- Short Squeez

- Posts

- 🍋 AI Is Writing Wall Street’s Homework

🍋 AI Is Writing Wall Street’s Homework

Plus: A “tremendous backlog” of big M&A deals, why Bain Capital is avoiding data center investments, and NYC now has a 12-minute helicopter to shuttle suburbanites.

Together With

“I’m hoping he’s the good one. That will be important to the future of New York.” — Jamie Dimon (on Zohran Mamdani)

Good Morning! Goldman CEO David Solomon says there’s a “tremendous backlog” of large M&A deals set for 2026 and 2027. One-third of JPMorgan’s billionaire clients are investing in sports teams, calling it their top specialty asset class. Bain Capital, meanwhile, is steering clear of U.S. data centers despite the boom.

Wall Street pros are set for their biggest bonus bump since 2021. Wealthy investors are expected to drive a $32 trillion surge in alternative assets. And Nvidia’s Jensen Huang says China is “on track to win the AI race.”

Plus: Jamie Dimon hopes Mamdani calls Detroit’s mayor for advice, and NYC now has a 12-minute helicopter to shuttle suburbanites from Manhattan to Westchester Airport.

Coverd lets users play mini-games to win back up to 100% of their purchases. The app has already paid out $2 million. Download Coverd today.

SQUEEZ OF THE DAY

AI Is Writing Wall Street’s Homework

Earnings season is here, and AI is quietly taking over the back office. What started as a tool to crunch numbers has become a co-author in earnings reports. Public companies are now letting generative AI write parts of their financial reports, the most regulated documents in corporate America.

ON Semiconductor uses AI to generate entire sections of its quarterly filings. It began as an experiment with a few paragraphs, but now the company’s Management’s Discussion and Analysis, the most narrative-heavy part of any 10-Q, is almost fully AI-written. “It is much better than humans at capturing everything in your earnings and reflecting it back,” said CFO Thad Trent.

Hewlett-Packard Enterprise is close behind. The company’s CFO says that the company’s in-house language model will soon draft both the financial and non-financial sections of its filings. HPE already uses AI to anticipate analyst questions and evaluate executive tone, and that “it is much better than humans at that.”

Goldman CEO David Solomon predicts that 95% of an IPO prospectus could now be generated by AI “in minutes.” Accounting firms are testing the same tools for audits. Regulators, meanwhile, are watching to see how far automation can go before human oversight becomes little more than ceremonial.

This isn’t just a workflow upgrade; it’s a shift in how markets get information. Equity analysts, hedge funds, and quant desks mine corporate filings for tone and sentiment. If AI starts writing them, the market’s feedback loop could begin echoing itself. The danger isn’t a bad number. It’s the loss of nuance, the subtle language that signals when management is confident, cautious, or hiding something.

The upside is clear: faster reports, lower costs, more consistency. The risk is harder to price. AI-generated writing can sound robotic and inauthentic, which could erode investor trust over time. As one accounting professor put it, “If everything reads like ChatGPT, the market may stop believing management at all.”

Takeaway: AI has entered the boardroom, and it’s writing the first drafts of Wall Street’s most trusted documents. Humans still sign off, but if oversight becomes a spell-check, the next market correction might start with a glitch. And if you see a ton of em dashes, it might be time to short.

PRESENTED BY COVERD

How Coverd Is Rethinking Personal Finance With Interactive Rewards

Coverd combines spending insights with reward-based mini-games. Users track purchases, play for cashback, and apply winnings toward bills or future expenses. The platform has returned $2 million to early users.

Built by former traders Albert Wang and Eric Xu, Coverd flips the traditional rewards model. Instead of earning fixed percentages that accumulate slowly, users get variable returns through gameplay; up to 100% of purchase amounts back.

The Coverd Card launches early 2026 with the same interactive reward structure built into every transaction.

Please Support Our Partners!

HEADLINES

Top Reads

Goldman CEO says there’s a “tremendous backlog” of large M&A deals (BB)

JPMorgan’s billionaire clients want sports teams more than fine art (YF)

Bain Capital steers clear of U.S. data-center boom (BB)

Wall Street pros to see biggest bonus bump since 2021 (YF)

Wealthy investors expected to drive $32 trillion boom in alternatives (CNBC)

Jamie Dimon hopes Mamdani calls Detroit mayor for advice (CNN)

Nvidia CEO says China on track "to win the AI race" (Axios)

NYC gets 12-minute helicopter for suburbanites avoiding gridlock (BB)

Apple nears deal to pay Google roughly $1 billion a year for Siri AI model (BB)

Big investors clap back against private funds for individuals (WSJ)

Hedge fund wannabes are opting to start with just one client (BB)

What is Mamdani’s millionaire tax and how would it work? (WSJ)

Bank surveys reveal curious quirks among family office priorities (BB)

Blackstone and Carlyle must start selling more assets “at whatever price” (BB)

Private payrolls rise by 42,000 in October, easing labor-market slowdown fears (CNBC)

The outperforming real estate sector hiding in plain sight (CNBC)

Sequoia Capital leader steps down from venture giant (WSJ)

Supreme Court questions legality of Trump’s sweeping tariff powers (YF)

CAPITAL PULSE

Markets Rundown

Market Update

Stocks closed higher after upbeat ADP private-sector job growth and an ISM Services PMI reading that hit an eight-month high.

Services activity strengthened, with new orders, employment, and business activity all improving.

ISM prices paid jumped to the highest since 2022, raising inflation concerns and pushing Treasury yields higher.

Europe gained on stronger PMI data, while Asia slipped after China signaled new restrictions requiring government-funded data centers to use only Chinese AI chips.

10-year Treasury yields moved higher, reflecting hotter prices data.

Economic Data Highlights

ADP private payrolls rose 42,000, topping expectations and breaking a two-month streak of negative job growth.

Job gains were concentrated among large firms, while smaller businesses saw modest declines.

Year-to-date ADP payroll growth has averaged 60,000 per month, down from 144,000 in 2024—but still enough to keep unemployment steady, given slower labor-force growth.

Markets continue to brace for a delayed BLS jobs report, with private-sector data carrying more weight during the shutdown.

Earnings Today

Under Armour (UA) – Watch for inventory trends, demand recovery, and gross-margin commentary.

Airbnb (ABNB) – Focus on bookings growth, nights stayed, and outlook for holiday-season travel.

DraftKings (DKNG) – Key areas include customer acquisition costs, state expansion, and profitability trajectory.

Movers & Shakers

(+) Rivian ($RIVN) +23% after the EV maker announced strong Q3 earnings and outlook.

(–) Super Micro Computer ($SMCI) -12% because Q1 earnings and revenue fell short of estimates.

(–) Pinterest ($PINS) -22% after an earnings miss and weak forecast.

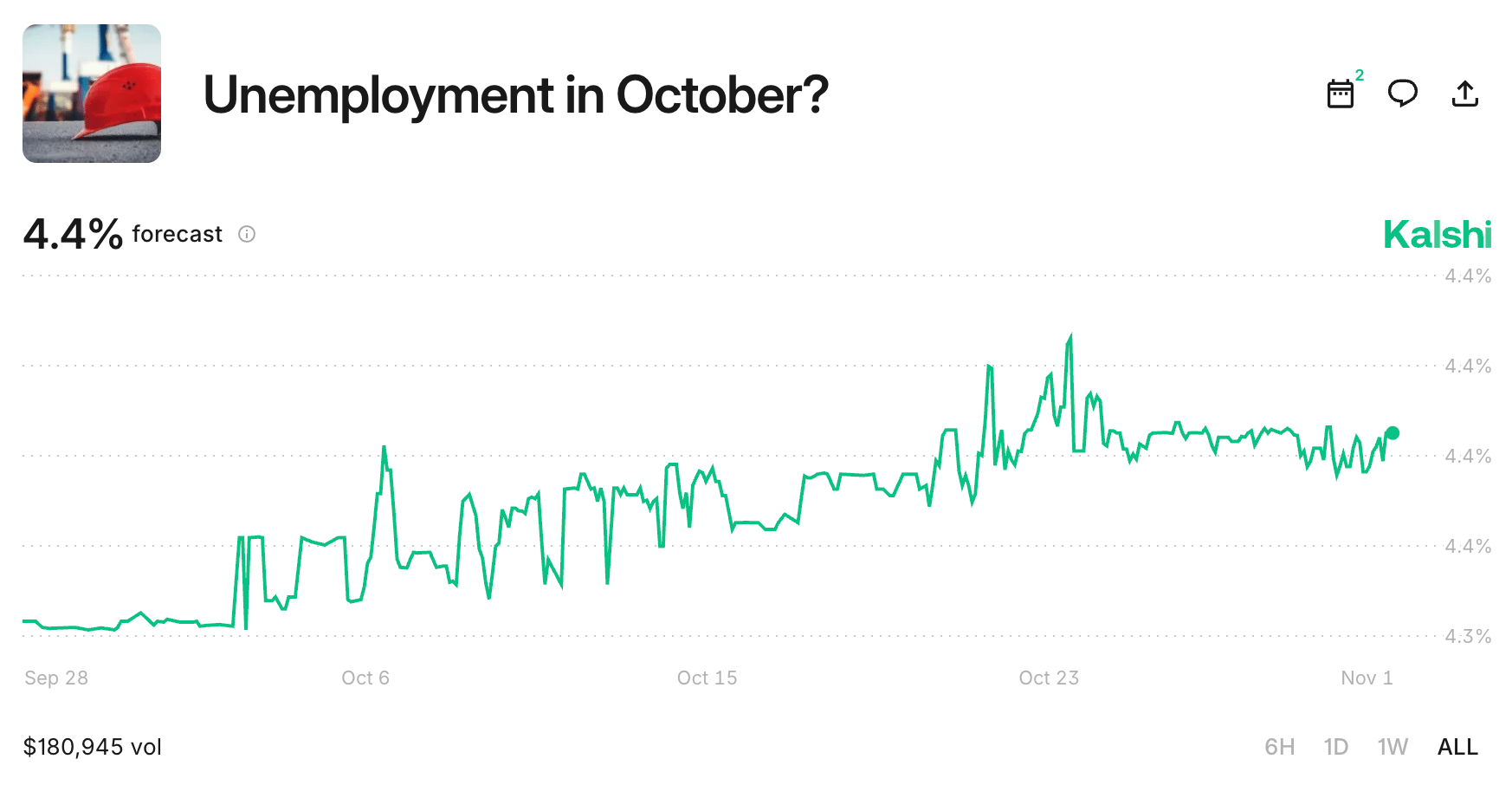

Prediction Markets

The unemployment rate for October is announced tomorrow. What will it be?

Trade on real-world events with Kalshi. Use code OWS to get a $10 bonus when you trade $10.

Private Dealmaking

Ripple, the cryptocurrency company behind XRP, raised $500 million

Armis, a cyber exposure management platform, raised $435 million

MoEngage, a customer engagement platform, raised $60 million

CourtReserve, a tennis and pickleball club management software provider, raised $54 million

Frontline Wildfire Defense, a fire sprinkler and detection startup, raised $48 million

Sensi.AI, a caregiver insight platform, raised $45 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

The Lucky Formula: How to Stack the Odds in Your Favor and Cash In on Success

The majority of people delay their dreams and goals, hoping and wishing for the perfect time to upgrade their lives. But not everyone is waiting. Author Mark Lachance is working. He discovered a proven process for engineering a high-performance life. By integrating this formula on a daily basis, he created a culture of winning both personally and professionally.

Born into a family that taught him "anything is possible," two of his brothers were drafted into the National Hockey League. Mark experienced massive success in multiple countries with multiple businesses. Outside observers chalked it up as luck and chance, but he knew the real secret.

In The Lucky Formula you'll learn how to stop waiting for a lucky break and start stacking the odds in your favor, create an environment of excellence that attracts achievement, and cash in on success in a game where you always win.

“personal growth + attitude + action = luck”

DAILY VISUAL

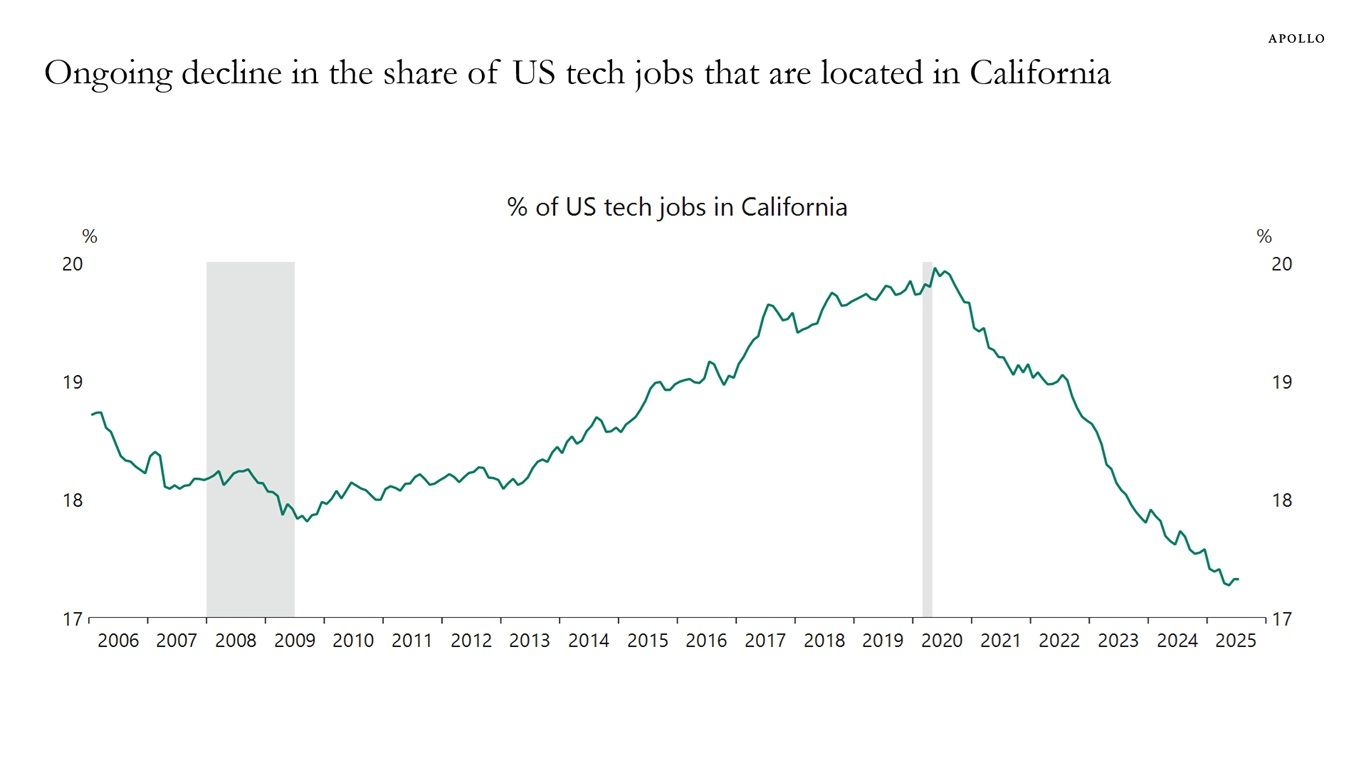

Fewer Tech Jobs Are in California

Source: Apollo

PRESENTED BY YIELDCLUB

The Easiest Way For Your Money To Make Money

Looking to earn more than 4% on your cash?

YieldClub is a simple platform that helps you earn 6–14% APY on your money while keeping full control of your funds (self-custody).

Your returns compound every 16 seconds, and the platform is built on audited protocols that already manage $10B+ in deposits.

You can earn institutional-grade yield on idle cash (without lockups, hidden fees, or confusing structures) while keeping your money ready for the next investment opportunity.

Please Support Our Partners!

DAILY ACUMEN

Metacognition

One of the biggest differentiators between successful learners and people who struggle is metacognition. It is the process of thinking about thinking.

Metacognition is really about trying to create the best possible opportunity to learn what you’re actually trying to learn.

Examples of metacognitive activities include planning how to approach a learning task, using appropriate skills and strategies to solve a problem, self-assessing and self-correcting in response to the self-assessment, evaluating progress toward the completion of a task, and becoming aware of distracting stimuli.

In other words, be more mindful about your learning.

ENLIGHTENMENT

Short Squeez Picks

How to take a refreshing nap without ending up more tired

What chefs and doctors eat when sick and hungover

How to wake up refreshed

The rise of the supermanager

The Einstein of Wall Street on building wealth through investments

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply