- Short Squeez

- Posts

- 🍋 Amazon’s $50B AI Insurance Policy

🍋 Amazon’s $50B AI Insurance Policy

Plus: software stocks slide into a bear market as Microsoft loses $357B, Apple surges on iPhone demand, and OpenAI races toward an IPO.

Together With

“The deal environment has reached escape velocity." — Blackstone president Jon Gray

Good Morning! Software stocks slid into a bear market on fears AI could crush license demand. Microsoft lost $357B in its worst drop since 2020, while Apple jumped 16% on surging iPhone sales.

The U.S. trade deficit saw its biggest jump in 34 years as AI-related imports soared. Gold pulled back to $5,300 and silver slipped from record highs as the metals rally entered what some call a “dangerous phase.” And a man allegedly posed as an FBI agent in an attempt to free Luigi Mangione from jail with a pizza cutter.

Plus: SpaceX is weighing a merger with Tesla or xAI, Lululemon blamed customers again for its see-through tights, and OpenAI is eyeing a Q4 IPO to beat Anthropic to market.

One of the fastest growing companies ever has a new product, Ramp Sheets. Build your next model in minutes.

SQUEEZ OF THE DAY

Amazon’s $50 Billion AI Insurance Policy

It was a big week for Amazon, with the company announcing plans to lay off tens of thousands of employees, as well as close most Amazon Fresh and Amazon Go stores. But make no mistake, the company isn’t retreating, it’s gearing up to chase the infamous circular AI money trades.

According to a new report, Amazon is weighing up to a $50 billion investment in OpenAI. OpenAI is reportedly to raise fresh funding, this time as much as $100 billion at up to a $830 billion valuation.

An Amazon investment would likely come with strings attached. In exchange for writing a multibillion-dollar check, Amazon would expect OpenAI to buy its in-house AI chips and cloud capacity.

In other words, it’s another circular trade… Amazon funds OpenAI, and OpenAI turns around and spends a chunk of that capital right back on Amazon’s infrastructure.

Amazon is also one of Anthropic’s biggest backers, having made an early $8 billion initial investment in 2024 and building out the data center capacity to support it. Anthropic is a direct competitor to OpenAI. But Amazon doesn’t want to pick a single winner in the AI race, it wants to be the infrastructure layer beneath all of them.

Whether it’s Anthropic, OpenAI, or the next breakout model, Amazon wants to sell the chips, the cloud, and the power that keeps the whole system running.

And while Amazon is cutting tens of thousands of jobs and pulling back from lower-return retail bets, it is still considering one of the largest AI investments ever proposed. For Amazon, it’s capital reallocation in real time, and the company is pruning the slow growers to double down on the platform shift it believes will define the next decade.

Takeaway: Amazon is basically buying insurance against missing the platform shift of the decade. But the bigger question is whether OpenAI is really building the future of tech, or if the startup is quietly becoming the most expensive balance-sheet experiment Silicon Valley has ever run.

PRESENTED BY RAMP SHEETS

From PDF to 5-Year Projection in 60 seconds

It’s 2am and you’re still in the trenches (building an operating model in Excel), hoping you can steal a couple hours of sleep before your 9am call.

It doesn’t have to be that way...

Ramp Sheets builds fully formulated, editable spreadsheets. Stop manually entering data from PPT and PDFs. Upload any file (PDF, CSV, Excel), and watch the AI agent:

Model: Upload a deck / CIM and receive a 5-year operating model with revenue build, margin expansion, and EBITDA projections. (Save 4+ hours)

Research: Request comps and see revenue/EBITDA multiples and pricing tiers pulled automatically. (Save 2+ hours)

Clean: Convert raw vendor exports into structured spend analyses, no manual formulas required. (Save 90+ minutes)

Over 10,000 analysts are already automating their work. You’re still doing it manually.

HEADLINES

Top Reads

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10% (CNBC)

Microsoft lost $357 billion in market cap as stock plunged most since 2020 (CNBC)

Apple sales surge 16% on ‘staggering’ iPhone demand (CNBC)

US trade deficit widens by the most in nearly 34 years in November (YF)

Gold hovers near $5,400, silver steadies as precious metals rally enters 'dangerous phase' (YF)

Luigi Mangione fan posed as FBI agent in botched bid to break accused CEO killer out of NYC jail (NYP)

Elon Musk’s SpaceX is said to consider merger with Tesla or xAI (BB)

Lululemon blames customers again after see-through tights fiasco (BB)

OpenAI plans fourth-quarter IPO in race to beat Anthropic to market (WSJ)

Meta soars after proving AI spend while Microsoft struggles to please (CNBC)

Apartment rents just dropped to the lowest level in 4 years (CNBC)

How investment firms of the ultra-rich partner with PE funds to find top deals and save on fees (CNBC)

Elon Musk says Tesla ending Models S and X production, converting Fremont factory lines to make Optimus robots (CNBC)

World’s largest sovereign wealth fund made $247 billion in 2025, driven by tech and banking rally (CNBC)

How elite college finance clubs pave the way to Wall Street (FT)

Meta's Mark Zuckerberg gets green light from Wall Street to keep pouring money into AI (CNBC)

Blackstone’s Gray sees AI disrupting industries as biggest risk (BB)

First Brands founder indicted on fraud, conspiracy charges (BB)

Oracle’s value is cut in half from 2025 peak as AI caution rises (BB)

Blackstone in talks to become New World’s top shareholder (BB)

What Starbucks’s new CEO has changed, and what he says is next on his list (WSJ)

Ares inks $1.6 billion private loan to support Evermark deal (BB)

CAPITAL PULSE

Markets Rundown

Market Update

U.S. equities finished lower as technology weakened following mixed Magnificent 7 earnings

Microsoft fell sharply on higher AI spending and slowing cloud growth, while Meta surged on a stronger revenue outlook

Geopolitical risk tied to potential U.S. military action against Iran weighed on sentiment

Treasury yields were relatively steady; broader risk appetite softened

WTI crude jumped 3%+ to ~$65 on Middle East supply concerns

Gold briefly surged above $5,500/oz and silver +6% before paring gains

Sector Trends

Technology lagged on earnings dispersion and AI spending scrutiny

Energy outperformed on rising oil prices

Market leadership continues to broaden beyond mega cap tech, as growth slows in tech while other sectors accelerate

Tesla & AI

Tesla highlighted strategic focus on autonomous driving and robotics

Investors are rewarding companies that can convert AI investment into earnings, while penalizing unclear monetization paths

Fed & Macro Outlook

The Fed held rates at 3.5% to 3.75%, signaling an extended pause

The statement cited solid economic growth and a stabilizing labor market

Inflation pressures appear to be easing gradually, reducing urgency for near term cuts

Base case remains one to two rate cuts later in 2026 as tariff related inflation fades

A prolonged pause could weigh on the dollar and help anchor the 10 year Treasury in the upper half of the 4% to 5% range

Big Picture

Equities remain supported by earnings growth, solid economic momentum, and accommodative financial conditions

However, high expectations, AI investment dispersion, and geopolitical risk may drive periodic volatility

Movers & Shakers

(+) Royal Caribbean ($RCL) +19% after the cruise line announced strong earnings

(+) Southwest Airlines ($LUV) +19% because the airline projects strong profit.

(–) Microsoft ($MSFT) -10% after investors worry about AI spending.

Prediction Markets

Private Dealmaking

VSE, a provider of aftermarket distribution and maintenance services for aviation and defense, bought Precision Aviation Group for $2 billion

Decagon, an AI concierge startup, raised $250 million

Terra Energy, a company selling home solar through short-term subscription models, raised $105 million

Big Shot Pictures, an animation studio founded by former Paramount Global co-CEO Brian Robbins, raised $100 million

Sage Geosystems, a geothermal energy company developing subsurface energy storage and power systems, raised $97 million

Rogo, a developer of AI agents for dealmakers and investors, raised $75 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

The Bookie

Description: A raw, fast moving insider account of the underground sports betting world, told through the eyes of a veteran bookmaker who has taken action from gangsters, celebrities, professional gamblers, and everyday degenerates. Knish breaks down how betting lines are made, how sharp money moves markets, how bookies manage risk, and why discipline and psychology matter more than picks. It is part crime story, part gambling memoir, and part strategy manual for understanding how the real betting economy works.

Book Length: 304 pages

Release Date: March 19, 2024

Ideal For: Sports bettors, gamblers, finance minds, risk takers, and anyone fascinated by odds making, market psychology, and high pressure decision making.

“The real edge is not picking winners. It is managing risk when the action never stops.”

DAILY VISUAL

Puma is Cooked

Source: Chartr

PRESENTED BY ENDEX

GPT-6 expected Q1 2026. What Will New Launch Mean For Finance?

December’s GPT 5.2 launch brought significant improvements to the LLMs. Analysts, associates, and C-Suites are wondering how close to a true “AI analyst” will we come to in 2026.

Endex, OpenAI’s Excel agent, is already capable of generalist work such as building DCFs, comps, and sensitivity analysis.

Investment banks and PE firms are racing to bring AI agents into their workflows, as they prepare for future LLM breakthroughs.

To request access to Endex, click here.

DAILY ACUMEN

Principal-Agent Problems

You're creating principal-agent problems within yourself.

Your present self is the agent. Your future self is the principal. Present you wants the donut. Future you wanted to be healthy. Present you hits snooze. Future you wanted to be productive.

This isn't weakness. It's misaligned incentives. Present you bears zero cost of bad decisions. Future you pays entirely. The person scrolling Instagram at midnight isn't the person exhausted tomorrow morning.

Remember, you're not one person. You're a principal negotiating with an often-rebellious agent.

ENLIGHTENMENT

Short Squeez Picks

How to deal with a bad bonus

Should you be yourself at work?

Why coasters are overrated

How to tell if it’s time for a career pivot

Why mental fitness is leadership’s next frontier

MEME-A-PALOOZA

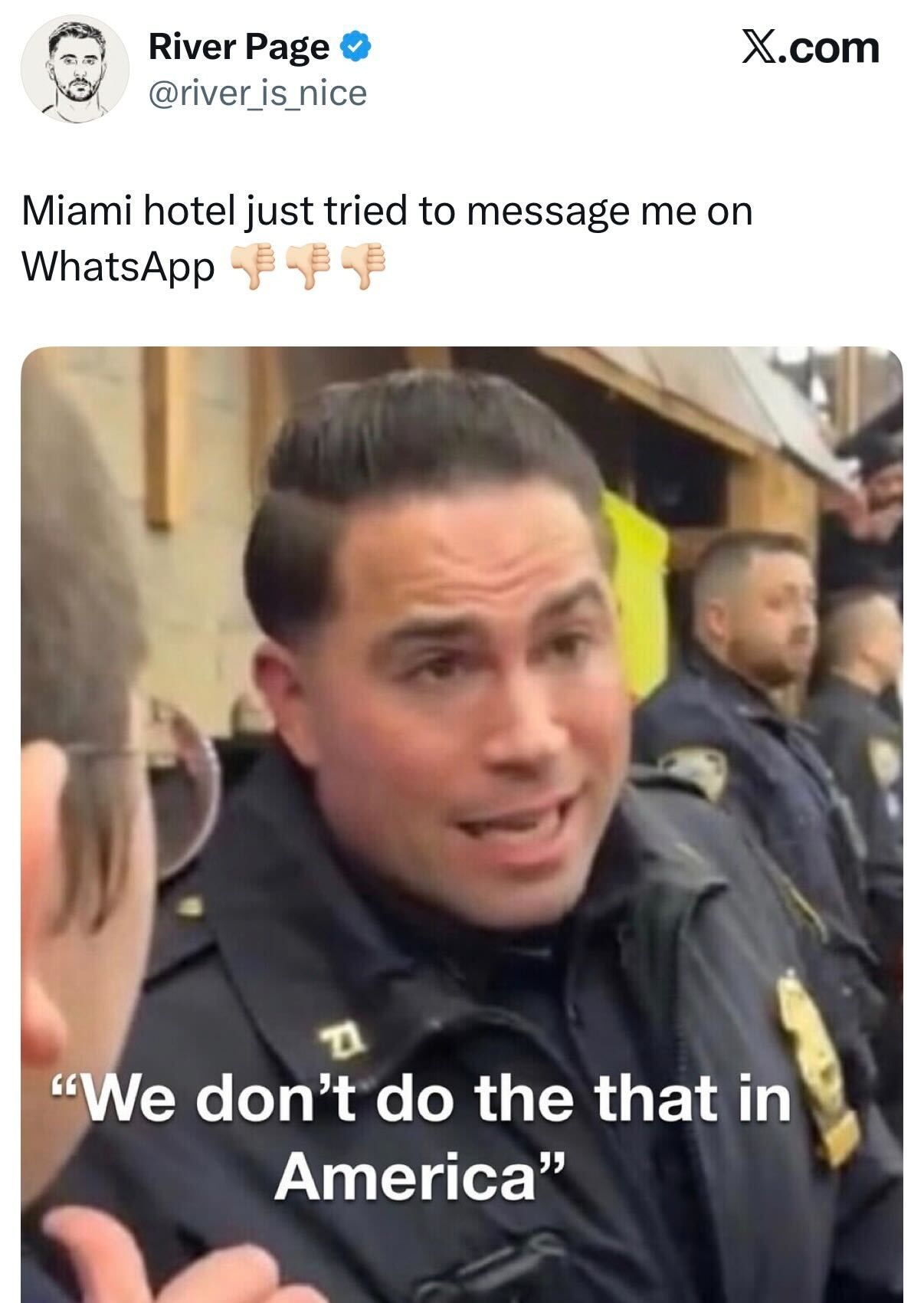

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply