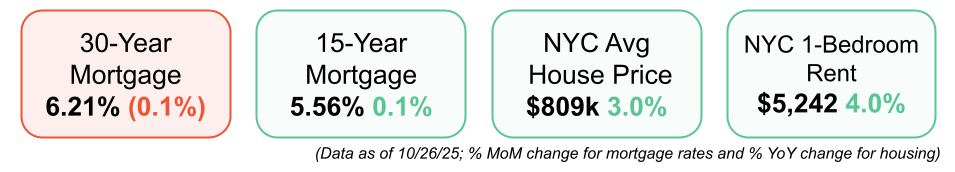

The 30-year fixed mortgage rate continued its downward slide this week, reaching its lowest level in more than a year. After topping 7% at the start of 2025, rates now sit roughly a full percentage point lower. The trend is keeping the refi boom alive, with refinancing making up more than half of all mortgage activity for the sixth week in a row.

Latest News

New Listings

Via Marina Piccola Capri, Italy: 3 Bed / 2 Bath – $3.8M

300 Biscayne Blvd Way #2004 Miami, FL: 4 Bed / 6 Bath - $4.9M

220 Eckford St Brooklyn, NY : 8 Bed / 5 Bath - $3.4M

9255 Doheny Rd Apt: 706 West Hollywood, CA : 2 Bed / 3 Bath - $2.8M

30 Breese Ln Southampton, NY: 5 Bed / 4 Bath – $4.5M

BOOK OF THE DAY

The First Minute

Description: A step-by-step guide that shows you how to start every business conversation, email or meeting with clarity and purpose. Fenning emphasizes the first minute—not just as an opener, but the critical moment when you frame your message, set expectations, and steer the interaction toward a clear goal.

Book Length: 128 pages

Ideal For: Professionals, team leads, managers, and anyone keen to improve workplace communication—especially those who feel meetings drag on without results.

“If you cannot deliver information in an organized way, you will have a hard time being respected professionally.”

DAILY VISUAL

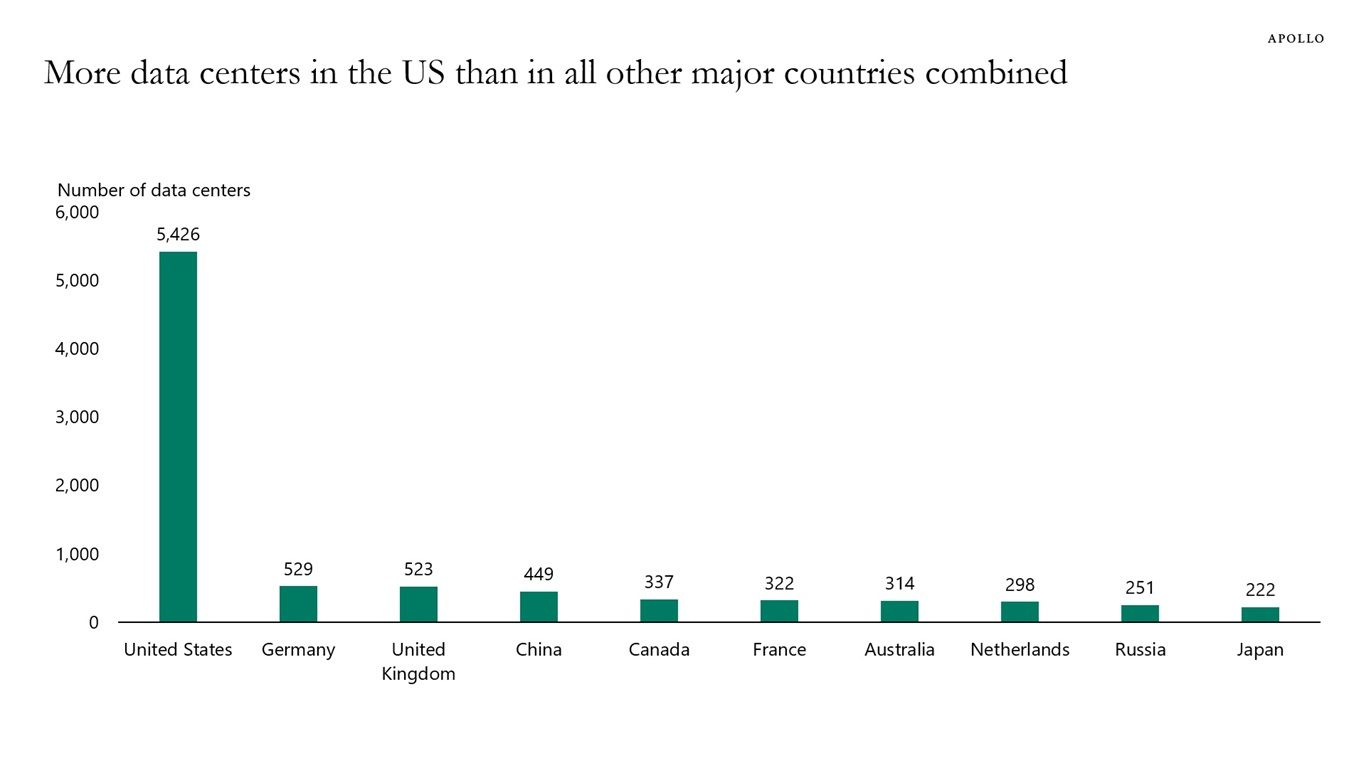

5,426 Data Centers in the US

Source: Apollo

PRESENTED BY BILL

Purchase. Pay. Done.

For growing companies, procurement workflows become bottlenecks fast. Manual PO approvals, invoice mismatches, and last-minute spend surprises drain finance teams and create compliance risks.

BILL Procurement integrates directly with Accounts Payable to automate your entire procure-to-pay process. Finance teams get pre-purchase spend controls, automated 2-way invoice matching, and complete visibility from request to reconciliation in one platform. With strict approval workflows and separation of duties built in, BILL reduces fraud risk while keeping business operations moving.

Over 475,000 businesses rely on BILL to streamline financial operations and maintain spend control as they scale.

Short Squeez readers get a $200 Amazon gift card when booking a demo.*

Please Support Our Partners!

DAILY ACUMEN

Friction

Growth doesn’t happen when things go smoothly; it happens when they don’t.

Friction is the universe’s way of asking, How badly do you want this?

We think progress should feel like flow, but most of it feels like resistance — the unread email, the failed project, the awkward silence in a meeting.

Friction doesn’t mean you’re off course; it means you’re interacting with the world.

A plane only lifts because air pushes back.

If you can stop seeing friction as failure and start treating it as feedback, life stops being a fight and becomes a form of sculpting.

Every rough edge reveals what you’re made of.

ENLIGHTENMENT

Short Squeez Picks

How working abroad accelerates professional development

What your heart rate should be when working out

11 of NYC’s best pizzerias, according to chefs

The gold prices paradox

Giving career advice to kids has never been harder

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply