- Short Squeez

- Posts

- 🍋 Ads Coming for ChatGPT

🍋 Ads Coming for ChatGPT

Plus: Trump attacks Jamie Dimon over Fed remarks, Greenland tariffs just dropped, 401(k) money for mortgage down payments, and computer memory prices expected to rise 50%.

Together With

“Chairman of the Fed, I’d put in the absolutely, positively no chance, no way, no how, for any reason.” — Jamie Dimon

Good Morning! A new federal housing plan could let Americans tap 401(k)s for down payments. Trump threatened 25% tariffs on eight European nations over Greenland, and private credit investors pulled $7B from Wall Street’s biggest funds last quarter.

AI memory is sold out, with RAM prices expected to jump over 50% this quarter. Musk is seeking up to $134B from OpenAI and Microsoft, JPMorgan formed a new team to chase the private markets boom, and Jamie Dimon said he plans to stay CEO for “at least” five more years.

Plus: Trump attacked Dimon on Truth Social after he defended Fed independence, said he’ll sue JPMorgan over alleged debanking, and Novo Nordisk shares jumped after a “solid” Wegovy launch.

High-end real estate without the management fees? Explore mogul today.

SQUEEZ OF THE DAY

Ads Coming for ChatGPT

OpenAI is doing something it long resisted and something Sam Altman swore it would never do: start selling ads. The company will begin testing advertising inside ChatGPT in the U.S. in the coming weeks, and the move could open up a potentially massive new revenue stream just as the company’s infrastructure costs are exploding.

OpenAI says the ads will appear at the bottom of responses, be clearly labeled, and apply only to free users and the new low-cost ChatGPT Go tier ($8/month). Paid users on Plus, Pro, and Enterprise will remain ad-free, and users under 18 won’t see ads. OpenAI says placements will also be restricted around sensitive topics like politics and health.

Ads will be based on users’ conversations, and right now it’s a test, not a full rollout. But with ads so central to Big Tech’s playbook, we’re expecting OpenAI to integrate them into its business model.

The timing is no accident because OpenAI needs the money. The company has locked in more than $1.4 trillion of infrastructure and compute commitments in 2025, even as CEO Sam Altman says the company is tracking toward a $20 billion annualized revenue run rate. Advertising gives OpenAI a classic Big Tech lever to fund that spending without forcing every user into a subscription.

For context, Meta’s global ARPU is roughly ~$50 per user annually. At 1 billion users, OpenAI monetizing at Meta-like levels could generate ~$50 billion per year in advertising revenue alone, even before subscriptions and API usage.

Altman has historically warned that ads could erode trust in AI outputs. To limit that risk, OpenAI says responses won’t be influenced by advertisers, user data won’t be sold, and users will be able to see why an ad appeared, dismiss it, or give feedback. Altman knows the real value is users trusting ChatGPT as an objective tool, so they’re taking steps to wall off ads from model outputs.

Takeaway: OpenAI is quietly adopting the Google–Meta playbook. Right now, they have two main revenue engines in subscriptions and developer usage. They’re moving away from pure SaaS AI, and subscriptions may remain the core business, but ads are how you build a trillion-dollar platform. And ads might be structurally necessary for OpenAI to meet its lofty ambitions.

PRESENTED BY MOGUL

Invest like Blackstone Without Outbidding Moms on Single-Family Homes

mogul is a real estate investment platform offering fractional ownership in blue-chip rental properties. This gives you monthly rental income, real-time appreciation and tax benefits without a hefty down payment or 3 a.m. tenant calls.

Founded by former Goldman Sachs real estate investors, they hand-pick the top 1% of single-family rental homes for you. Each property undergoes a vetting process led by their founders. Across the board, their cash-on-cash yields average ~7% annually. What’s more, they’re averaging an 18.8% IRR annually since inception*. Offerings often sell out in under 3 hours, with investors putting in $15,000 per property.

Long story short: you can invest in institutional quality real estate for a fraction of the usual cost and leave the property management to the professionals. Plus, you don’t need to outbid moms for homes like Blackstone to get access to this powerful investment.

HEADLINES

Top Reads

Trump housing plan would let Americans tap 401(k)s for down payments (Fox)

Trump floats new tariffs in push to acquire Greenland (CNBC)

Private credit investors pull $7B from Wall Street’s biggest funds (YF)

AI memory is sold out, causing an unprecedented surge in prices (CNBC)

JPMorgan forms new team to get in on the boom in private markets (YF)

Jamie Dimon says he plans to stay in JPMorgan CEO job ‘at least’ 5 more years (NYP)

Trump says he’ll sue JPMorgan in coming weeks for debanking (BB)

Novo Nordisk shares rise after Wegovy obesity pill has ‘solid’ launch (CNBC)

Musk seeks up to $134B from OpenAI, Microsoft in 'wrongful gains' (YF)

Tesla's FSD, like almost everything else, is becoming a subscription (YF)

SEC corrects 10% AUM capital rule to 0.1% after industry pushback (Naira)

Micron stock climbs as CEO highlights AI demand for memory (CNBC)

AI boom brings big business to banks (Axios)

Investment banking’s liberation year (FT)

CAPITAL PULSE

Markets Rundown

Market Update

U.S. equities finished modestly lower as earnings season got underway

Real estate and industrials outperformed, while health care lagged

Treasury yields moved higher, with the 10-year ending near 4.23%

Asian markets closed higher after a Taiwan–U.S. trade deal lowered tariffs to 15% in exchange for $250B of U.S. chip investment

European equities declined following proposed tariffs tied to opposition to U.S. control of Greenland

The U.S. dollar strengthened; WTI crude traded higher amid ongoing geopolitical volatility

Economic Data Highlights

No major U.S. macro releases; focus remained on earnings and policy headlines

Bond markets continue to price a Fed pause after three consecutive cuts to end 2025

Inflation remains above target, reinforcing expectations for policy stability in the near term

Reported Earnings

JP Morgan, Bank of America, Wells Fargo, Goldman Sachs, and Morgan Stanley all beat estimates

Early results point to solid loan demand and healthy investment banking activity

Earnings Season Outlook

Q4 S&P 500 earnings expected to grow ~8% YoY, led by technology (25%+)

2026 earnings projected to rise ~15%, supporting equities despite elevated valuations

Continued earnings strength viewed as a key driver of further gains this year

Looking Ahead

10-year yields remain range-bound between 4.0%–4.25%

Markets remain focused on earnings delivery and geopolitical developments as primary near-term drivers

Movers & Shakers

(+) Novo Nordisk ($NVO) +9% after the company’s Wegovy obesity pill had a “solid” launch.

(+) Micron ($MU) +8% because of strong AI demand for memory.

(–) DraftKings ($DKNG) -8% after prediction markets gain NFL volume traction.

Prediction Markets

Private Dealmaking

ClickHouse, a high-performance analytical database designed for real-time analytics and large-scale data workloads, raised $400 million

Tulip, a factory automation software platform that helps manufacturers digitize operations and improve productivity on the shop floor, raised $120 million

Osapiens, a software company that helps enterprises manage ESG reporting and regulatory compliance, raised $100 million

Higgsfield, an AI-powered video generation platform focused on creating and editing synthetic video content, raised $80 million

Wasabi, a cloud storage provider focused on low-cost, high-performance object storage, raised $70 million

Hydrosat, a satellite imagery company that uses thermal data to monitor water stress and climate-related risks, raised $60 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

The Score

Description: A sharp, original critique of how modern life has been quietly gamified. Nguyen shows how scores, metrics, and incentives, from social media likes to workplace KPIs, hijack our values and push us to chase goals we never consciously chose. Using philosophy and game theory, he argues for reclaiming agency, redefining success, and learning how to play our own game instead of optimizing for someone else’s scoreboard.

Book Length: 368 pages

Release Date: January 13, 2026

Ideal For: Thinkers, leaders, creators, and anyone questioning the invisible rules shaping their ambition and attention.

“The real danger isn’t losing the game, it’s forgetting why you’re playing at all.”

DAILY VISUAL

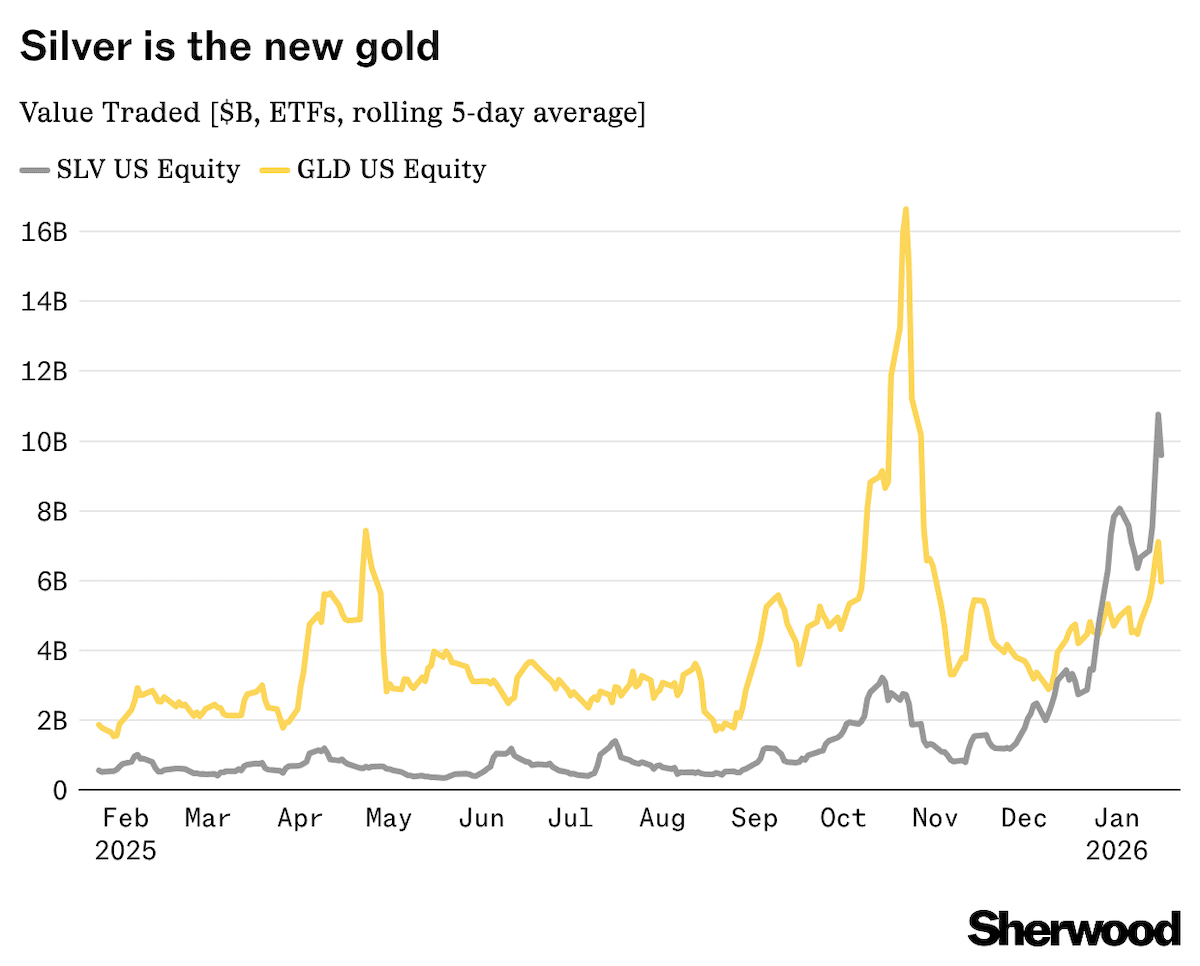

Silver on a Generational Run

Source: Chartr

PRESENTED BY YIELDCLUB

The Easiest Way For Your Money to Make Money in the New Year

Looking to earn more than 4% on your cash?

YieldClub is a simple platform that helps you earn 5–15% APY on your money while keeping full control of your funds (self-custody).

Your returns compound every 16 seconds, and the platform is built on audited protocols that already manage $10B+ in deposits.

You can earn institutional-grade yield on idle cash (without lockups, hidden fees, or confusing structures) while keeping your money ready for the next investment opportunity.

DAILY ACUMEN

Hidden Dangers of Advice

Steve Jobs told graduates to "follow your passion." Sounds inspiring. But Jobs didn't follow his passion into technology.

He stumbled into it, got fired from Apple, and only found his passion through decades of work. Cal Newport researched this "follow your passion" advice and found it's not just wrong, it's harmful.

Passion follows mastery, not the other way around. When you're terrible at something, you can't be passionate about it. But get good at anything, and passion emerges from competence.

Most career advice comes from survivorship bias. Successful people reverse-engineer their journey, creating a tidy narrative that ignores luck, timing, and circumstances.

They tell you to take risks because their risks paid off, forgetting the thousands whose identical risks led to bankruptcy. They tell you to quit your job because they did, ignoring that they had a safety net you don't.

Naval Ravikant says, "Specific knowledge cannot be taught." Your path is uniquely yours. What worked for someone else might destroy you. Their context, skills, timing, and resources were different.

Be wary of anyone selling a formula for success. What advice are you following blindly without considering if it fits your situation? What successful person's path are you trying to copy instead of creating your own?

Remember, the best advice is often the most useless because context matters more than content.

ENLIGHTENMENT

Short Squeez Picks

The unique new way to pay your bills

7 Mediterranean diet sheet pan dinners

The secret to better habits

The podcast productivity trap

How much do you need to walk to lose weight?

How to make a strategic plan that boosts accountability

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

*See Important Disclosures. Past performance does not guarantee future results.

Reply