- Short Squeez

- Posts

- 🍋 Blackstone vs. the Single Mom

🍋 Blackstone vs. the Single Mom

Plus: JPMorgan takes over Apple Card, cuts proxy advisers with AI, Discord files for a U.S. IPO, and what happens to Venezuela’s $60 billion Bitcoin stash?

Together With

“Capital is cheap when you don’t need it. Expensive when you do.” — Howard Marks

Good Morning! JPMorgan agreed to take over Apple’s credit-card portfolio from Goldman Sachs, paying a $1B+ discount on roughly $20B in balances. JPMorgan also cut ties with proxy advisers, launching an AI-powered internal voting platform.

President Trump said he will not allow defense companies to pay dividends or buy back stock until they address his concerns. Japan’s bond market is bracing for another volatile year. Venezuela may be sitting on a $60B Bitcoin stash.

Plus: Discord filed for U.S. IPO, Anthropic raised another $10B at a $350B valuation, Google overtook Apple in market cap for the first time since 2019, and why you’re probably underestimated at work.

Try FRE, the nicotine pouch designed for the high performer; flavorful, powerful, and spit-free.

SQUEEZ OF THE DAY

Blackstone vs. the Single Mom

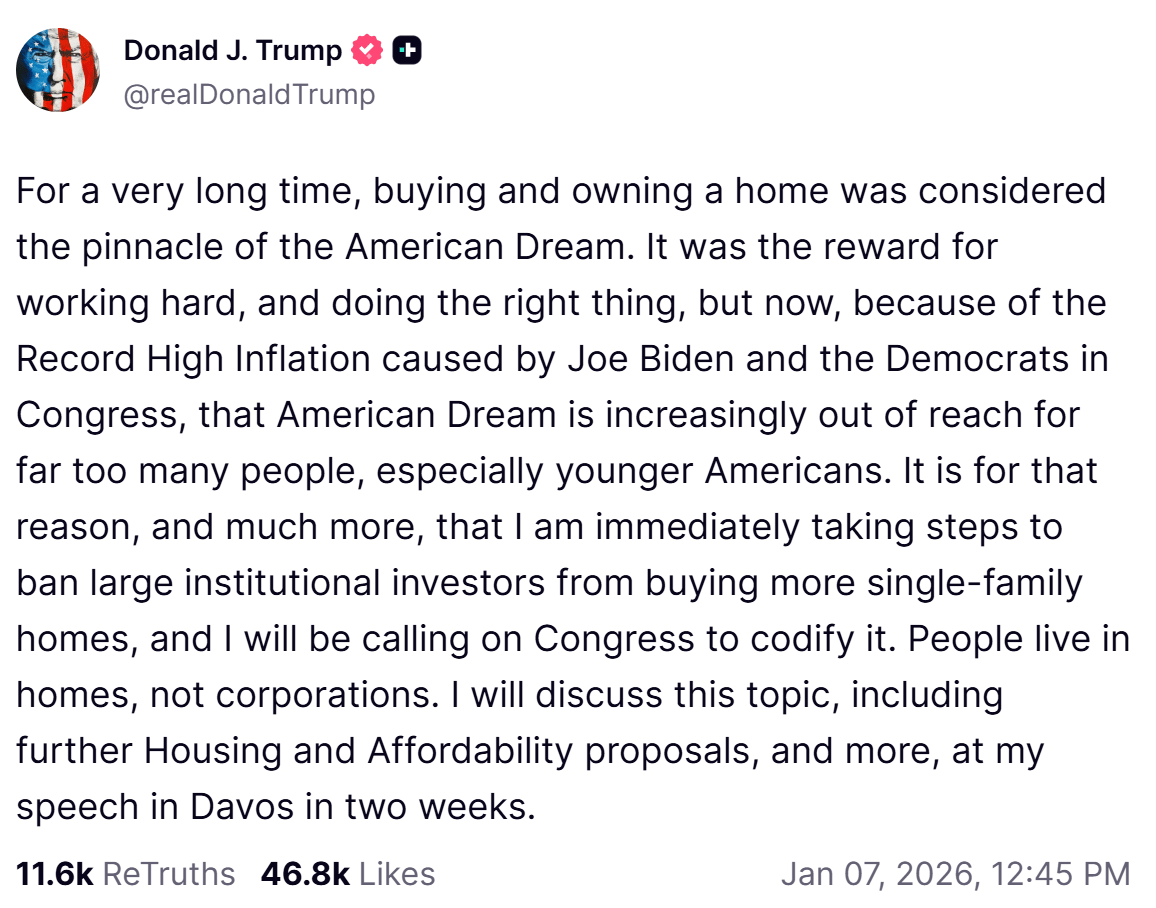

If there are three certainties in life, it’s death, taxes, and Blackstone outbidding a single mom for a single-family home. Now, President Trump wants to break that third rule.

On Truth Social, Trump said he plans to block large institutional investors from buying single-family homes, arguing that “people live in homes, not corporations.” The move would directly target Wall Street giants like Blackstone and Cerberus that have spent the past decade building large single-family rental portfolios.

Blackstone shares fell as much as 9% before closing down ~6%. Invitation Homes dropped ~6%, housing-linked stocks sold off, and REIT bonds widened as investors repriced regulatory risk.

Housing affordability has become a political third rail, with the median age of first-time homebuyers now at a record 40. While investors bought roughly 30% of homes last year, most of that activity came from small landlords.

In a January 2025 note, Blackstone said institutional purchases of single-family homes have fallen about 90% since 2022 and argued housing inflation is being driven by supply shortages, not Wall Street landlords.

According to the FT, institutional investors overall own just 0.5% of the ~106 million single-family homes in the U.S.

Whether this ban survives Congress is unclear, with legislative approval required and heavy pushback expected from Wall Street. Trump says more details are coming later this month.

Takeaway: When housing gets unaffordable, Wall Street is always an easy target. Even if this proposal stalls, single-family rentals are now a political flashpoint, and for private equity, regulatory risk has officially entered the underwriting model. Looks like Steve Schwarzman won’t be funding a Trump third term!

PRESENTED BY FRE

Performance for the Clutch Moments

Traditional nicotine pouches cluster around 3mg to 6mg. FRE identified a segment of professionals requiring more options for the high pressure moments.

FRE provides one of the widest strength ranges available: 3mg to 15mg, with a pre-primed tech that activates on contact. Each can contains 20 pouches versus a typical 15, offering more consistent usage across long workdays.

Tobacco-free, spit-free, and engineered for professionals who need results during IC marathons, board presentations, and 2am model builds.

HEADLINES

Top Reads

JPMorgan Chase reaches deal to become Apple credit card issuer (CNBC)

JPMorgan cuts all ties with proxy advisers in industry first (WSJ)

Chat platform Discord files confidentially for US IPO (TC)

Venezuela could be sitting on a big Bitcoin stash (CNBC)

World's worst bond market faces another big supply shock (YF)

Trump says he will not permit dividends, stock buybacks for defense companies (CNBC)

Alphabet’s market cap surpasses Apple’s for first time since 2019 (CNBC)

Anthropic signs term sheet for $10 billion funding round at $350 billion valuation (CNBC)

Carlyle sees good year for private equity deals after tricky 2025 (BB)

Ventyx stock jumps on Lilly’s $1.2 billion buyout (YF)

Jefferies profit rises on dealmaking, takes $30M loss linked to First Brands (BB)

Venezuela will ship sanctioned oil to U.S. indefinitely, sources say (CNBC)

ADP data shows employers added 41,000 jobs in December (YF)

Billionaires make strategic moves out of California ahead of proposed wealth tax (Fox)

Berkshire Hathaway CEO Abel’s salary set at $25 million, topping Buffett (WSJ)

Goldman Sachs hires ex-Qatalyst banker Brian Cayne to co-lead software (TI)

KKR to invest $1.5B into European data center business (FT)

GameStop unveils $35B pay pan for CEO Ryan Cohen (YF)

CAPITAL PULSE

Markets Rundown

Market Update

U.S. equities ended mixed: Nasdaq advanced while the Dow slipped after touching fresh record highs

Treasury yields fell as bonds rallied on softer German retail sales, easing eurozone inflation, and lower U.S. job openings

Oil declined after the administration signaled Venezuela would ship 30–50M barrels of sanctioned oil to the U.S.

Headlines pressured select industries: defense stocks fell after threats to pause capital returns, and asset managers dipped following talk of a ban on institutional single-family home purchases

Precious metals pulled back after a strong run, with both gold and silver lower on the day

Sector Trends

Small-caps and value continue to outperform early in 2026 amid a pro-cyclical rally

Market resilience persists despite geopolitical noise, with indexes recently hitting fresh highs

Earnings momentum is beginning to broaden beyond mega-cap tech, supporting cyclical leadership

Economic Data Highlights

ADP private payrolls rose 41,000 in December, consistent with expectations and signaling tentative stabilization

Job gains were led by education and health services, with small firms (<50 employees) adding jobs for the first time in four months

Friday’s December employment report remains the key data point for markets and the Fed

Unemployment remains elevated at 4.6%, but for constructive reasons as labor-force participation improves

Looking Ahead

We continue to see a low-hiring, low-firing labor environment, with job gains likely firming into the 50,000–100,000 range

Lower immigration and tighter labor supply should keep unemployment near ~4.5% in 2026

Despite geopolitical turbulence, the macro outlook remains stable, supporting ongoing strength in equities and further market broadening

Movers & Shakers

(+) Ventyx Biosciences ($VTYX) +37% after Eli Lilly nears a $1.2B deal for the oral therapies company.

(+) GameStop ($GME) +3% because the company announced a $35B pay plan for CEO Ryan Cohen.

(–) Blackstone ($BX) -6% after Trump wants to block large institutional investors from buying single-family homes.

Prediction Markets

Unemployment numbers get announced tomorrow at 8:30am

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

Hg agreed to acquire OneStream for $6.4 billion

KKR is investing an additional $1.5 billion into Global Technical Realty

Mobileye agreed to acquire Mentee Robotics for $900 million

Soley Therapeutics, an oncology biotechnology company, raised $200 million

LMArena, an artificial intelligence model evaluation platform, raised $150 million

Photonic, a quantum computing company, raised $130 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Guinness

Description: A sweeping, inside portrait of the Guinness dynasty, told by the current head of the family. Arthur Edward Guinness traces four generations of ambition, rivalry, expansion, and reinvention, revealing how a modest Dublin brewery grew into one of the most famous brands on the planet. Blending family drama with business strategy, it shows how legacy, personality, and bold decisions shaped the world’s most iconic stout.

Book Length: 312 pages

Release Date: October 21, 2025

Ideal For: History buffs, brand builders, business strategists, and anyone fascinated by how family empires rise, fracture, and ultimately endure.

“Great brands aren’t just built, they’re inherited, contested, and fought for.”

DAILY VISUAL

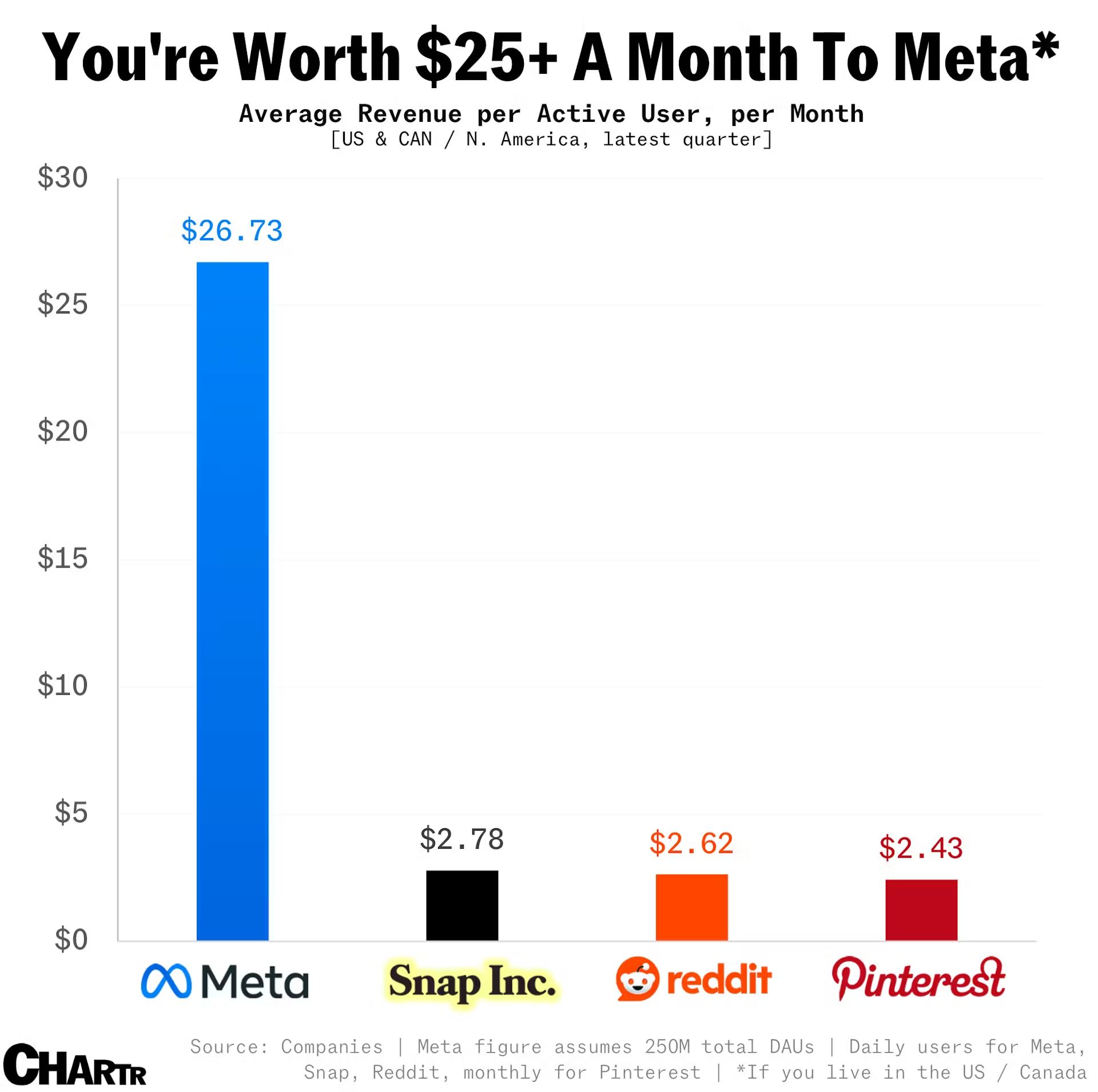

How Much Are You Worth to Zuck?

Source: Chartr

PRESENTED BY MOSAIC

M&A Word of the Day: Dividend Recapitalizations

In a world where exits are becoming more challenging, more and more sponsors are turning to dividend recaps to improve returns while waiting for equity markets and M&A to pick up.

Dividend recaps allow a sponsor to raise additional debt at the portfolio company and use some (or all) of those proceeds to pay a cash dividend to the Sponsor. This improves IRR as it brings the returns forward due to the time value of money.

Additionally, this de-risks the investments as there is a benefit to taking some money off the table early.

Mosaic’s modeling tool can help build dividend recaps seamlessly into your operating models to assess if you could benefit from a dividend recap while markets pick back up.

DAILY ACUMEN

Boredom Tolerance

In a famous study, people were placed alone in a room for 15 minutes with nothing but their thoughts. They could press a button to give themselves a mild electric shock.

Two-thirds of men and one-quarter of women chose to shock themselves rather than sit quietly. We've lost the ability to be alone with our thoughts, and it's destroying us.

Blaise Pascal wrote, "All of humanity's problems stem from man's inability to sit quietly in a room alone."

The moment we feel boredom or discomfort, we reach for our phones. Waiting in line? Scroll. Stuck in traffic? Podcast. Awkward silence? Check Instagram. We're terrified of our own thoughts.

But boredom isn't empty, it's where creativity lives.

Bill Gates takes "Think Weeks" with no distractions. His biggest insights come from these periods.

Your constant stimulation isn't making you smarter or happier, it's making you dependent and anxious.

Practice boredom tolerance. Sit for five minutes without stimulus. Walk without headphones. Eat a meal without your phone. Feel the discomfort and stay with it.

ENLIGHTENMENT

Short Squeez Picks

The joy of running

Why you’re underestimated at work

We are not as wealthy as we thought we were

Compulsive behaviors may stem from too much (misguided) self-control

10 signs someone is far more intelligent than they let on

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply