- Short Squeez

- Posts

- 🍋 Ackman All-In On Meta

🍋 Ackman All-In On Meta

Plus: Wall Street bonuses saving NYC, real estate stocks get crushed on AI fears, junior analysts teaching boomer MDs AI, and private equity braces for a SaaSpocalypse.

Together With

“Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.” — Warren Buffett

Good Morning! Real estate services stocks slid as investors debated whether they’re next in the AI scare trade, following insurance brokers and wealth managers. CBRE and JLL fell 12%, while Cushman & Wakefield dropped 14%. Mamdani says surging Wall Street bonuses have helped shrink NYC’s budget gap by roughly $5 billion.

Thousands of amateur traders are outperforming Wall Street PhDs in prediction markets. Vietnam is building a 130,000-seat mega stadium. And junior bankers at Morgan Stanley and Bank of America are now teaching senior colleagues how to use AI.

Plus: Canada’s largest investors rethink U.S. exposure, private equity braces for a SaaSpocalypse, and how to build your career with the 90-minute mindset.

It’s like a private bank in your pocket. Join the waitlist for the Stelrix gold card.

SQUEEZ OF THE DAY

Ackman’s All-In On Meta

Bill Ackman is one of the great high-conviction investors of the modern era. When he spots what he believes is an asymmetric opportunity, Wall Street pays attention. This time, the bet is a name most portfolios already own, and one he believes is mispriced.

At Pershing Square’s annual investor presentation, the firm disclosed that Meta represents roughly 10% of capital as of year-end 2025.

Ackman began building the position last November, and at approximately $2 billion, it is now one of the largest holdings in a concentrated 13-stock portfolio.

Meta has faced pressure over its aggressive AI spending plans. After guiding to $115–$135 billion in 2026 AI-related capex, shares pulled back as investors questioned the return profile. The stock remains more than 15% below its highs.

Ackman views AI not as a margin drag, but as an accelerant to Meta’s ad engine. Better recommendations drive engagement. Engagement improves targeting. Improved targeting enhances pricing power. In his framework, AI strengthens the flywheel.

Even at a $1.7 trillion market cap, Meta trades around 22x forward earnings, near a market multiple for a business generating significant free cash flow with AI optionality layered on top. In a market awarding premium valuations to AI winners, Ackman argues Meta offers comparable upside without paying a stretched multiple.

If the capex cycle drives durable earnings acceleration, the stock rerates. If not, Meta’s scale and cash generation help cushion the downside. For Ackman, a manager who rarely swings at marginal pitches, allocating 10% of capital suggests he believes the asymmetry is compelling.

Takeaway: This fits the classic Ackman playbook: buy a dominant franchise when the narrative turns cautious, size it aggressively, and wait for fundamentals to reassert themselves. While others worry about the AI bill, Ackman is betting Meta will ultimately capture the return on it. Now, may I meet you, Zuck?

PRESENTED BY STELRIX

The Card That Treats Your Portfolio Like the Asset It Is

Private banks have offered portfolio-backed lending for decades, but only to clients who clear six-figure minimums and navigate weeks of underwriting. The rest rely on credit cards that ignore their actual financial position.

Stelrix delivers that same institutional infrastructure to high achievers who understand how wealth actually works. The platform connects directly to your brokerage and provides spending power secured by your holdings, not your credit history. Your assets remain invested and continue generating returns while you access capital for opportunities that don't wait for liquidation timelines.

Weighing almost twice a typical Amex, the card's technology is communicated through its physical design. The sleek gold finish signals a different class of financial product. Your capital works on your timeline, deployed when you need it without disrupting long-term strategy.

HEADLINES

Top Reads

Real estate services stock latest domino in AI scare trade (YF)

Wall Street bonuses help shrink NYC budget gap by $5 billion (BB)

Kraft Heinz pauses work to split the company as new CEO says 'challenges are fixable' (CNBC)

Thousands of amateur gamblers are beating Wall Street PhDs (NYT)

Vietnam will build the largest stadium in the world with capacity of over 130,000 (Bein)

Junior bankers are teaching their elders how to use AI (BB)

Canada’s biggest investors are starting to reconsider their U.S. exposure (TL)

How the SaaSpocalypse will hit private equity (FT)

Musk announces xAI re-org following co-founder departures, SpaceX merger (CNBC)

Why the AI-fueled software meltdown is 'overblown' (YF)

U.S. payrolls rose by 130,000 in January, more than expected; unemployment down to 4.3% (CNBC)

Tariff revenue soars more than 300% as U.S. awaits Supreme Court decision (CNBC)

AI threatens the finance industry’s perpetual profit machine (BB)

A Stanford experiment to pair 5,000 singles has taken over campus (WSJ)

Trump orders Pentagon to buy power from coal plants (CNBC)

Goldman’s push bears fruit in India’s crowded Wall Street field (BB)

Meta announces plans to build 1-gigawatt data center in Indiana as part of AI build-out (YF)

CAPITAL PULSE

Markets Rundown

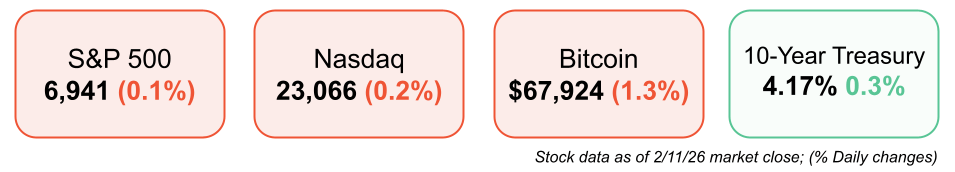

Market Update

U.S. equities finished little changed after early gains faded following a strong January jobs report

Bonds sold off modestly, with markets pricing a slower pace of Fed rate cuts

Value-style stocks continued to outperform year-to-date, supported by solid growth expectations

Commodities were broadly higher, with gold, silver, and oil each up more than 1%

Economic Data Highlights

January nonfarm payrolls rose 130K, well above expectations for 50K and the strongest gain in 12 months

Unemployment rate ticked lower, while labor-force participation and hours worked increased

Manufacturing employment rose for the first time since 2024

Annual revisions removed 862K jobs, confirming 2025 hiring was sluggish but not as weak as feared

Markets now fully price the first Fed rate cut in July, rather than June

Sector Trends

Industrials, transportation, chemicals, and real-asset sectors continued to gain leadership

Growth and software stocks lagged amid ongoing AI disruption concerns

Rotation toward pro-cyclical and old-economy sectors remains a defining theme of early 2026

Value continues to outperform growth year-to-date

Movers & Shakers

(+) Generac ($GNRC) +10% after the generator company spiked on potential tailwinds for data center products.

(–) Moderna ($MRNA) -4% because the FDA declined to review the pharmaceutical company’s new flu vaccine.

(–) Lyft ($LYFT) -17% after the rideshare company announced disappointing Q4 results; drop in rider numbers.

Prediction Markets

Private Dealmaking

Inertia Enterprises, a fusion energy startup led by Twilio founder Jeff Lawson, raised $450 million

General Atlantic will acquire European Wax Center for $330 million

OLIX, a chipmaker, raised $220 million

Vega, a security analytics mesh platform, raised $120 million

Garner, a health care navigation company, raised $118 million

ILiAD Biotechnologies, a whooping cough vaccine developer, raised $115 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

Unhinged Habits

Description: A fresh perspective on habits that challenges the idea that productivity is always about doing more. Goodman argues that intentional subtraction and deliberate focus can create deeper satisfaction, better relationships, and more meaning. Drawing on his own unconventional life experiments and practical frameworks like the 8:4 Rule and the Explorer’s Compass, he shows how smart, unbalanced living can unlock more energy, clarity, and fulfillment.

Book Length: 240 pages

Release Date: January 27, 2026

Ideal For: Anyone feeling overwhelmed by busyness, seeking greater clarity about priorities, or wanting a structured way to break unhelpful patterns and live with intention.

“More effort does not equal more meaning. The trick is choosing what to keep and what to let go of.”

DAILY VISUAL

Spotify Still Cooking

Source: Chartr

PRESENTED BY BLUEFLAME AI

Data Room Deal Intelligence

Time may heal wounds, but it kills deals.

Thanks to Blueflame AI’s union with Datasite, data rooms are living sources of intelligence that accelerate the deal close.

With a secure integration to Datasite, Blueflame AI receives all VDR content flows, and the Agentic AI updates the firm’s analysis, in real time. This shortens diligence without sacrificing quality and provides constant monitoring without manual document exchanges.

As the only Agentic AI solution that integrates directly with virtual data rooms, Blueflame AI enables dealmakers to work faster. Instead of working file by file, Blueflame’s agentic AI works across the full data room, connecting information, tracking change, and supporting higher-confidence decisions as deals evolve; without the need to rebuild context every deal.

Blueflame is AI that treats deals as the living organism they are and that returns years to the deal team’s lives.

Schedule your demo to learn more.

DAILY ACUMEN

Willpower

Psychologist Kurt Lewin said behavior is a function of person and environment. Most people try to change the person. Smart people change the environment.

Want to eat healthier? Don't rely on willpower. Remove junk food from your house. Want to read more? Put books everywhere and hide your phone. Want to exercise? Sleep in your workout clothes.

Your environment shapes your behavior more than your intentions. Change the environment and behavior changes automatically. No willpower required.

What behavior are you trying to change through willpower alone? What environmental change would make the behavior automatic?

Remember, don't change yourself. Change your surroundings. Behavior follows environment.

ENLIGHTENMENT

Short Squeez Picks

How taking notes by hand boosts your memory

Build your career with the 90-minute mindset

4 ways to end the cycle of sleep anxiety

Mixing up your workouts might be the secret to longevity

MEME-A-PALOOZA

Memes of the Day

📣 Partner With Us: Get in front of an audience of over 1 million finance professionals, business leaders, and policy influencers. Submit a partnership inquiry.

📈 Grow With Us: Work directly with the Overheard on Wall Street team to scale your finance brand. Schedule your free consult.

🔒 Short Squeez Premium – Insiders: Access exclusive content, including investment analysis, wellness features, career tools, and our full recruiting resource library. Upgrade to Premium.

🧢 Wall Street Shop: Explore our collection of finance-themed apparel and merchandise. Visit the shop.

📬 Deals Newsletter – Buysiders: A curated roundup of major M&A, private equity, and VC activity. Plus access to private deal flow. Subscribe here.

What'd you think of today's edition? |

Reply