- Short Squeez

- Posts

- 🍋 Barbarians at the BnB

🍋 Barbarians at the BnB

Why your next Airbnb host might be a private equity firm, plus Goldman feeling bullish about IPOs.

Together With

"You are never too smart to be confused.” — Bill Gates

Good Morning! Goldman is bullish on IPOs - it sees the market reopening if the Fed slashes rates next year. And that’s great news for fashion brands - Alo Yoga hired Moelis to raise capital at a $10 billion valuation, and Shein is gunning for a $90 billion IPO valuation. KKR and Carlyle released earnings, and they’re all-in on private credit as LBOs dry up. The Fed thinks the U.S. has two million retirees too many. And Vivid Seats bought Vegas.com for $240 million.

Today’s edition is brought to you by hear.com - the device ushering in a new era of hearing clarity.

SQUEEZ OF THE DAY

Barbarians at the BnB

Your next Airbnb host could be a…private equity firm.

TPG is one of the largest megafunds in the game, with $135 billion in assets under management. Their latest bet is snatching up single-family homes and turning them into your next Airbnb hotspot.

Private equity firms gobbling up single-family homes isn't exactly new. But what sets TPG apart is that they're specifically doing it to become short-term rental landlords.

Texas-based TPG sees massive opportunity in Florida. Since the pandemic, travelers have mixed business with pleasure, extending their stays by days or even weeks. And they don’t want to stay in a cramped hotel suite.

Execs at TPG are betting big on what they call "bleisure" travelers - flexible remote workers and families who want space, a kitchen and privacy.

Takeaway: Right now, TPG says they’re just testing it out in Florida, but could be open to expanding its market reach. If other big investment firms decide to copy this playbook and start renting out homes nightly in major tourist markets, it could disrupt the hotel industry even further. They're already battling it out with the Airbnb and Vrbo crew, and now private equity is joining the party.

CAPITAL PULSE

Markets Rundown

Stocks closed higher, scoring their longest win streak in 2 years.

Movers & Shakers

(+) Planet Fitness ($PLNT) +13% after the gym chain hiked its forecast because of a boost in membership and store growth.

(+) Tripadvisor ($TRIP) +11% after beating profit estimates, selling more travel packages.

(–) Re/Max ($RMAX) -9% after Morgan Stanley downgraded the real estate company.

Private Dealmaking

Vivid Seats bought Vegas.com, a Las Vegas entertainment website, for $240 million

Better Collective bought Playmaker Capital for $188 million

Enable, a rebate management platform, raised $120 million

May Mobility, a micro-transit company, raised $105 million

Xpressbees, an e-commerce logistics firm, raised $80 million

Volante Technologies, a cloud payments company, raised $66 million

SPONSORED BY HEAR.COM

A New Standard For Hearing Clarity

Discover unparalleled speech clarity with advanced, state-of-the-art hearing aids. Immerse yourself fully in crystal-clear sound, with features like Bluetooth and smartphone connectivity.

Thanks to the world's first dual processing system, you can now enjoy clear speech with minimum background distractions in even the noisiest environments.

Take comfort in knowing that you're choosing a hearing aid that people genuinely enjoy wearing.

HEADLINES

Top Reads

Carlyle CEO says firm working with urgency to grow, cut costs (YF)

IBM debuts $500 million enterprise AI venture fund (Axios)

Why the U.S. won’t change physical cash (CNBC)

Why higher U.S. unemployment is a worry (Axios)

Frustrations over housing market bleed into Americans’ view of economy (YF)

Bridgewater had believability issues (BB)

Americans turn to credit cards for everyday expenses, balances jump to $1.08 trillion (CNBC)

Apple delays work on next year’s iPhone, Mac software (YF)

A $5B recipe for success in private equity M&A (BB)

The price of money is going up, and it’s not just because of the Fed (YF)

BOOK OF THE DAY

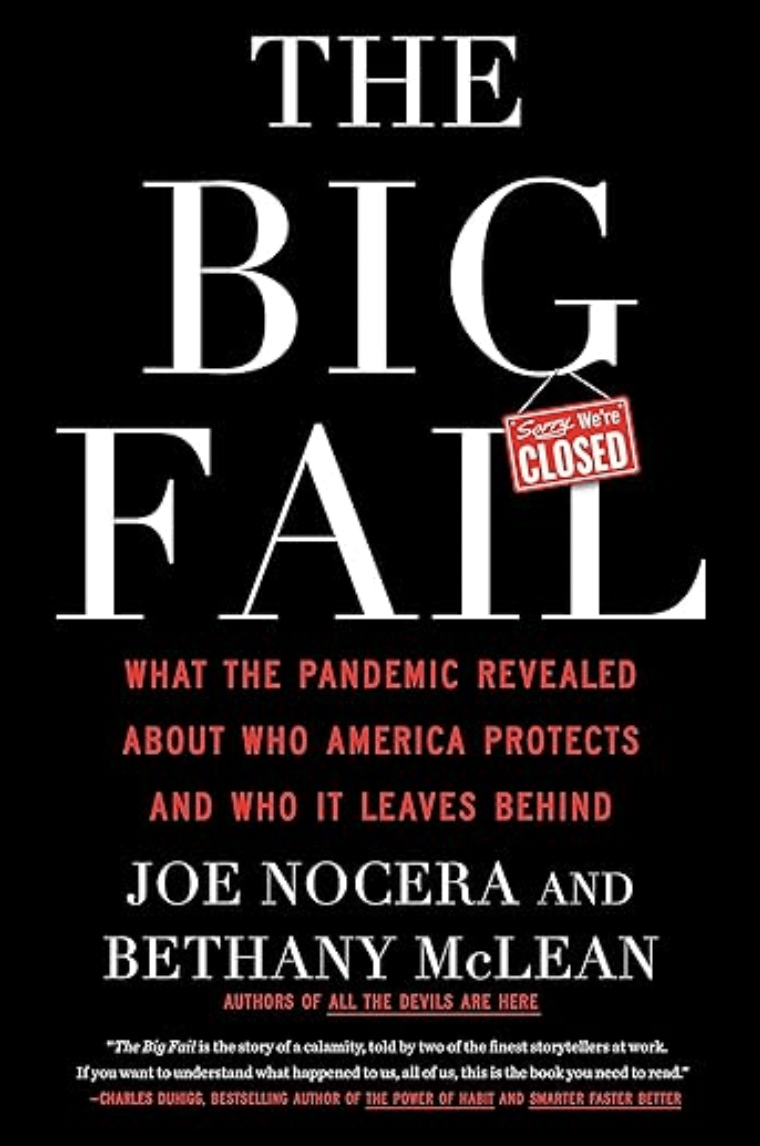

The Big Fail

In 2020, the novel coronavirus pandemic made it painfully clear that the U.S. could not adequately protect its citizens. Millions of Americans suffered—and over a million died—in less than two years, while government officials blundered; prize-winning economists overlooked devastating trade-offs; and elites escaped to isolated retreats, unaffected by and even profiting from the pandemic.

Why and how did America, in a catastrophically enormous failure, become the world leader in COVID deaths? In this page-turning economic, political, and financial history, veteran journalists Bethany McLean and Joe Nocera offer fresh and provocative answers.

With laser-sharp analysis and deep sourcing, they investigate both what really happened when governments ran out of PPE due to snarled supply chains and the shock to the financial system when the world's biggest economy stumbled.

In the tradition of the authors’ previous landmark exposés, The Big Fail is an expansive, insightful account on what the pandemic did to the economy and how American capitalism has jumped the rails—and is essential reading to understand where we’re going next.

“First-rate reportage with astute big-picture analysis.”

ENLIGHTENMENT

Short Squeez Picks

11 little mindset changes anyone can make

Google’s CEO on hindsight and avoiding regret

6 universal practices of great managers

New York is too expensive

Inside James Comey’s bizarre $7 million job at a hedge fund

DAILY VISUAL

Public EV Charging Stations per 100k Residents

Source: Axios

SPONSORED BY PERCENT

Institutional Investors Have Been Loading Up On This Investment For Years

High yield, income generation, diversification and greater resistance to inflation and volatility — are just some of the factors that have attracted investors to private credit in recent years.

What are they? Private credit are loans which are negotiated privately and are not originated by banks. They can command much higher interest rates and offer largely uncorrelated risk profiles.

Where can you invest? Percent is the only platform exclusively dedicated to private credit, making it available to everyday investors. Accredited investors can get access to:

APY: Average of 18.76% as of September 30, 2023

Welcome bonus: Earn up to $500 bonus on your first investment

Shorter-term investments: Some offering liquidity after just one month

Income generating: Potential for passive income, often monthly, throughout the lifetime of the deal

Visit Percent to create a free account and see all current offerings available.

DAILY ACUMEN

Success

Charlie Munger on achieving success:

It's so simple: you spend less than you earn.

Invest shrewdly.

Avoid toxic people and toxic activities.

Try to keep learning all your life.

And do a lot of deferred gratification.

If you do all those things, you are almost certain to succeed.

And if you don't, you'll need a lot of luck.

And you don't want to need a lot of luck.

You want to go into a game where you're very likely to win without having any unusual luck.

MEME-A-PALOOZA

Memes of the Day

What'd you think of today's email? |

Reply